Life annuity rates up 11% this year amidst Trump and GNU chaos

9 April 2025

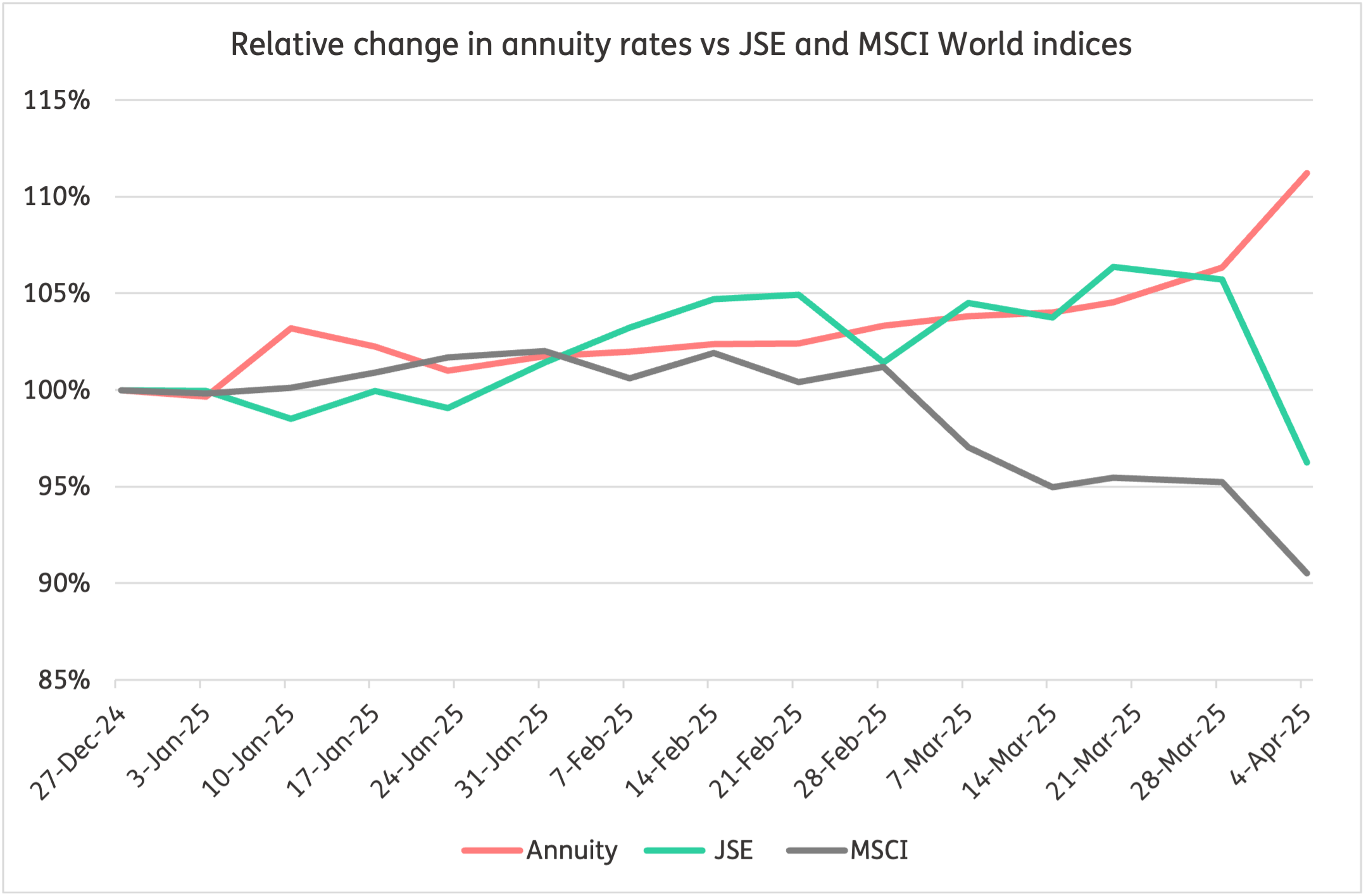

Amidst the massive turmoil in local and global investment markets in the last week, there is good news for pensioners: life annuity rates are up 11% this year.

This allows pensioners to lock in the peace of mind of a guaranteed income for life, rather than riding the emotional and financial rollercoaster of some of the most volatile investment conditions seen this millennium.

By comparison, since the beginning of this year, the JSE equity index is down 4% and the MSCI World equity index down 10% in Rand terms (even allowing for the fall in the Rand against the dollar).

Source: Just SA

In current market conditions, any pensioner drawing income of between 5% and 10% of their assets each year could guarantee that level of income for life in a life annuity. Based on research carried out by Just SA, this is about 35% of pensioners managing their assets in a living annuity.

It is well documented that most SA pensioners have not saved enough to cover their essential expenses and maintain their lifestyle in retirement. If they are managing their assets in a living annuity, they don’t have the luxury to reduce the income they draw from their retirement savings in adverse market conditions. So, whilst investment markets may bounce back over time, pensioners will have less assets remaining to benefit from the recovery.

South African pensioners cannot afford to risk their financial security in volatile markets impacted by Trump’s blustery America-first agenda, or the ideological differences being fought in the GNU. Current conditions provide a good opportunity to secure income guaranteed for life which is sufficient to cover their essential expenditure.

Need more information?

Please contact us if you'd like to discuss Just SA's offering in more detail with one of our consultants, or if you'd like to request quotes.

A reminder that JustTools allows registered financial advisers to request quotes direct to your inbox.

If you’re not registered, please contact us and we will gladly assist you.

Disclaimer: The information contained in this document is for information purposes only and it should not be regarded as advice as defined in the Financial Advisory and Intermediary Services Act 37 of 2002, or any form of advice in respect of the policy, retirement, tax, legal or other professional service whatsoever. You are encouraged to seek advice from an authorised financial adviser, or to independently decide that the policy or financial product is appropriate for you based upon your own judgment and understanding of your financial needs. Just Retirement Life (South Africa) Limited is a registered life insurance company, regulated by the Prudential Authority of the South African Reserve Bank and the Financial Sector Conduct Authority as an authorised financial services provider (FSP no. 46423). Additional information about Just, our products, including brochures, application forms and fund fact sheets, can be obtained from Just and from our website: www.justsa.co.zaThis document and the information contained within are the sole property of Just and any reproduction in part or in whole without the written permission of Just is strictly prohibited.