The relative value of with-profit and non-profit annuities

Comparing the starting income of with-profit annuities to non-profit annuities only considers part of the picture and should not be used in isolation when assessing the relative value of these two annuity products. When comparing the value of an annuity, you should consider two main aspects together:

- Starting annuity on day one

- Expected future increases and increase potential over the long term

Starting annuity on day one

The starting income is often the most visible part of an annuity and tends to be the focus of attention when comparing annuity products. A higher starting income may appear more attractive, but you need to consider your income over the long term.

Expected future increases and increase potential

To fully appreciate the value an annuity will provide over the lifetime of the policy, you should understand how that starting income is expected to grow over the longer term. The trouble is that the specific duration is unknown at the outset but could last well over 30 years.

For example, a typical joint life policy (male aged 65, female aged 61) has a life expectancy of over 25 years, where there is a 50% chance that at least one will survive beyond 25 years (also known as the 50th percentile of life expectancy). A joint life surviving to the 75th and 90th percentiles of life expectancy can expect to live for over 32 and 37 years respectively.

When you start to consider the full lifetime of an annuity, the long-term increase potential becomes far more important than the starting income and increases received over the short term.

Modelling the relative value of annuities

It is complex to directly compare annuities with different starting incomes, different short-term increase expectations and different long-term increase potentials. To assist with this comparison, Just built a break-even analysis model that allows for the comparison of these annuity products in today’s terms, while considering all the above moving parts.

The model calculates what percentage return a balanced fund (which determines the future increases of a with-profit annuity) would need to outperform the expected bond yield in order to have exactly the same value as a fixed escalation annuity, projected to each of the 50th, 75th and 90th percentiles of life expectancies. Simply put, if you believe that a balanced fund will outperform at least this percentage above the expected bond yield, you would accept that a with-profit annuity will provide superior value to a fixed escalation annuity.

For the purposes of this note, we compare Just Lifetime Income (JuLI StableGro) to a fixed escalation annuity (FEA 5%).

The model point considers:

- a couple i.e. joint life

- male aged 65, female aged 61

- 75% spouse’s income

- 10-year minimum payment period

- a typical balanced fund as the underlying investment portfolio

The relative value of JuLI StableGro with-profit annuity versus 5% fixed escalation

| Life expectancy | JuLI StableGro |

| 50th percentile | 0.7% |

| 75th percentile | -0.1% |

| 90th percentile | -0.4% |

The interpretation

If the balanced fund outperforms government bonds by more than 0.7% p.a. after fees over the long term, then the JuLI StableGro with-profit annuity will be a much better value proposition. Normal financial theory suggests that equities (and other risky assets) will outperform risk-free assets (such as government bonds) over the long term. This reinforces our belief that there is currently value in WPA over the life expectancy of our policyholders.

The longer the life expectancy (or rather the longer the last survivor lives) the lower this hurdle rate becomes i.e. for longer durations, the balanced fund would need to match or even provide returns below the expected bond yield for a with-profit annuity to be more valuable.

Important to note that yield curves and balanced fund returns move around daily, and hence starting incomes and future increase expectations are volatile. As a result, the analysis does differ depending on the inputs, however the conclusion remains similar.

Expectation versus reality, and starting income versus income growth over time

The current reality of attractive long-term bond yields against the relatively low expected increases on with-profit annuities over the next few years due to the lower-than-expected balanced fund returns over the last three years is a challenging discussion with clients.

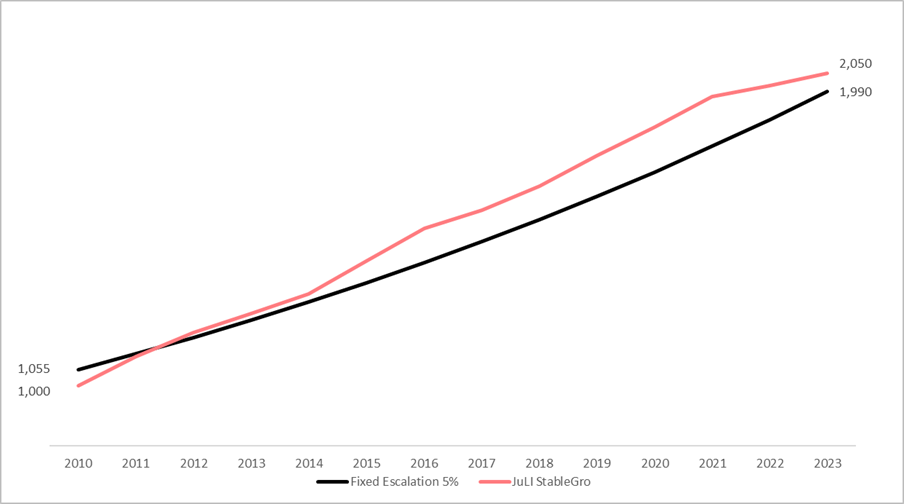

For example, a fixed escalation annuity may offer a higher starting income compared to a with-profit annuity. But over the long-term, the income derived from a with-profit annuity can catch up and exceed the fixed escalation income.

When we look back over the past 13 years, JuLI StableGro would have outperformed a fixed escalation annuity. This despite the fixed escalation annuity having a higher starting income in 2010.

Starting annuity income on its own is not a sufficient measure of value for guaranteed annuities. A guaranteed life annuity’s value is the sum of its starting income and the expected future increases over a long-term investment horizon.

When considering life expectancy, clients should understand that even though a with-profit annuity’s increases may be expected to be lower in the short term compared to a fixed escalating annuity, a longer-term view is important. The growth in income from a with-profit annuity is expected to better protect the retirees’ purchasing power later in life.

The information contained in this newsnote is intended for financial advisers and is for information purposes only. It should not be regarded as advice as defined in the Financial Advisory and Intermediary Services Act 37 of 2002, or any form of advice in respect of the policy, retirement, tax, legal or other professional service whatsoever. You are encouraged to seek advice from an authorised financial adviser, or to independently decide that the financial product is appropriate for you based upon your own judgment and understanding of your financial needs.