Riding the market wave: Why it's a good time to consider with-profit annuities

7 October 2025

Thanks to robust market performance, the JSE is at record levels and balanced funds have delivered double-digit returns over the past year. With-profit life annuities benefit from this in two ways: strong prospects for good increases from 2026 onwards, and more available funds to secure a higher guaranteed income for retirement, making it a compelling time to consider Just Lifetime Income.

In recent years, retirees have gravitated toward fixed escalating life annuity options, especially those guaranteeing annual increases of around 5%. The appeal of these products lies in their simplicity and predictability as clients know exactly how much their income will grow each year. The downside, however, is that fixed annual increases may not be sufficient if inflation rises unexpectedly.

With-profit annuities were popular before 2023, but their appeal has declined recently due to modest annual increases driven by subdued smoothed returns from balanced funds.

However, the landscape for with-profit annuities is shifting.

A with-profit annuity is invested in a diversified portfolio of bonds and a balanced fund and is therefore expected to outperform a fixed escalating income product in the longer term, which is invested only in bonds. And right now, with-profit annuities offer the benefit of locking in recent good market returns with two valuable safeguards:

- Increases are based on six-year smoothed returns that offer protection against volatile future returns.

- Increases can never be below zero.

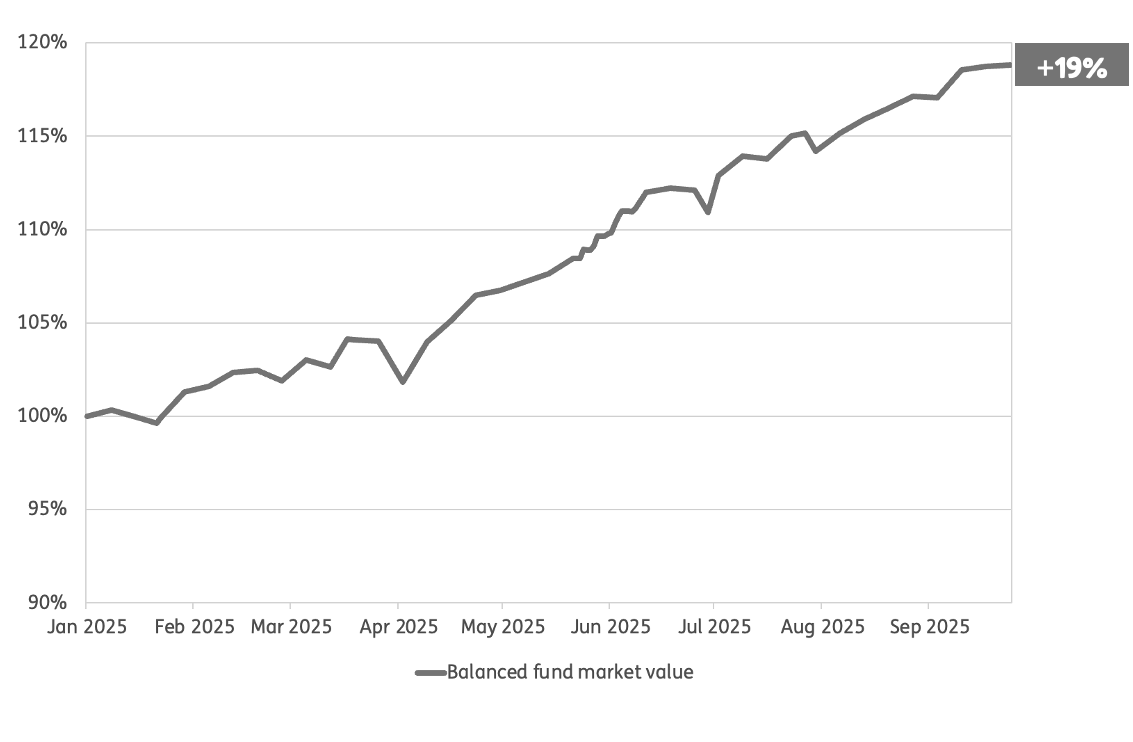

The graph below shows the robust returns posted by balanced funds since the start of this year:

Source: Just SA

As a result, increases of more than 5% are projected for 2026 on some of the popular Just Lifetime Income options – and more than similarly-priced fixed escalating counterparts. This marks a notable improvement and signals a return to competitiveness for with-profit annuities, making them a compelling choice once again for those seeking lifetime income solutions with higher expected income growth over the long term.

