2 in 3 living annuitants draw more than the sustainable level

A recent study of a sizeable portion of the living annuity market conducted by Just SA, reveals

- two thirds draw more than the recommended sustainable drawdown rate[1]

- an average drawdown rate of 8.5% per year

These retirees are at risk of running out of money in retirement.

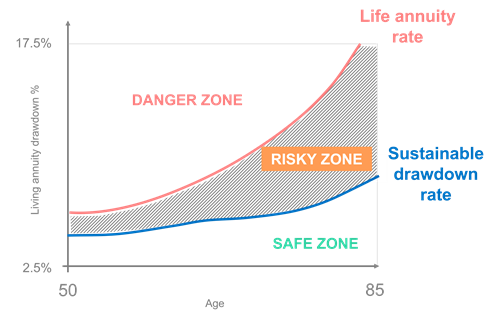

Diagram

There are three possible scenarios or zones for living annuitants, they are either:

Drawing an income at a sustainable rate (safe zone)

Drawing an income that is above the recommended sustainable rate, but below life annuity rates (risky zone) or

Drawing an income at an unsustainable rate, above life annuity rates (danger zone)

Reframing Loss in Retirement

As humans, we do not like to lose. However, people seem to be more averse to a perceived short-term loss of capital than a long-term loss of income.

In retirement, living annuities are better for preserving capital in the event of early death, but are only likely to preserve capital in the long term for those who draw less than the sustainable drawdown rate (those in the safe zone above – the minority). Life annuities are better at sustaining an income for life – no matter how long you live.

And the reality is that pensioners need a mix of both.

Blending introduces a dimension to a pure living annuity which reduces the risk of running out of money. Whether this is to sustain your income for longer in retirement, or to leave a legacy to loved ones.

A blended annuity, which has both life and living annuity components in one investment, allows clients to structure a suitable balance of a life and living annuity over time. It allows you to manage the trade-off of flexibility and certainty because you can switch portions of the living annuity into the life annuity portfolio over time, when required.

Historically, the inability to adjust income from a life annuity and the misperception of lack of capital protection are some of the reasons why many South African retirees opt for a living annuity, or defer converting to a life annuity until later. But new generation life annuities are proving to be a suitable solution for those seeking certainty and security in retirement, or for those seeking a diversifying asset class.

[1] FSCA: Notice regarding the publication of draft conduct standard [*] of 2020 (RF) Conditions for Living Annuities in an Annuity Strategy