A golden opportunity for your clients' golden years

21 November 2023

South African life insurers are currently offering annuity rates at highs rarely seen over the past 20 years. The main driver behind the sudden leap in annuity rates is the country’s long-term bond yields, which are at their highest since November 2002.

While South Africa’s rising short-term interest rates have inflicted some financial pain on consumers by increasing the cost of living, long-term bond yields have also risen, which means that life companies are able to offer higher annuity rates.

This is good news for retirees looking to buy a guaranteed income for life with their retirement savings. Buying a guaranteed life annuity now will lock in the current high rates – for life. Over the past five years, there has been an average increase in annuity rates of 33% for men and 43% for women for guaranteed life annuities.

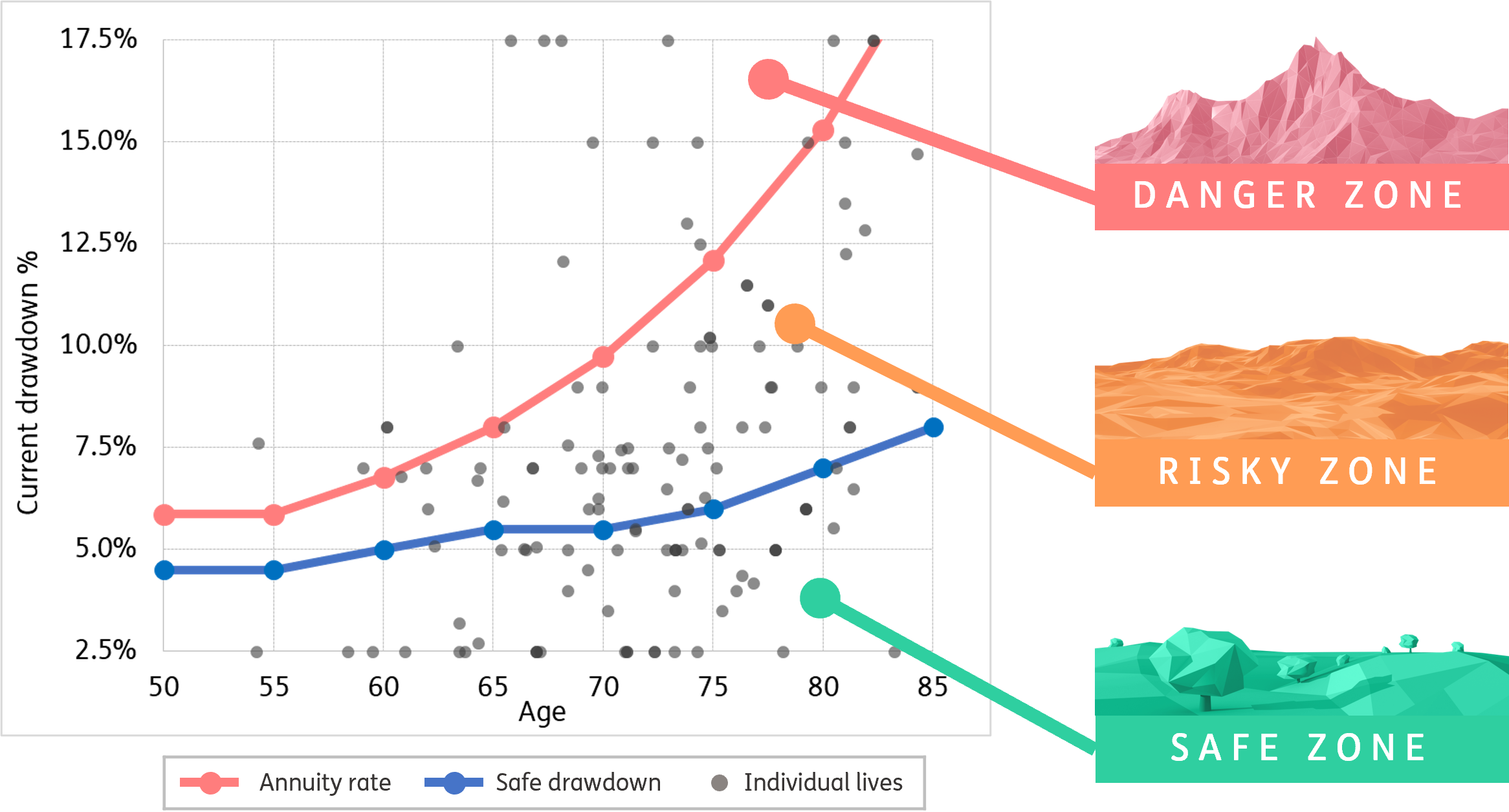

Let’s look at this with reference to our Income Sustainability Map.

