Living annuity clients don't need to become a burden on their children

15 November 2022

|

A recent study of around 10% of the living annuity market conducted by Just SA, shows

- an average drawdown rate of 8.5% per year

- two thirds draw more than the recommended sustainable drawdown rate[1] and risk running out of money in retirement

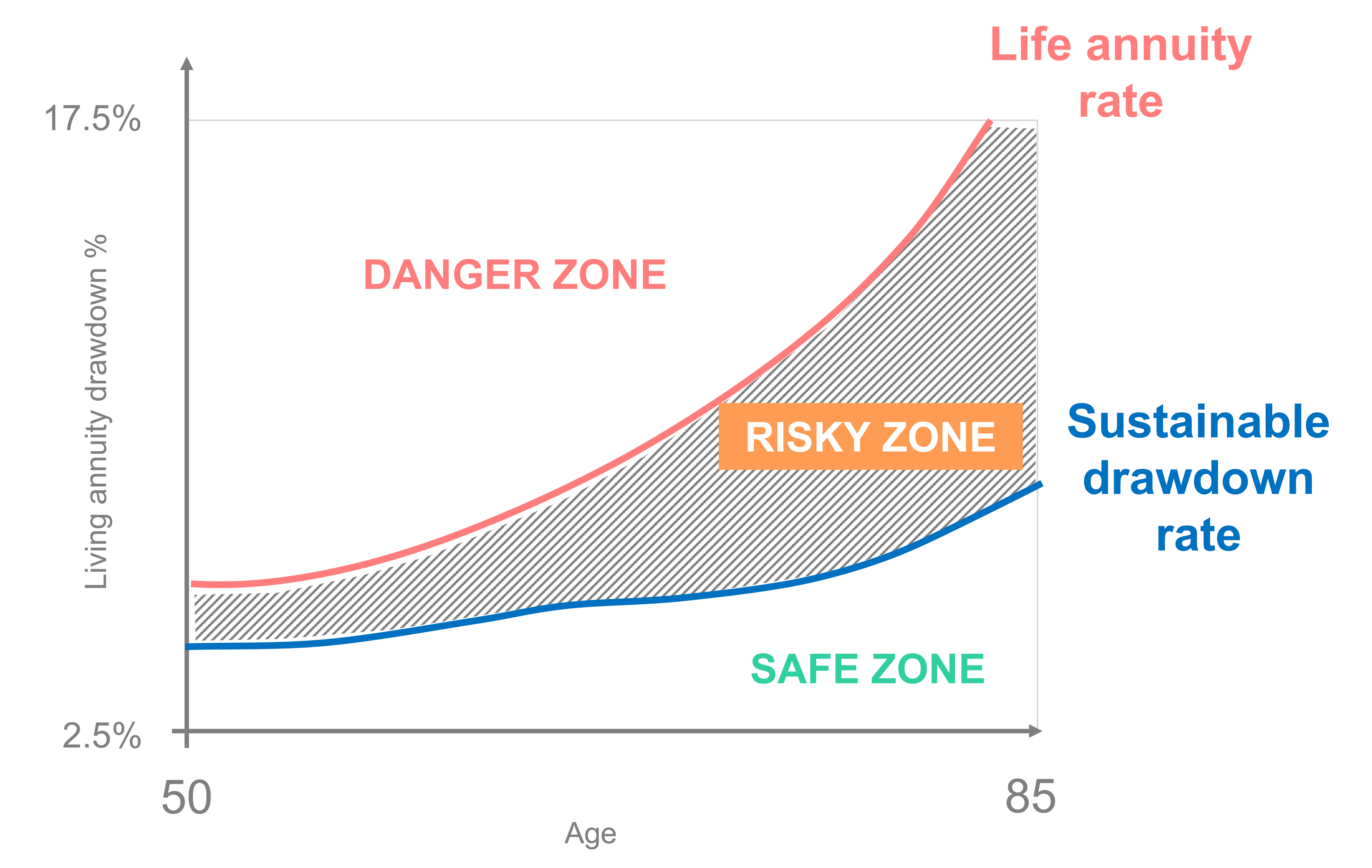

The irony is, half of these could guarantee that income for life, with annual increases that target inflation, by investing part of their living annuity assets in a life annuity (those in the ‘Risky Zone’ in the diagram above). The simple reason that life annuities sustain a higher income for life, is that policyholders pool their risk and those who die earlier cross-subsidise those that live longer.

This may be the last opportunity for those in the Risky Zone to be able to secure their current income, guaranteed for life.

