Just Lifetime Income Risk Management

24 March 2020

Market crash caused by COVID-19 is a robust, practical due diligence test

When our with-profit solution, Just Lifetime Income (JuLI) is subject to due diligence, there is always an appropriately significant focus on how it will cope with extreme market conditions. Current conditions are a good practical test to supplement the “what if” scenarios that are usually tested.

We are pleased to report that the risk management has been successful and has done exactly what it was designed and expected to do, insulating JuLI policyholders from the extreme market volatility of the past few weeks. This note provides insight into how the risk management applied to JuLI has performed over this time.

Underlying Just Lifetime Income investments

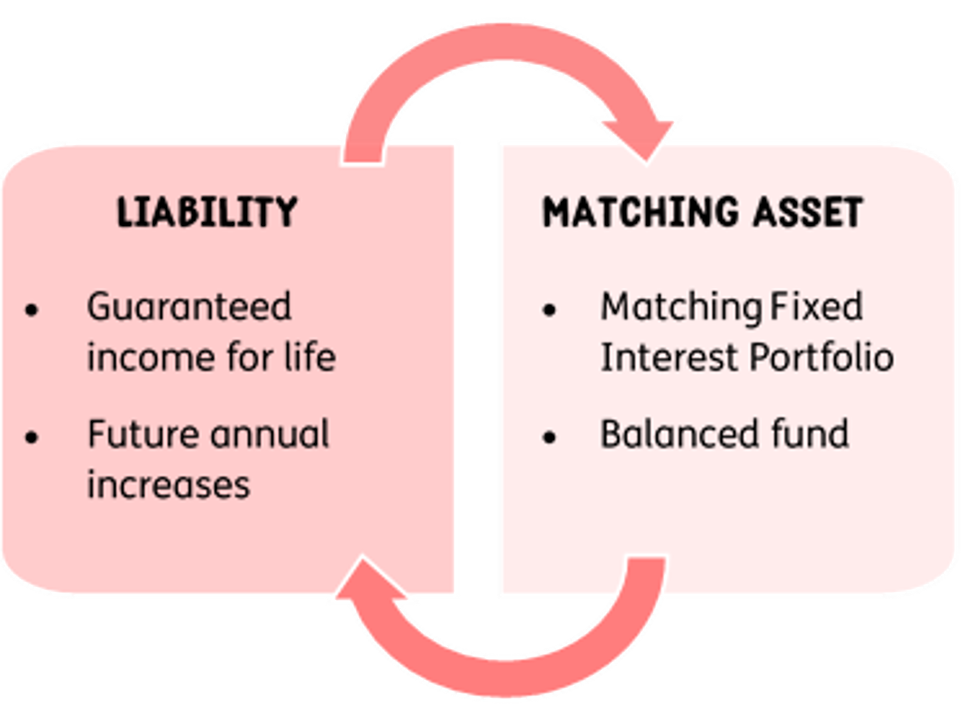

First, it is important to recap that JuLI has two underlying investment buckets:

1. The matching fixed interest portfolio

- This is the portion of JuLI assets invested in fixed interest assets.

- These assets are used to match the known liability at policy inception. The known liability is a guaranteed income of Rx per annum for a life expectancy of x years.

The percentage of the JuLI assets invested in each of the underlying investment buckets is determined at policy inception by the specifics of each policyholder and the selected calibration of JuLI e.g. HiGro,

StableGro or HiYield.

So, at policy inception there is a match of assets to liabilities (see graphic).

2. The underlying balanced fund

- This is the portion of JuLI assets invested in the selected underlying balanced fund(s) – the driver of the future annual increases.

- These assets are used to match the variable liability of future annual increases.

Just Lifetime Income risk management

The liabilities (guaranteed income for life and future annual increases) change over time, and when they do, the corresponding asset should also immediately be adjusted so that the assets and liabilities continue to be matched. If this is done, the funding level always remains at, or very close to, 100%. This equates to successful risk management.

The change in liabilities can be daily and is exacerbated in times of extreme market volatility.

Dynamic hedging

As you may remember when we first introduced JuLI to you, the risk management technique Just uses to continuously match the assets to the liabilities is called dynamic hedging. Simply put dynamic hedging is the daily valuation of liabilities with, if needed, an immediate adjustment in the corresponding assets to ensure that the liabilities continue to be hedged (a fancy word for matched).

Each policyholder’s liability is the combined value of the current guaranteed income, over the remaining life expectancy, plus the next annual increase. To apply dynamic hedging, Just’s Asset Liability Management Team value all policyholder liabilities each day and make the required adjustments to the corresponding assets.

How we value the variable liability of the next annual increase

JuLI has a transparent annual increase formula driven by the rolling six-year return of the selected balanced fund, and the annual increase calculation date is 31 October each year.

Just receives a daily unit price on each balanced fund from the respective asset manager. We know the published rolling five-year return to 31 October of the previous year, and with each new daily unit price, we are able to build the return of the sixth year as this progresses.

So, because the build-up of the return of the sixth year happens daily, we can value the variable liability of the next annual increase on a daily basis until the next increase calculation date of 31 October. And then the process repeats for the next annual increase to be calculated on the following 31 October.

How has dynamic hedging performed over the past few weeks?

Over the last few weeks, we have seen dramatic falls in equity markets and changes in interest rates. The impact of this, driven by dynamic hedging, has been:

- The two JuLI investment buckets have been significantly rebalanced with the allocation to the selected balanced fund, falling to about 30% of its long-term position.

- These assets have been transferred to the matching fixed interest portfolio.

- There have been no liquidity constraints to implementing the required dynamic hedging trades.

- The JuLI funding level remains very close to 100%.

Therefore, despite 16 March 2020 being the largest single-day global market crash since Black Monday 1987, Just’s dynamic hedging risk management has accomplished the primary objective of continuously matching the assets to the liabilities and in so doing, insulating JuLI policyholders from the extreme market volatility and protecting their guaranteed annual income.

When markets recover and the daily unit price rises, the liability profile will change again, and this will trigger a rebalancing of assets from the matching fixed interest portfolio back to the selected balanced fund.

JuLI policyholders will therefore fully participate in this recovery because it is the rolling six-year return of the balanced fund that drives the annual increase.

It is however also important to remember that Just provides JuLI policyholders with a guarantee that their income:

- Will be paid for life, or possibly longer if an income death benefit has been selected

- Will never reduce – so the lowest possible annual increase is 0%

- Once a positive increase is declared, this is locked into the lifetime income

This guarantee is permanently funded by the regulatory capital reserve requirements. This is capital that Just must hold in addition to the assets required to match the liabilities, referred to as dynamic hedging.

This regulatory capital reserve is set to withstand a 1-in-200 year “overnight” equity shock that assumes dynamic hedging has not provided any mitigation to that fall.

Because dynamic hedging has maintained the funding level at close to 100%, this regulatory capital reserve remains completely intact.

The information contained in this newsnote is intended for financial advisers and is for information purposes only. It should not be regarded as advice as defined in the Financial Advisory and Intermediary Services Act 37 of 2002, or any form of advice in respect of the policy, retirement, tax, legal or other professional service whatsoever. You are encouraged to seek advice from an authorised financial adviser, or to independently decide that the financial product is appropriate for you based upon your own judgment and understanding of your financial needs.