In Conversation with CEO Deane Moore

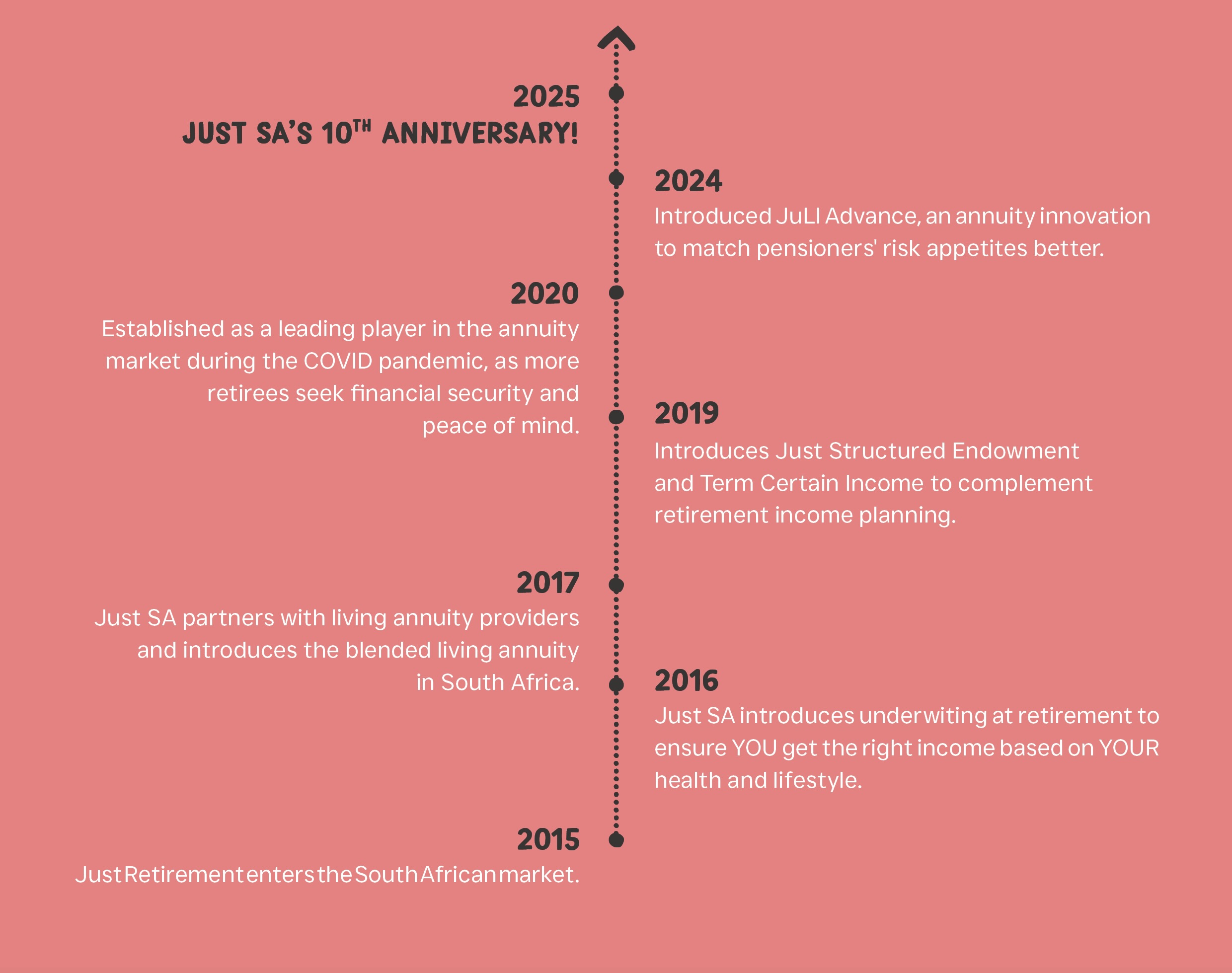

February 2025 marked Just SA’s 10th anniversary

Over the past decade, Just SA has grown and evolved thanks to your support and trust.

