CEO's newsnote

Investment Protection for Pensioners

12 November 2025

In the last month, the CEOs of JP Morgan, Goldman Sachs and Morgan Stanley have warned of the risk of a significant fall in the equity market

- JPMorgan Chase CEO Jamie Dimon warned of a heightened risk of a significant correction in the US stock market within the next six months to two years

(9/10/2025 JPMorgan CEO Dimon warns of US stock market correction risk, BBC reports | Reuters) - “We should welcome the possibility that there would be drawdowns, 10 to 15 per cent, that are not driven by some sort of macro cliff effect,” Morgan Stanley CEO Ted Pick said

- “When you have these cycles, things can run for a period of time. But there are things that will change sentiment and will create drawdowns, or change the perspective on the growth trajectory, and none of us are smart enough to see them until they actually occur,” Goldman CEO David Solomon

(04/11/2025: Goldman, Morgan Stanley CEOs warn of pullback in global equity markets - The Business Times)

You have the opportunity to help your clients lock in guaranteed income for life before the next market fall

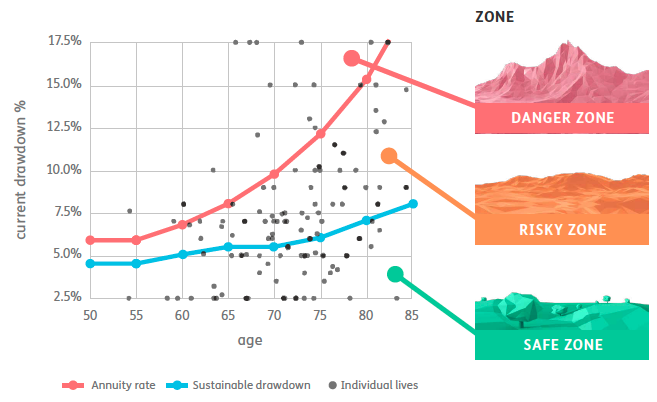

- 1/3 of living annuity pensioners are in the Risky Zone, drawing more than a sustainable level of income, but less than guaranteed life annuity rates.

