Expanded Just Lifetime Income options

Introduction of 7-year level initial period for Just Lifetime Income

We are pleased to share an important development for Just Lifetime Income (JuLI), Just SA’s with-profit annuity solution in response to market demand. In our commitment to providing innovative features and greater flexibility for your clients, we are now introducing a 7-year level initial period.

Overview of level initial periods

During the level initial period the client’s income remains unaffected by investment performance or increase declarations — now available in 3, 5, or 7-year options. Once the level initial period concludes, income will adjust in line with the increase option selected at the outset (but adjusted for the experience of the pool over the period), ensuring clients benefit from positive investment performance in future.

Key benefits for clients

A level initial period is designed to ease clients into their retirement lifestyle. Incorporating a level initial period complements the existing features of Just Lifetime Income, providing a higher starting income yet offering inflation protection in line with the chosen increase option in later years when it is needed most.

Client suitability

The level period feature is most appropriate for clients with the following profiles:

- Clients requiring higher starting income to meet higher expenses during the early years of retirement.

- Clients seeking protection against long-term inflation by selecting their preferred Just Lifetime Income increase option.

Comparison to existing features

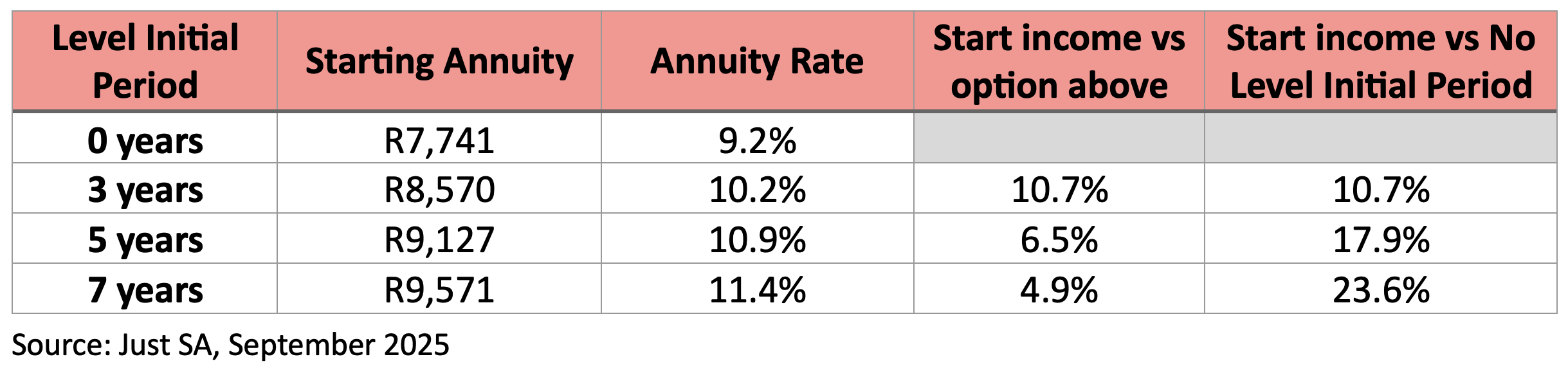

In this scenario we look at Alex, a 65-year-old male with R1 million. He requested a quote for a Just Lifetime Income StableGro Advance. Alex wants to see how the 7-year level initial period will increase his starting income.

The 7-year level initial period offers a 23.6% higher starting income vs no level initial period, and a 4.9% higher starting income compared to a five-year level initial period.

Implementation, availability and support

The 7-year level initial period option is available on new Just Lifetime Income applications effective immediately.

Thank you for your continued partnership and for the crucial role you play in helping clients achieve a better later life. Our team is available to help with any queries or bespoke scenarios you may encounter. Do not hesitate to contact us for further information or to arrange a discussion about integrating this feature into your advice processes.

The information contained in this newsnote is intended for financial advisers and is for information purposes only. It should not be regarded as advice as defined in the Financial Advisory and Intermediary Services Act 37 of 2002, or any form of advice in respect of the policy, retirement, tax, legal or other professional service whatsoever. You are encouraged to seek advice from an authorised financial adviser, or to independently decide that the financial product is appropriate for you based upon your own judgment and understanding of your financial needs.