We have expanded our services, embraced innovation, and we continuously strive to exceed your expectations.

To celebrate the milestone, our marketing manager, Michelle Dodd, sat down with CEO Deane Moore to reflect on a decade of growth, innovation, and impact.

“I’ll lead with a question about the last ten years of Just SA: what stands out as the most significant milestone?” Dodd begins.

Moore pauses, a subtle yet proud smile crossing his face, before answering confidently:

“Without a doubt, it was devising a legal structure that made it possible for pensioners to add the security of a guaranteed income for life to a flexible living annuity investment.

“To put that into perspective, when we first explored this product design, we were told it was impossible in South Africa. Fast forward a few years, and instead of forcing clients to choose between a living and a life annuity at retirement, we made it possible to combine the best of both in a single investment – a blended annuity. In my view, that’s our most significant milestone to date.”

“I absolutely agree. Can you talk briefly about where Just SA began and some of the big challenges you and the other founders faced?”

Three laptops, a kettle, and a vision

Moore replies: “In 2013, myself and the first two employees ordered three blank laptops to be delivered to a rented studio in Blouberg, Cape Town, where we had three chairs, two tables, a kettle and a mop. That was it. Those were the early days. We had to introduce an entirely new brand into a very well-established market.

“Getting off the ground was a massive challenge. But looking back, I’m filled with appreciation for the trust placed in us by respected firms such as Alexforbes, Allan Gray and Sygnia – all of whom undertook thorough due diligence before partnering with us."

Dodd, who joined the company years later, reflects, “That’s an incredible origin story. And what’s so striking is how the ethos of those early years still defines who we are today. Bold thinking, innovation, persistence, and a commitment to providing more value – these values remain unchanged.”

“Exactly," Moore agrees.

2013: Three blank laptops, a kettle, and a vision

"From day one, we’ve focused on innovating to meet client needs. Just three years in – by 2016 – we had combined three major industry breakthroughs: underwriting at retirement, with-profit annuities without discretion, and wrapping guaranteed lifetime income inside a living annuity. That’s when we knew we’d made it, at least from a value-creation perspective in South Africa.

“And even through those uncertain times,” Moore adds, “we’ve shown tremendous resilience as an organisation. After the 2020 market crash, people, especially those nearing retirement, began to see the value of peace of mind. A guaranteed income for life offers exactly that. We’re proud to provide solutions that deliver that kind of security.”

Growth and impact

Over the past decade, Just SA has played a pivotal role in reshaping retirement income options for South African pensioners. At the heart of this success is a simple yet powerful concept: guaranteed income for life.

To explore this further, Dodd asks, “In your words, why is guaranteed income such an important part of who we are and what we do?”

“Well,” Moore replies, “guaranteed income offers more long-term security than most alternatives. You see, there are some real problems in the broader retirement finance landscape – economic challenges, high immediate financial obligations, and an inability to save are some of the biggest barriers that prevent people from planning for retirement. These are huge barriers to a secure retirement. I believe our annuities address these barriers.”