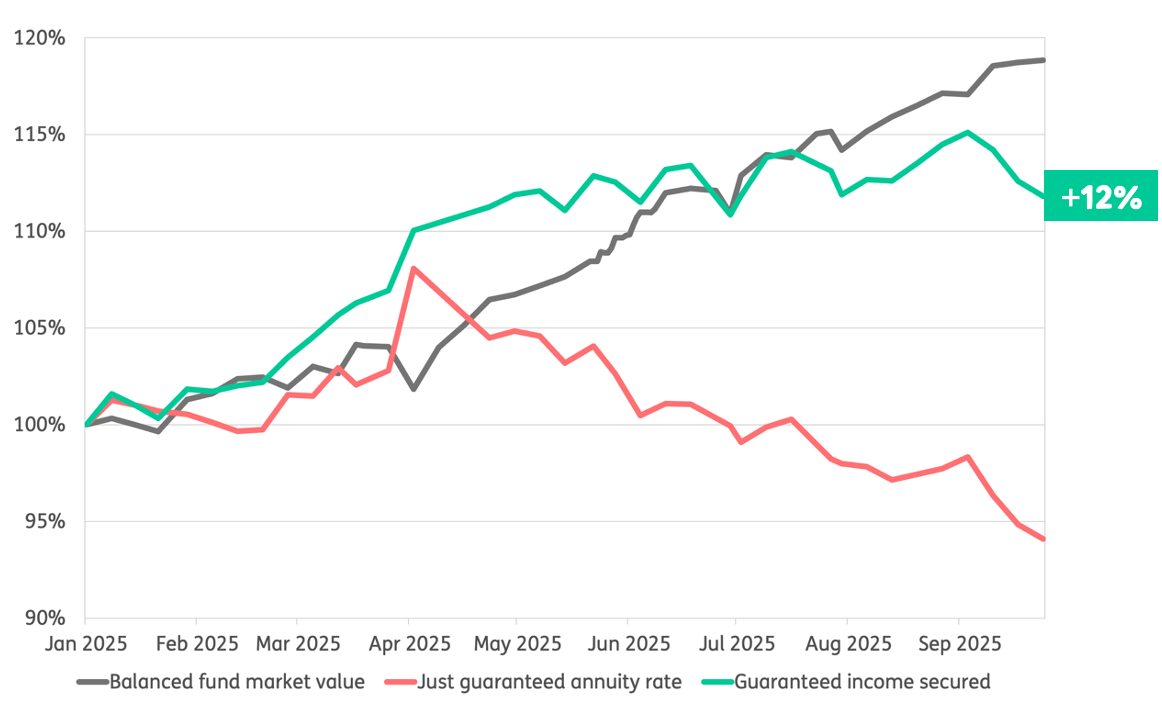

A further benefit of good balanced fund performance is that the effective guaranteed income clients can secure has increased materially, even though annuity rates have come off their recent highs experienced around April 2025.

This can be seen in the graph below, which tracks the following since January 2025:

- The grey line is the market value of a balanced portfolio.

- The coral line is the JuLI annuity rate.

- The green line is the level of guaranteed lifetime income that a client can purchase: the market value of the balanced portfolio is applied to the JuLI annuity rate to calculate the starting income that can be bought.

Source: Just SA

If starting income for with-profit annuities is a concern, you may want to consider Just Lifetime Income Advance which offers 5% to 15% higher income compared to a standard with-profit annuity.

It is important to recognise the risks involved in delaying annuitisation in hopes of higher yields. While it may seem appealing to wait for yields to spike again to secure a higher starting income from annuities, this approach is typically tied to adverse market conditions. Historically, significant increases in yields are often the result of a market crash. Such events can substantially reduce the value of the funds available for investment, ultimately offsetting any potential gains from higher annuity rates.

For both advisers and clients, it is therefore an opportune time to reap the benefits of good market performance and consider securing a Just Lifetime Income. The current environment offers the potential for a robust starting income, along with the possibility of benefiting from recent and future market performance. Taking action now will ensure a degree of financial stability for clients, a safety net of income that cannot decrease, while still allowing for the prospect of investment-linked income growth.

Need more information?

Please contact us if you'd like to discuss Just SA's offering in more detail with one of our consultants, or if you'd like to request quotes.

A reminder that JustTools allows registered financial advisers to request quotes direct to your inbox.

If you’re not registered, please contact us and we will gladly assist you.

Disclaimer: The information contained in this document is for information purposes only and it should not be regarded as advice as defined in the Financial Advisory and Intermediary Services Act 37 of 2002, or any form of advice in respect of the policy, retirement, tax, legal or other professional service whatsoever. You are encouraged to seek advice from an authorised financial adviser, or to independently decide that the policy or financial product is appropriate for you based upon your own judgment and understanding of your financial needs. Just Retirement Life (South Africa) Limited is a registered life insurance company, regulated by the Prudential Authority of the South African Reserve Bank and the Financial Sector Conduct Authority as an authorised financial services provider (FSP no. 46423). Additional information about Just, our products, including brochures, application forms and fund fact sheets, can be obtained from Just and from our website: www.justsa.co.zaThis document and the information contained within are the sole property of Just and any reproduction in part or in whole without the written permission of Just is strictly prohibited.