| Zone | Solution |

| Danger zone: Annuitants are drawing above the guaranteed sustainable annuity rate, which is an unsustainable drawdown strategy. |

Life annuity |

| Risky zone: Drawdown % between the sustainable drawdown rate and the life annuity rate, which is potentially unsustainable depending on circumstances. |

Blended annuity |

| Safe zone: Drawdown % is less than the sustainable drawdown rate, which is sustainable. |

Living annuity |

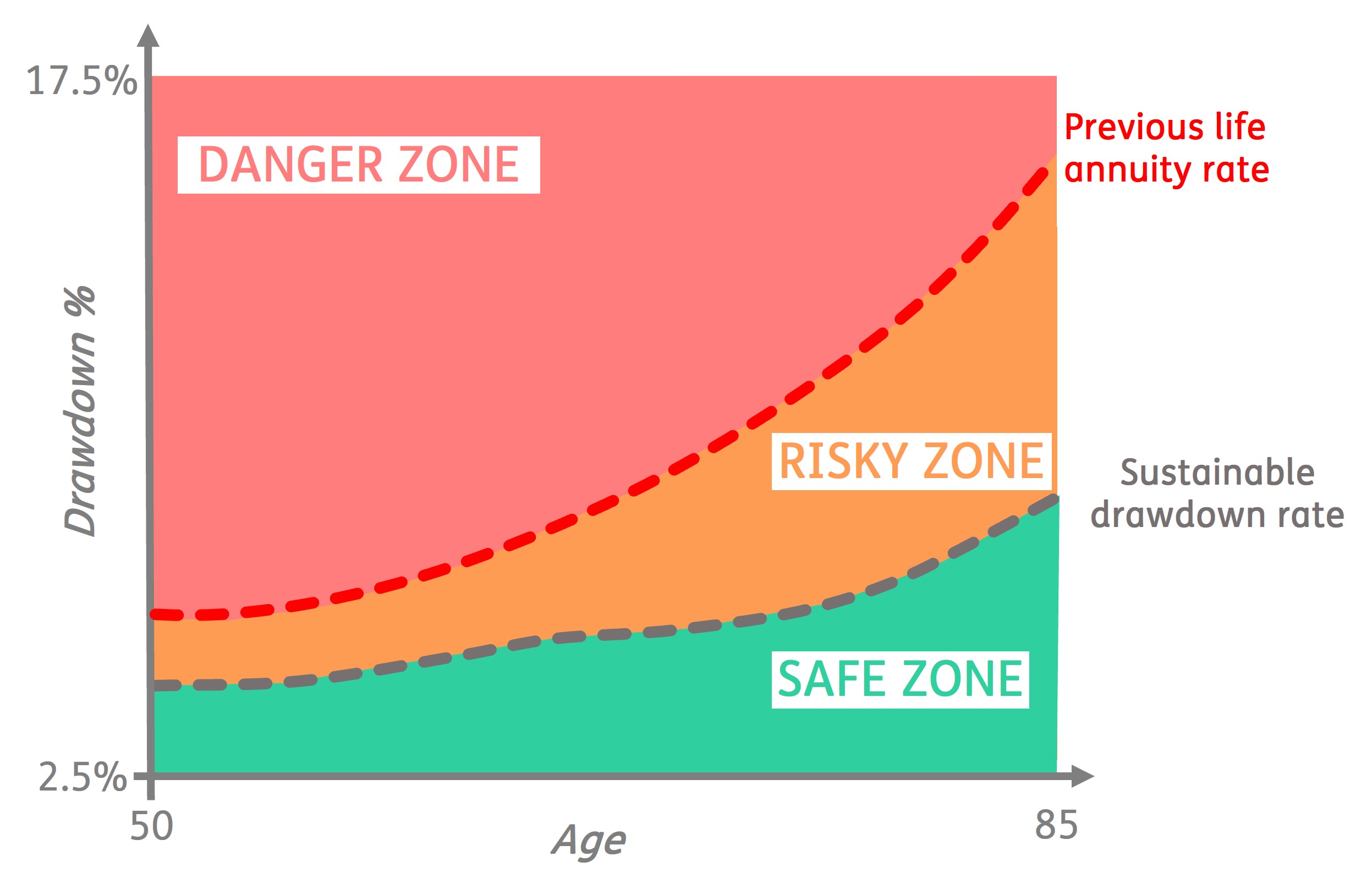

Here’s an impression of what the income sustainability map looked like back in 2018, when life annuity rates were much lower. You will note a smaller risky zone or put differently, a bigger danger zone.

