Market variables affecting with profit annuity rates

26 August 2020

A with-profit annuity is a promise to a policyholder to pay an income (and increases) for their lifetime in exchange for a lumpsum investment. To ensure the minimum guarantee can always be met, Just invests the assets it receives as part of this exchange in a cashflow-matching fixed interest portfolio and the chosen multi-asset balanced portfolio of one of our investment management partners, to which future increases are linked.

As a result, there are two aspects of market data affecting the starting income of new generation with-profit annuities, like Just Lifetime Income, on a daily basis:

- Yield curve movement

- Historical return of the underlying investment portfolio

Note: For non-profit or fixed increase annuities like Just Inflation-linked, Level or Fixed Escalation Lifetime Income, only the yield curve is considered because the increases are not linked to the performance of an investment portfolio.

Yield curve movement and its effect on starting income

Yield curves do not always rise and fall consistently across the term of the curve. As a result, we may see a drop in the short end of the curve and a rise in the long end of the curve, or vice versa. This is a tilting of the yield curve, or change of shape (like what’s happened in South Africa over the last few months).

If the yield curve falls, the starting income will fall. Conversely, if the yield curve rises, the starting income will rise. When the yield curve tilts, the effect on starting income will depend on the duration of the policy.

An annuity policy covers the lifetime of the policyholder, which could span 30 plus years into the future. Depending on this expected future lifetime, different points along the term of the yield curve will have different relevance.

Historical return of the underlying investment portfolio

For with-profit annuities, the underlying investment portfolio is the driver of future annual increases.

Just’s transparent increase formula uses the smoothed investment return over a six-year period of the selected underlying balanced fund. Because past returns affect future increases (i.e. the value of the past returns will be reflected in the first few annual increases), we take this into account when calculating the starting income.

The purchase amount is used in the calculations to fund an annuity that will increase over time and is payable for the lifetime of the policyholder. If the increases are expected to be higher, a higher purchase amount is required to get the same starting annuity income. Or, for the same purchase amount, you get a lower starting income. The higher the rolling six-year return of the underlying balanced fund(s), the higher the initial annual increases – but the lower the starting income.

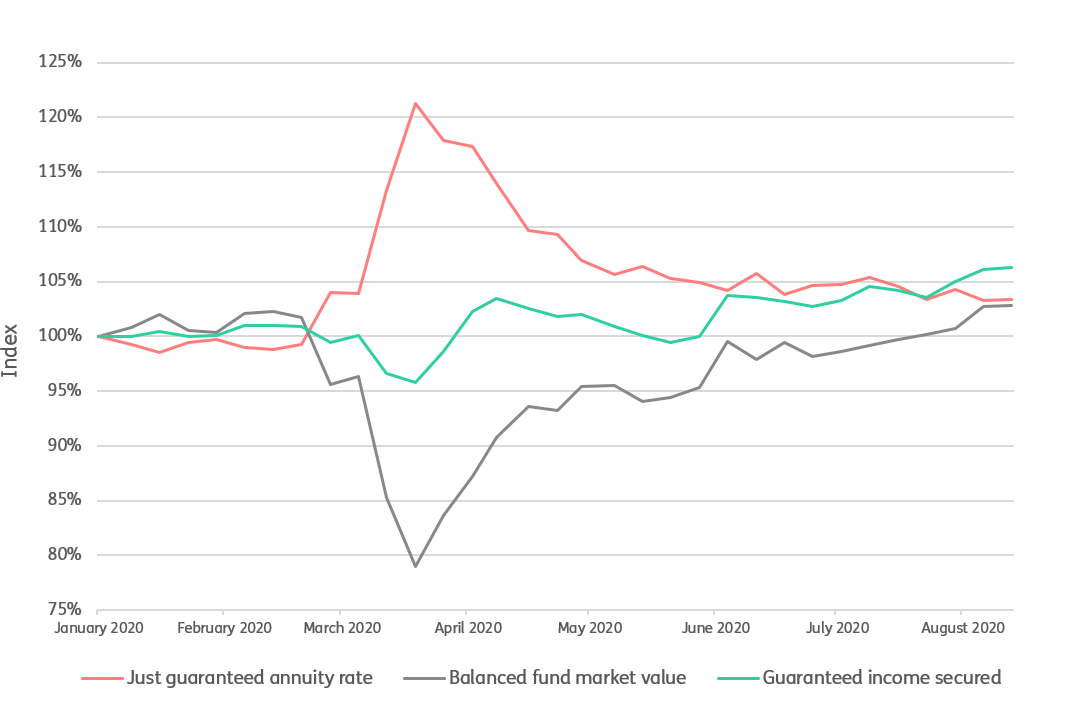

Impact of market conditions on guaranteed income

- The grey line plots the market value of a balanced fund each week from 1 January 2020.

- The coral line compares Just Lifetime Income annuity rates (incorporating the same balanced fund as the underlying investment portfolio for increases) at the same points in time.

- The green line compares the guaranteed income you could secure, if you converted the fund amount into a guaranteed annuity, taking assumed benefit options1 into account.

This graph aims to show the unique environment experienced earlier this year. Annuity rates improved significantly due to higher long-term interest rates, as a result of the SA sovereign risk downgrade by rating agencies as well as a fall in the underlying investment portfolios, which reduced future increase expectations and made annuities cheaper. The gain from a higher annuity rate essentially matched the loss experienced in investment markets. In other words, the capital or “purchase amount” will have fallen due to market crash, but you could secure a similar income (green line) due to higher annuity rates.

JuLI - a good alternative investment strategy

Just Lifetime Income represents a high-yielding investment, and yields are locked in for life in the form of a sustainable income with no downside risk. And because increases are linked to the performance of a balanced fund, you retain exposure to high growth assets at a lower risk due to smoothing protection.

It is vital to consider both starting income as well as the expected income growth over a long-term investment horizon. Both these factors drive the value for money of a guaranteed annuity.

On starting income alone, a fixed escalation annuity (or even inflation-linked annuities) may look attractive compared to a with-profit annuity. But the income derived from a with-profit annuity can catch up and exceed fixed escalation income over time because it is linked to the performance of the selected balanced fund (which we believe will outperform fixed interest investments in the long term). The growth in income of a with-profit annuity can therefore better protect purchasing power later in life.

1 Benefit options include a 75% spouse’s income and a 10-year minimum payment period for a 65-year old male with a 62-year old female spouse.

The information contained in this newsnote is intended for financial advisers and is for information purposes only. It should not be regarded as advice as defined in the Financial Advisory and Intermediary Services Act 37 of 2002, or any form of advice in respect of the policy, retirement, tax, legal or other professional service whatsoever. You are encouraged to seek advice from an authorised financial adviser, or to independently decide that the financial product is appropriate for you based upon your own judgment and understanding of your financial needs.