Best opportunity to buy a with-profit life annuity this decade

6 April 2022

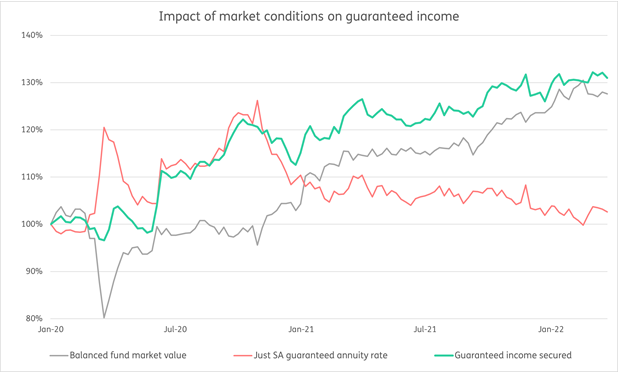

A person reaching retirement with their money invested in a balanced fund, is able to purchase 30% more guaranteed Just Lifetime Income (JuLI)1 than they could two years ago!

It is a great opportunity to lock in income that is guaranteed for life to cover a pensioner’s essential expenses – to provide pensioners with peace of mind against the backdrop of global uncertainty caused by a combination of an unpredictable war in Europe, rising global inflation and interest rates.

Current value offered by JuLI is at its highest since we started tracking this on 1 January 2020 (shown by the green line in the graph below).

- The grey line is the market value of a balanced portfolio.

- The coral line is the JuLI annuity rate, which changes to more-or-less offset the change in market value of the balanced portfolio.

- The green line is the level of guaranteed lifetime income that a client can purchase: the market value of the balanced portfolio is applied to the JuLI annuity rate to calculate the starting income that can be bought.

Source: Just SA

What is driving the improved value?

Two factors combined are making the price of JuLI attractive in current conditions:

- Pricing alignment: The price of JuLI moves more-or-less in line with the market value of the balanced portfolio to which it is linked: so a client gets a similar level of guaranteed lifetime income whether markets go up or down.

- Rising fixed interest yields: JuLI has become cheaper as fixed interest yields have risen.

So, even though the JuLI annuity rate is lower today than in the midst of the Covid-19 market crash in 2020, a pensioner invested in a balanced fund can still purchase more guaranteed lifetime income from JuLI:

|

|

Market value in balanced fund |

JuLI annuity rate* |

JuLI guaranteed lifetime income pa that can be purchased |

|

1 January 2020 |

R 1 000 000 |

6,9% |

R 69 000 |

|

1 April 2020 (Covid-19 market crash) |

R 879 000 |

8,1% |

R 71 200 |

|

Today |

R 1 276 000 |

7,1% |

R 90 600 |

*JuLI StableGro targets increases in line with inflation.

Annuity rate for a typical retired couple: male age 65; female age 62 (75% spouse’s annuity); 10 year minimum payment period.

Blending in these market conditions

Investing some of a pensioner’s living annuity assets into JuLI gives a pensioner the peace of mind that that income can never decline in any market scenario. They also retain long-term exposure to investment markets, because their future increases are directly linked to the smoothed returns of a balanced portfolio.

This also allows them to maintain equity exposure on their other retirement savings, which cover discretionary expenses or are intended as a capital legacy.

What yield does my client earn on JuLI?

Because JuLI pays an income that targets growth in line with inflation, the starting annuity is similar to the dividend yield on an equity that is expected to keep pace with inflation – except that JuLI comes with the downside protection of a lifetime income guarantee – it will never miss a dividend.

Allocating part of a pensioner’s living annuity to JuLI allows them to consume more during their lifetime, at lower risk.

[1] Just SA’s with-profit annuities

Download a PDF version of the Q1 2022 Newsnote

The information contained in this newsnote is intended for financial advisers and is for information purposes only. It should not be regarded as advice as defined in the Financial Advisory and Intermediary Services Act 37 of 2002, or any form of advice in respect of the policy, retirement, tax, legal or other professional service whatsoever. You are encouraged to seek advice from an authorised financial adviser, or to independently decide that the financial product is appropriate for you based upon your own judgment and understanding of your financial needs.