Now is the time to lock in market gains

30 November 2021

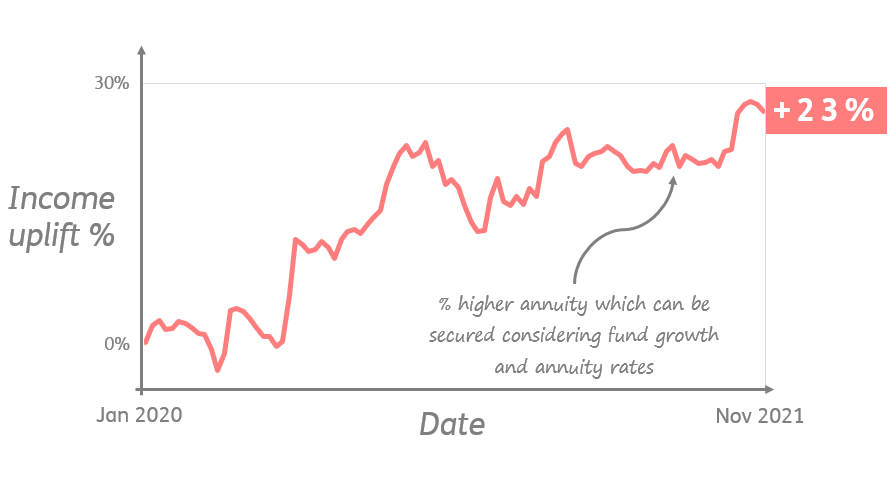

It’s always a good time for your client to purchase a life annuity, but every now and again, market conditions create an even better time to purchase a life annuity. Now is one of those times.

If your client’s retirement savings were invested in a balanced fund through the market turmoil of 2020 up until now, they could currently secure a lifetime income around 23% higher* than if they purchased a lifetime income on the 1st of January 2020, before the market crash. In other words, your client is currently able to get a higher income from each rand of their retirement capital if they invest it in a with-profit life annuity today.

Source: Just SA

There are two main reasons for this:

- Investment markets have recovered substantially since the 2020 market crash, which means a client’s capital value will have improved significantly.

- Life annuity rates have remained stable over the same period because of these two underlying factors which have largely cancelled each other out:

- Higher expected future increases (off the back of higher portfolio returns), resulting in lower annuity rates.

- Higher bond yields, resulting in higher annuity rates.

It’s a great combination of factors that make this the perfect time for your clients to lock in a secure lifetime income for the rest of their lives. However, this window of opportunity may not last, so there is a strong case for a hesitant client not to defer annuitisation any longer.

Besides the recent market gains, a life annuity will always be a good purchase in any climate. In a life annuity, income is guaranteed and will never decrease, no matter what happens in the market. Our with-profit annuity, Just Lifetime Income (JuLI), is designed to provide annual payment increases that target a percentage of inflation, and increases are linked to the performance of an independent underlying investment portfolio managed by specialist asset managers.

These factors give your clients certainty of income and the prospect of upside gains if the market continues to outperform. JuLI can also be purchased within a blended living annuity, giving your clients the opportunity to lock in a guaranteed income while retaining the flexibility that a living annuity offers.

It’s all good news, and there’s certainly not enough of that in the world right now. We believe that Just SA offers an excellent range of retirement income solutions for your clients, and the assurance of a guaranteed income is particularly attractive given the ongoing uncertainties created by the Covid-19 pandemic.

Please feel free to contact us if you have any questions.

*Based on:

- Allan Gray Balanced Fund returns over the period 1 January 2020 to 29 October 2021

- Indicative level of Just Lifetime Income (HiGro) which could be purchased for R1m by a male aged 65 with a spouse’s benefit over the same period