Still a good time to lock into an income for life

10 October 2024

Guaranteed life annuities are still offering good value for money, despite the recent reduction in annuity rates.

The income a retiree can secure at any point in time, is what really matters. This is what determines their standard of living. Income is determined by the combination of the market value of retirement savings and the annuity rate at any point in time - not the annuity rate alone.

Recovering markets have increased the value of retirement savings and long-term interest rates remain high, even though they have come off from their highs in May 2024. Therefore a person in, or approaching retirement who has been invested in a balanced fund, is still able to purchase more guaranteed Just Lifetime Income (JuLI) than they could have 18 months ago.

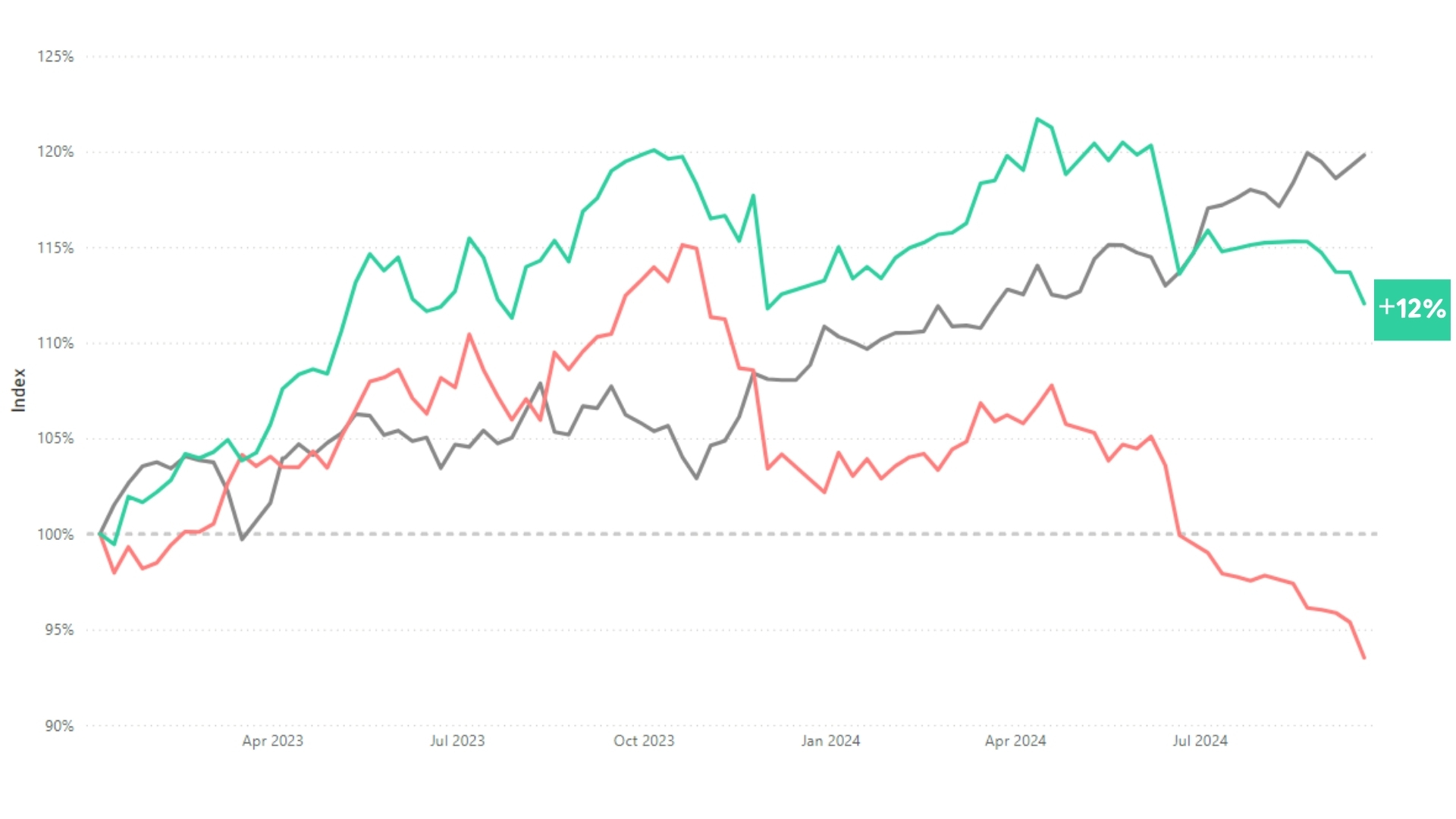

In order to put the current market conditions into perspective, have a look at how the different components have moved over time. The current value offered by JuLI (shown by the green line in the graph below) illustrates a 12% higher starting income now compared to 1 January 2023 even though the annuity rate is lower than it would have been 18 months ago.