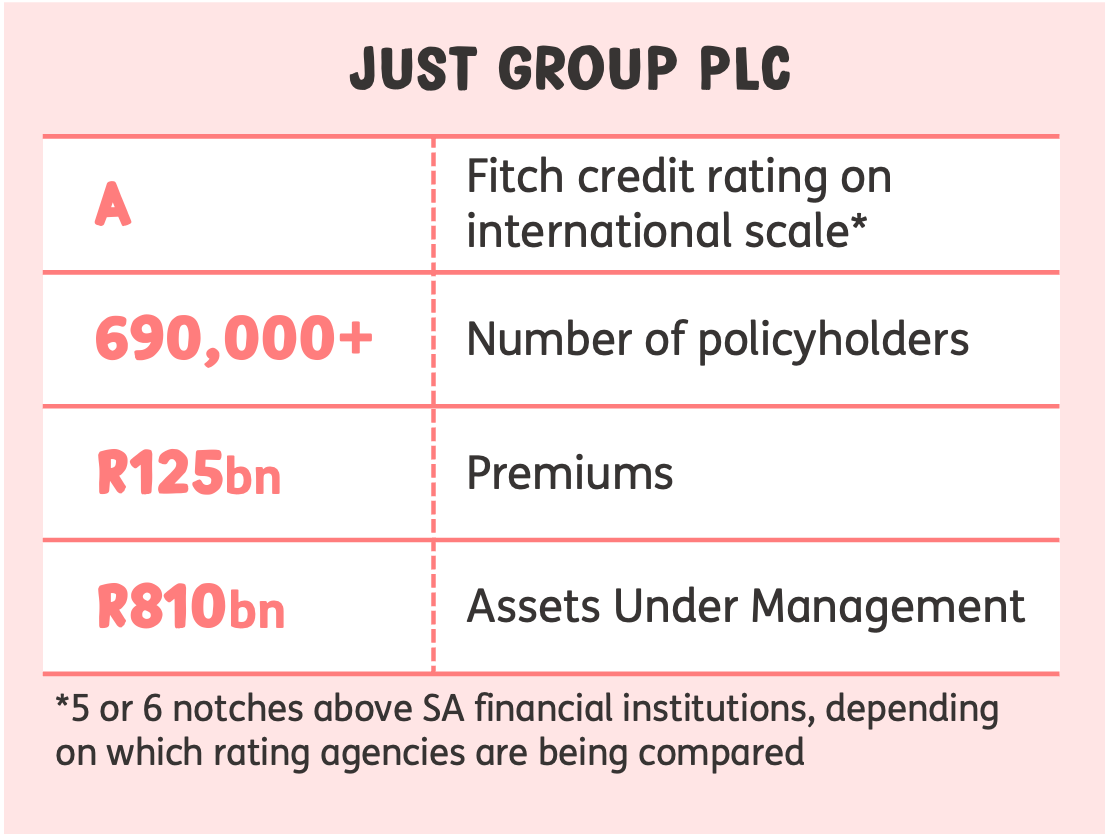

As at December 2024

Dodd adds, “Our underwriting approach plays a big part in that, too.”

“Yes, exactly,” Moore agrees. “It’s another innovative, fair way we help clients secure the right income for life. I think it's important for the record to reflect that we are currently the only firm in South Africa that offers underwriting for retirement income.

“Another point worth mentioning before we move on,” he continues, “is that we’re a subsidiary of the UK-listed Just Group plc. The Group has a credit rating of A — five or six notches above local insurers, depending on which you compare. Many of our clients are glad to know that this backing provides additional financial strength and security to our offering.”

Moore concludes: “Ten years in, we’re proud of what we’ve built — and excited about what comes next.”

Helping nearly 10,000 pensioners secure a dignified retirement

Dodd asks, “Thanks, Deane. I just wanted to ask how the retirement landscape in South Africa has changed in the past decade, and how we have adapted in response.”

“Great question. Things started to change for the better when the National Treasury Retirement Reform papers were published between 2012 and 2014, which focused on improving the appropriateness of solutions and reducing the cost to pensioners. At the time, it was widely recognised that 90% of pension money flowed to living annuities, which, while not bad products on their own, are not always the right fit for everyone. And I remember one of the larger insurer brands saying this tendency would never change.

2015 onwards: Helping retirees achieve a better later life

“The issue is that, in trying to maintain their lifestyles, many retirees end up drawing too much income, which means the risk of running out of money too soon significantly increases.” Moore continues, “However, more recently, the flow of pension money has moved closer to 70% to living annuities, and 30% to life annuities. We would like to believe that the innovations we’ve brought to market have played their part as a catalyst for this change in retirement income priorities.