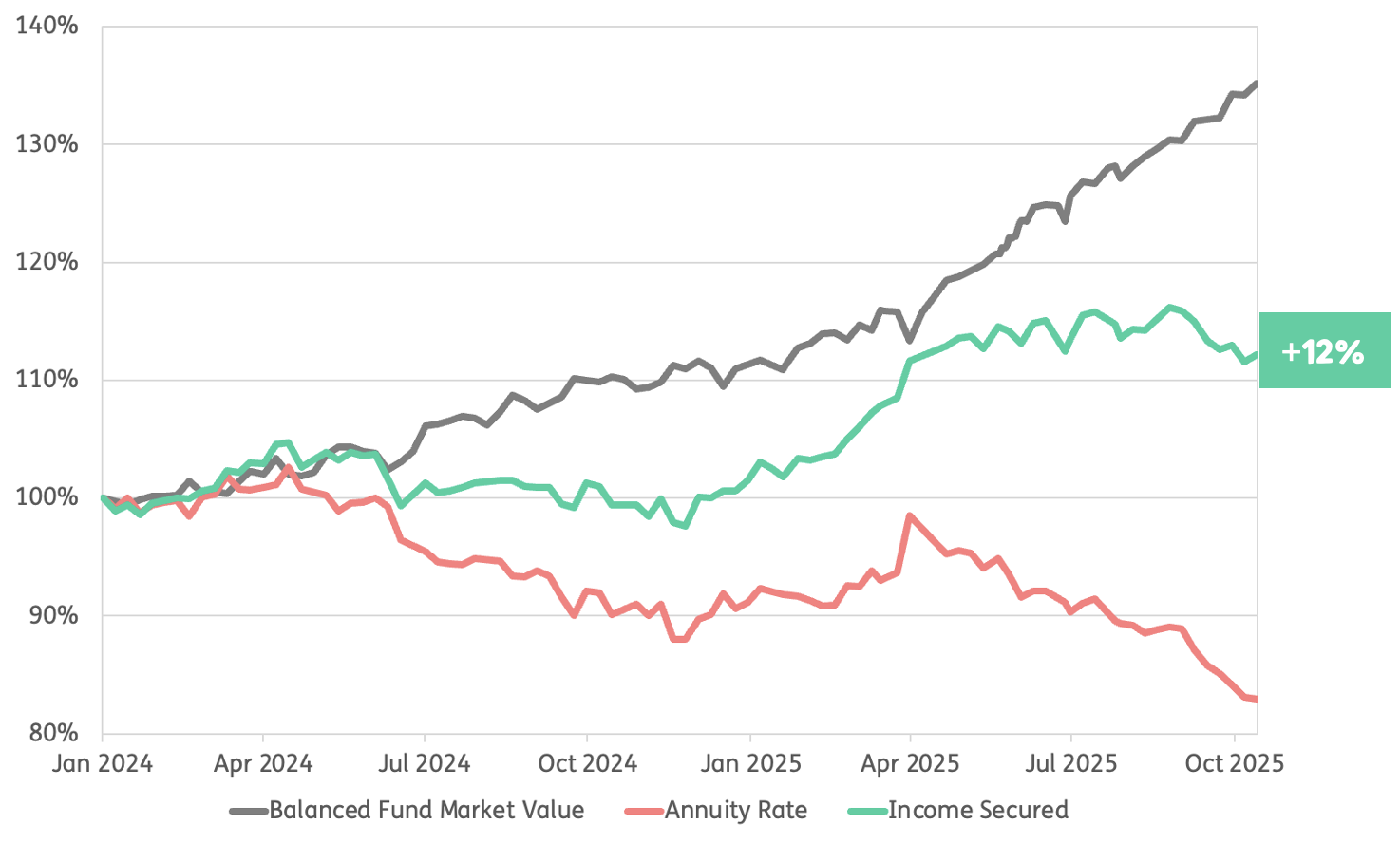

- If they were invested in a balanced fund, they have benefited from 2 years of strong double digit returns:

- drawdown rates may have become more comfortable for some

- some may have moved from the Danger Zone to the Risky Zone

Source: Just SA

Your clients can stay invested and look to beat inflation, with downside protection

- A with-profit annuity allows pensioners to remain invested in this strategy, but with smoothed returns and downside protection.

- Their income will never decrease even if investment markets fall from current levels.

- With-profit annuity increases for 2026 will be formally announced in December.

- Those targeting increases in line with inflation will beat that target comfortably in 2026.

- Increases for 2027 will remain strong, even if investment returns are low single digits next year (check your fund fact sheet for projected increases under different investment return scenarios).

Don’t wait for better annuity rates

- The equity market and long term interest rates (that drive annuity prices) are typically inversely correlated.

- When pensioners invest their higher market values at current annuity rates, they can secure higher guaranteed income for life than in early 2024 when annuity rates were higher.

Source: Just SA

Your pensioners could enjoy peace of mind over the festive season

They can focus on family and don’t need to worry about market predictions from the CEOs of the world’s major investment banks.

Need more information?

Please contact us if you'd like to discuss Just SA's offering in more detail with one of our consultants, or if you'd like to request quotes.

A reminder that JustTools allows registered financial advisers to request quotes direct to your inbox.

If you’re not registered, please contact us and we will gladly assist you.

Disclaimer: The information contained in this document is for information purposes only and it should not be regarded as advice as defined in the Financial Advisory and Intermediary Services Act 37 of 2002, or any form of advice in respect of the policy, retirement, tax, legal or other professional service whatsoever. You are encouraged to seek advice from an authorised financial adviser, or to independently decide that the policy or financial product is appropriate for you based upon your own judgment and understanding of your financial needs. Just Retirement Life (South Africa) Limited is a registered life insurance company, regulated by the Prudential Authority of the South African Reserve Bank and the Financial Sector Conduct Authority as an authorised financial services provider (FSP no. 46423). Additional information about Just, our products, including brochures, application forms and fund fact sheets, can be obtained from Just and from our website: www.justsa.co.zaThis document and the information contained within are the sole property of Just and any reproduction in part or in whole without the written permission of Just is strictly prohibited.