Rethink Conventional Wisdom

1 April 2020

Opportunities for pensioners in COVID-19 market conditions

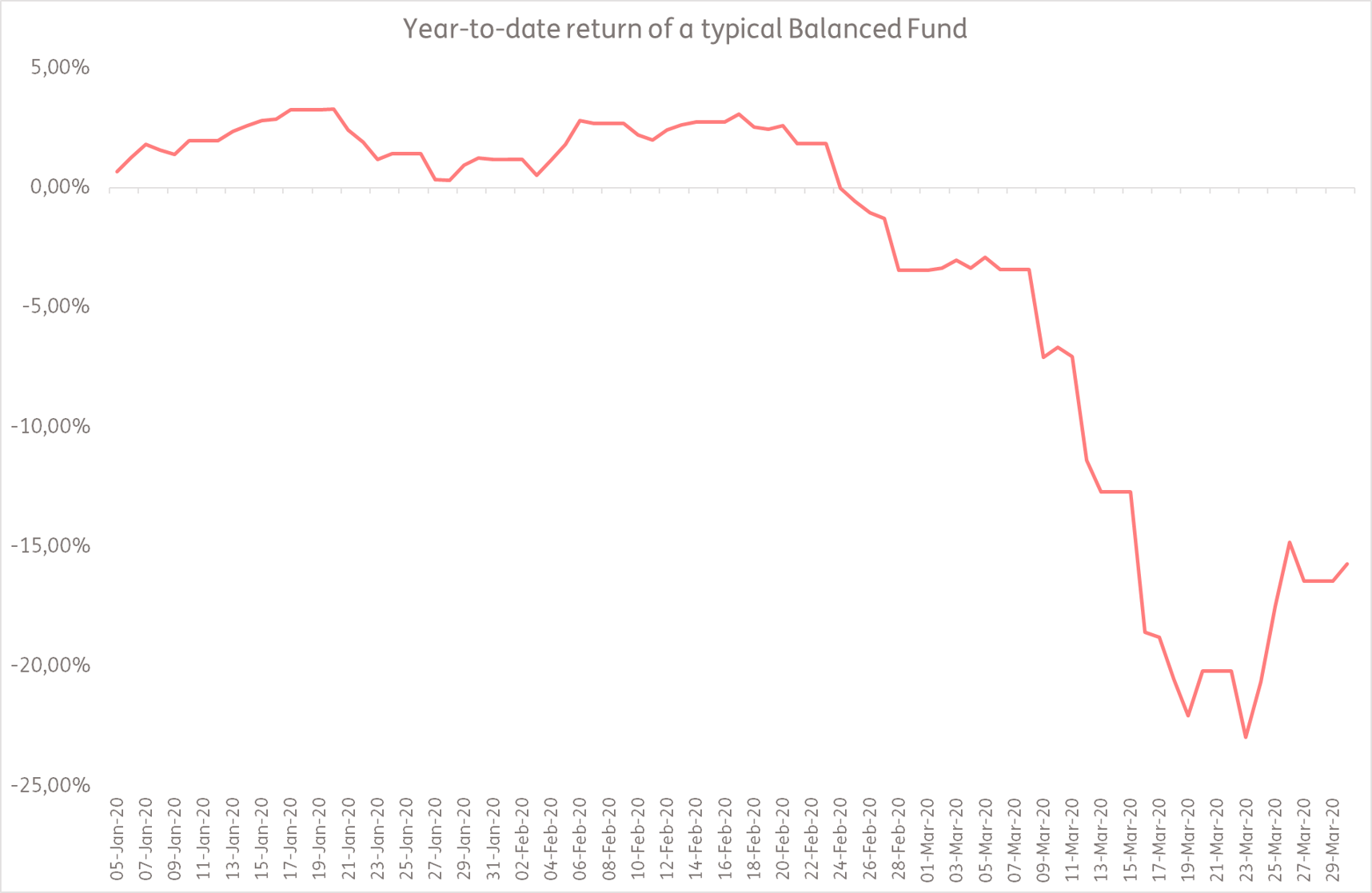

Conventional wisdom suggests that investors should not make any drastic changes to their investment strategy during times of market stress. While this certainly is valid for the younger generation in their accumulation phase, for investors in the decumulation phase, it is important not to focus purely on the absolute change in the market value of their investments, but rather to consider the relative movement in the income that they can secure at each point in time.

This is why it is important to understand the effect this recent period of market volatility has had on Just Lifetime Income (JuLI) annuity rates – and there is in fact some good news.

Higher long-term interest rates is good news for pensioners

The bad and the ugly: Equity markets crashed and SA downgraded to Junk

The good: Long-term interest rates spiked

JuLI annuity rates have increased sharply, which means depending on the performance of your client’s portfolio, you can secure the same or even a higher starting lifetime income for each R1 of purchase amount compared to before the crash.

As an example, a 65 year old male with a 61 year old female spouse, the increase in annuity rates from 1 January 2020 to 31 March 2020 has been:

Just Lifetime Income (JuLI)*

| i | HiGro | StableGro | HiYield |

|---|---|---|---|

| 1 January 2020 | R 4,809.30 | R 5,629.00 | R 6,338.15 |

| 31 March 2020 | R 5,653.91 | R 6,635.28 | R 7,252.71 |

| Increase | +17.6% | +17.9% | +14.4% |

*R1m purchase price, including a 75% spouse’s income and a 10 year minimum payment period.

A window of opportunity

This unprecedented increase in long term interest rates and the resulting positive impact on JuLI annuity rates provides an opportunity to consider an alternative investment strategy for pensioners.

By switching into JuLI, either in the form of a standalone annuity or as a lifetime income portfolio in a living annuity, a client’s risk and return profile can be improved in the following ways:

- No further downside risk. If markets fall further, the income secured by JuLI will not reduce.

- Retain exposure to high growth assets. When the market recovers, a client will participate in the rebound through future increases. You do not crystallise losses to date.

- JuLI represents one of the highest yielding investments available in the market and yields are locked in for life in the form of a sustainable income.

- Reduce sequence of returns risk in living annuities. It may take years for the markets to recover during which time living annuitants will consume their assets at depressed market values. This reduces the sustainability of a traditional living annuity even after the market recovery. Due to the sharp increase in JuLI rates, the sustainability of the client’s portfolio is restored without further downside risk.

- Not all or nothing. JuLI as a portfolio in a living annuity allows you to purchase as many tranches as you want, when you want. It is therefore possible to build a portfolio of tranches over time without having to make a big decision on the market conditions at any given point in time.

No time to waste

JuLI was designed for exactly the market conditions we are currently experiencing – to shield policyholders from market instability and protect guaranteed income – and it has performed as expected. We believe that these severe market conditions resulting from COVID-19 offer opportunities for pensioners to access lifetime income guarantees at record-low prices. This too shall pass, and with good news the markets will recover over time. By starting to build a portfolio of lifetime income for your client now, you can add value that will last a lifetime.