“But, as much as things change, they also stay the same. Unfortunately, two-thirds of living annuity policyholders are still drawing too much, and those income levels will not be sustainable for life. But these people would benefit most from having a portion of their savings invested in a life annuity – so our work is just beginning.”

Dodd responds, “I think the biggest problem is the lack of awareness around the importance of considering income sustainability. And that’s why we are here to educate — people approaching retirement must have a realistic plan for their increased life expectancy, and the increasing cost of living. Fortunately, our guaranteed lifetime income can be used effectively to manage certain risks in retirement.”

Moore concurs, replying, “That’s precisely it. I’d like to add that there is a myth that life annuities can’t be used to support beneficiaries in case you pass away — this is not totally true. We offer a spouse's benefit, adding that extra layer of security for our policyholders, ensuring their spouse is protected and provided for as long as they live, even if the policyholder passes away.”

Culture and team reflections

2014: The Just SA team

“I’d like to talk a little bit now about the Just SA team and our culture,” says Dodd. “Some of the original team are still with us. What’s kept the culture strong over the years?”

Moore responds, “Well, providing pensioners with a better later life is a strong purpose to have. I can confidently say, this ethos permeates everything we do, from the first interview to our weekly team meeting that plans work priorities, to our weekly tradition of celebrating the number of new clients we’ve helped.

“We’ve also embraced a flexible and forward-thinking work culture,” Moore continues. “Even before the pandemic, our employees had the option to work remotely. I think these elements collectively contribute to a strong and resilient culture – I’d like to think our employees feel valued, supported, and aligned with the company's mission and values.”

Says Dodd, “Well, in February, 15% of the current staff contingent celebrated their 10-year anniversaries with us. For a company that’s only 10 years old, that’s no mean feat!”

“Yes, I agree,” Moore concurs. “I think our practice of emphasising employee engagement and wellbeing, as well as commitment to promoting a fair and inclusive workplace, has much to do with staff satisfaction.”

Dodd, shifting the conversation in another direction, says, “I also think we tend to attract a very particular kind of person to our organisation. What kinds of people would you say truly thrive at Just SA?”

“I absolutely agree,” Moore replies. “We are a small team with a clear vision – people who care, and feel responsibility towards clients and colleagues, regulators, and shareholders.

“We always talk about being part of the Just SA family — our people share a sense of belonging. And we are innovative and challenge complacency — so people who are dynamic, adaptable, proactive, and collaborative in delivering on deadlines (and have a sense of humour) will feel at home in the Just SA family.”

The next 10 years of Just SA

“To wrap up, I want to talk a little bit about your outlook on the future of the company,” Michelle says. “What excites you most about the next 10 years at Just SA?”

Moore replies, “I’d like to start my answer to that question by reiterating the biggest problem facing the retirement income landscape today: the fact is that two-thirds of living annuitants are drawing at a level that is not sustainable and would benefit from the security of a guaranteed income for life in their retirement. So, in looking to the future, continuing to help these pensioners achieve a better later life is my most exciting outlook.”

“Thank you so much for your time, Deane. This conversation has been incredibly valuable to me. I think many readers will take comfort in seeing the person behind the title – someone guided by clear values, long-term thinking, and a genuine passion and commitment to the success of South Africa's retirees.”

“Thank you, Michelle — I appreciate that. Thank you for helping us document and promote our progress! We both recognise how complex the retirement landscape is, and we aim to simplify it in a way that genuinely benefits pensioners. My role has always been to help reinforce that mission and instil confidence in the people we serve.

“I take pride in being able to say that to date, we’ve helped nearly 10,000 pensioners achieve peace of mind. We’re focused on helping more South Africans find that same security over the next decade.”

Do you need advice?

It is worth considering advice from a qualified adviser, especially if you need help:

- Understanding your options at retirement

- Taking account of your personal financial circumstances

- Considering how your retirement savings can be used with other savings and investements to meet your financial needs

- Considering the tax implications of your choices