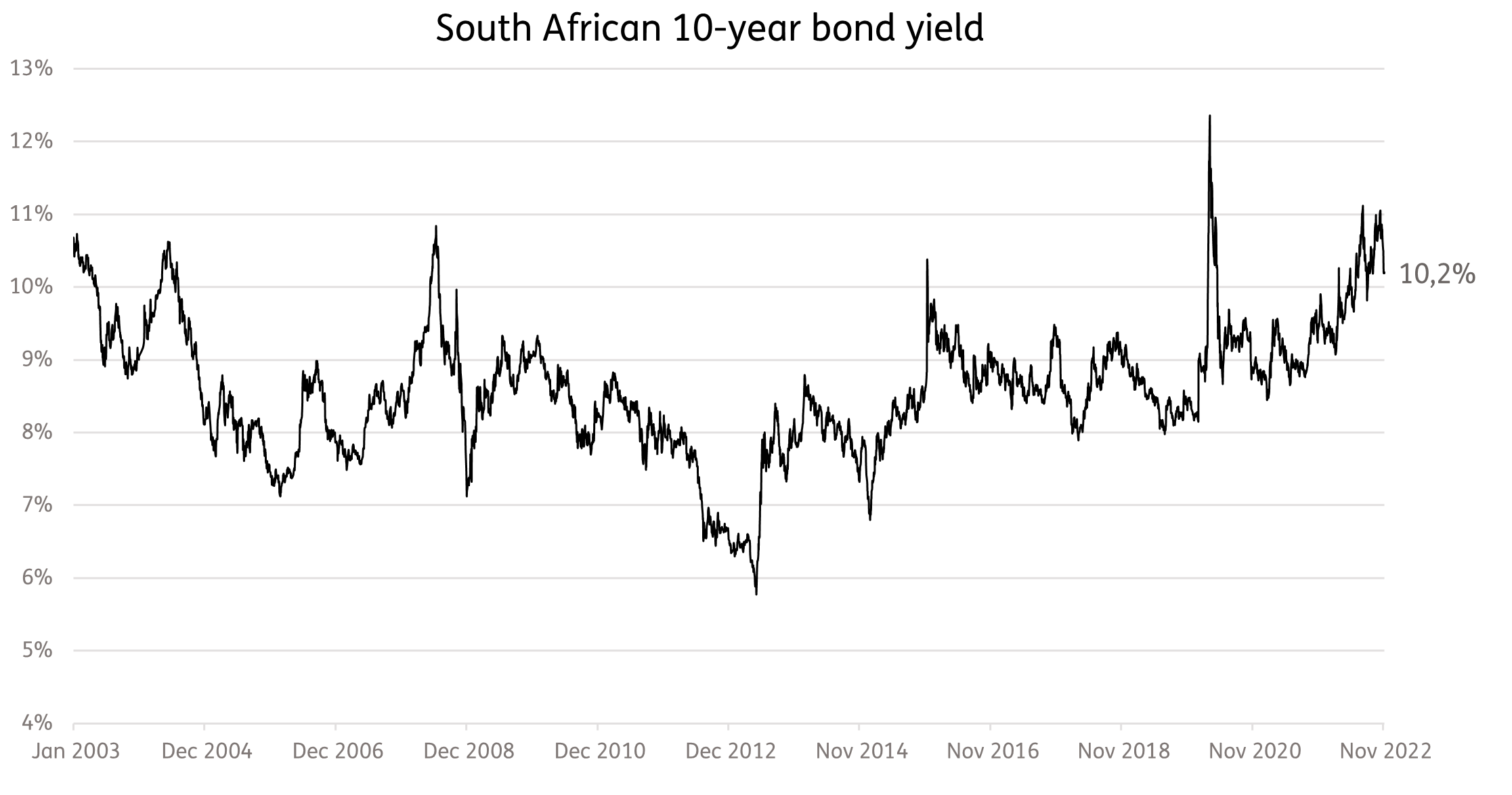

Long term interest rates, even after a correction in early November, are high relative to levels seen over the past 20 years (yields on 10-year SA Government Bonds shown below). This means high annuity rates to secure relatively high guaranteed income for life.

On the other hand, if they remain fully exposed to investment markets, a downward correction in equity markets will force those in the Risky Zone to eat into their capital to maintain their current level of income. They will slip towards the danger zone, where they can no longer guarantee that level of income for the rest of their life. It is not necessary for them to run this risk of becoming a burden on their children.

Authored by Deane Moore, CEO of Just SA

Download a PDF version of the November 2022 Newsnote

The information contained in this newsnote is intended for financial advisers and is for information purposes only. It should not be regarded as advice as defined in the Financial Advisory and Intermediary Services Act 37 of 2002, or any form of advice in respect of the policy, retirement, tax, legal or other professional service whatsoever. You are encouraged to seek advice from an authorised financial adviser, or to independently decide that the financial product is appropriate for you based upon your own judgment and understanding of your financial needs.