Source: Just SA

- The grey line is the market value of a balanced portfolio.

- The coral line is the JuLI annuity rate, which changes to more or less offset the change in market value of the balanced portfolio.

- The green line is the level of guaranteed lifetime income that a client can purchase: the market value of the balanced portfolio is applied to the JuLI annuity rate to calculate the starting income that can be bought.

What is driving the improved value?

Two factors combined are making the price of JuLI attractive in current conditions:

- Strong growth in balanced funds: Recovering markets have increased the value of retirement savings and have bolstered increase expectations of with-profit annuities.

- Fixed interest yields: Long-term interest rates are still high, which translates into good value for money for life annuities.

Even though the annuity rate is lower today than the highs of May 2024, a pensioner invested in a balanced fund can still purchase more guaranteed lifetime income from JuLI. Furthermore, JuLI Advance now offers between 5-15% higher starting income than standard JuLI, if a client is willing to cap the future six year average investment returns used to determine increases at 15%.

The table below shows an annuity rate for a typical retired couple (male age 65 and female age 62), with a 75% spouse’s annuity, and a 10-year minimum payment period.

|

|

Market value in |

JuLI* annuity rate |

JuLI* Advance annuity rate (starting income) |

|

1 January 2023 |

R 1 000 000 |

7,2% (R72 400) |

n/a |

|

Today |

R 1 190 000 |

6,8% (R80 600) |

7,5% (R88 700) |

*JuLI StableGro targets increases in line with inflation.

Waiting for higher annuity rates?

As mentioned, the annuity rate is only half the story. Historically, there has been a strong negative correlation between annuity rates and the performance of balance funds. This was very evident during the COVID crisis when market values dropped sharply, and annuity rates increased sharply. More recently, when markets rose sharply, annuity rates reduced. So, while some may want to hold off the purchase of a guaranteed annuity until annuity rates are higher than current levels, bear in mind that this scenario may coincide with a drop in your client’s investment portfolio, which may mean that the income you can secure at that time is no better than what is available today.

Including a guaranteed life annuity in your client’s overall investment portfolio will remove investment risk and provide greater peace of mind. While short-term opportunities will arise, the long-term benefits of having a combined strategy will provide a better risk-adjusted return.

Blending in current market conditions

Investing some of a pensioner’s living annuity assets into JuLI gives a pensioner the peace of mind that that portion of income can never decline in any market scenario. They also retain long-term exposure to investment markets, because future increases are directly linked to the smoothed returns of a balanced portfolio.

This also allows them to maintain equity exposure on their other retirement savings, which cover discretionary expenses or are intended as a capital legacy.

What yield does my client earn on JuLI?

Because JuLI pays an income that targets growth in line with inflation, the starting annuity is similar to the dividend yield on an equity that is expected to keep pace with inflation – except that JuLI comes with the downside protection of a lifetime income guarantee – it will never miss a dividend.

Allocating part of a pensioner’s living annuity to JuLI allows them to consume more during their lifetime, at lower risk. And with JuLI Advance, in exchange for capping participation in future investment returns at 15% over our 6-year smoothing period, clients can enjoy more income for life – no matter how long they live.

Need more information?

Please contact us if you'd like to discuss Just SA's offering in more detail with one of our consultants, or if you'd like to request quotes.

A reminder that JustTools allows registered financial advisers to request quotes direct to your inbox.

If you’re not registered, please contact us and we will gladly assist you.

Disclaimer: The information contained in this document is for information purposes only and it should not be regarded as advice as defined in the Financial Advisory and Intermediary Services Act 37 of 2002, or any form of advice in respect of the policy, retirement, tax, legal or other professional service whatsoever. You are encouraged to seek advice from an authorised financial adviser, or to independently decide that the policy or financial product is appropriate for you based upon your own judgment and understanding of your financial needs. Just Retirement Life (South Africa) Limited is a registered life insurance company, regulated by the Prudential Authority of the South African Reserve Bank and the Financial Sector Conduct Authority as an authorised financial services provider (FSP no. 46423). Additional information about Just, our products, including brochures, application forms and fund fact sheets, can be obtained from Just and from our website: www.justsa.co.zaThis document and the information contained within are the sole property of Just and any reproduction in part or in whole without the written permission of Just is strictly prohibited.