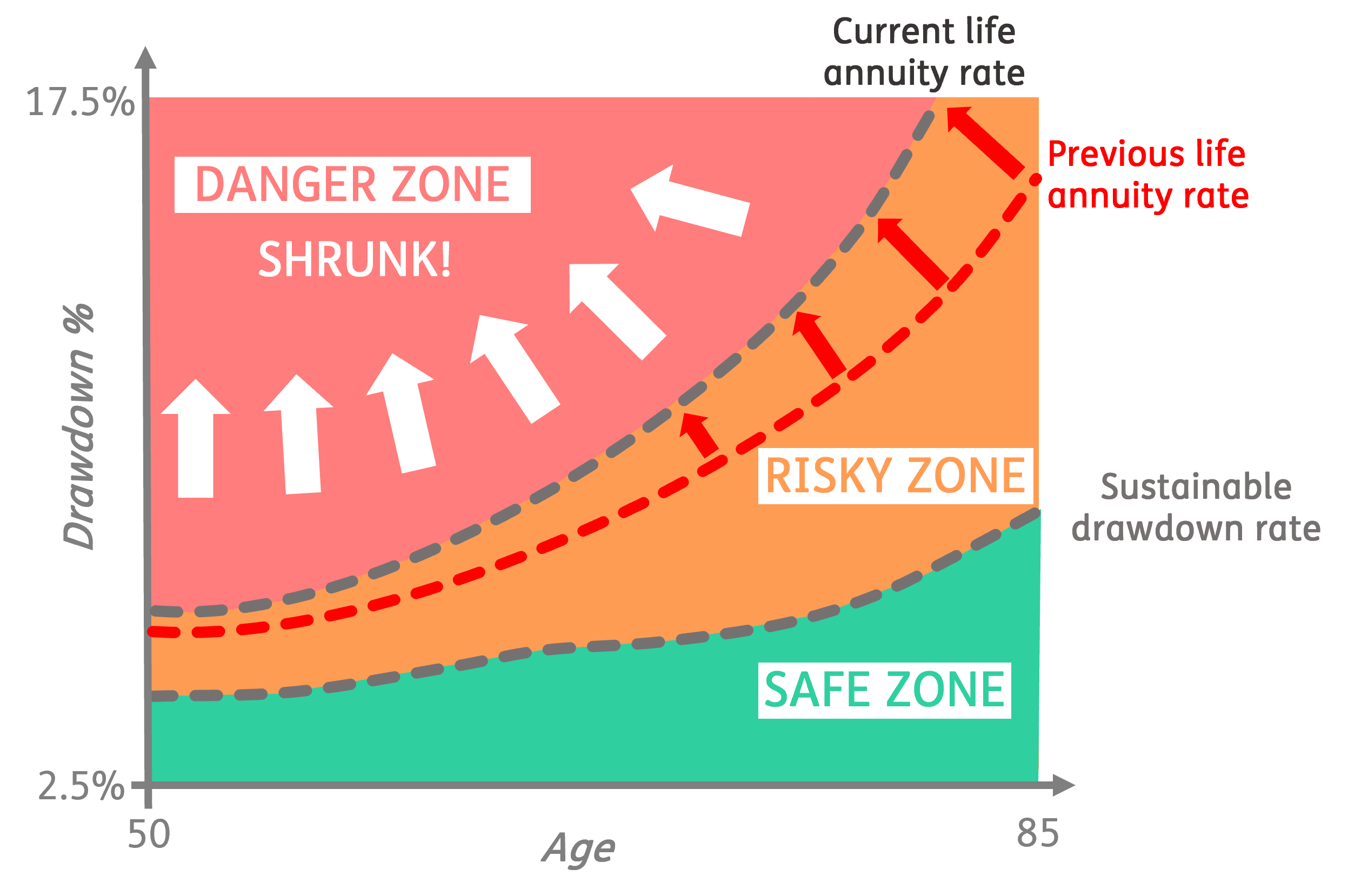

What has happened since due to increasing annuity rates is that the risky zone increased, which is good news because the danger zone has shrunk.

This indicates that more living annuitants are now in the risky zone, as opposed to the danger zone, compared to five years ago. This advantage holds particularly for those who ‘moved’ to the risky zone (between the red dash line and the new grey dash line).

Considering this golden opportunity, it is a good time for these living annuitants in particular to blend (adding a lifetime income portfolio to their living annuity). This provides a more sustainable income solution, without having to reduce their withdrawal amounts.

Authored by Heather Bell and Bjorn Ladewig

Download a PDF version of the November 2023 Newsnote

The information contained in this newsnote is intended for financial advisers and is for information purposes only. It should not be regarded as advice as defined in the Financial Advisory and Intermediary Services Act 37 of 2002, or any form of advice in respect of the policy, retirement, tax, legal or other professional service whatsoever. You are encouraged to seek advice from an authorised financial adviser, or to independently decide that the financial product is appropriate for you based upon your own judgment and understanding of your financial needs.