1 in 3 living annuity clients risk running out of money unnecessarily

By Deane Moore, CEO

A recent study of around 10% of the living annuity market conducted by Just SA, revealed:

- an average drawdown rate of 8.5% per year

- two thirds draw more than the recommended sustainable drawdown rate[1] and risk running out of money in retirement

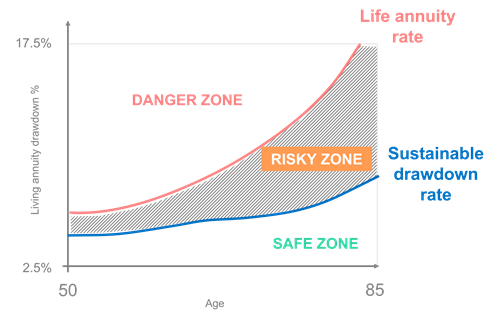

The irony is, half of these living annuitants could guarantee that income for life, with annual increases that target inflation, by investing part of their living annuity assets in a life annuity (those in the ‘Risky Zone’ in the diagram below). The simple reason that life annuities sustain a higher income for life is that policyholders pool their risk, and those who die earlier cross-subsidise those that live longer.

|

Diagram: There are three possible scenarios or zones for living annuitants. They are either: Drawing an income at a sustainable rate (safe zone) Drawing an income that is above the recommended sustainable rate, but below life annuity rates (risky zone) or Drawing an income at an unsustainable rate, above life annuity rates (danger zone)

|

Many pensioners remain stuck in their perilous predicament in living annuities with unsustainable drawdown rates, because they are reluctant to lose any of their hard-earned capital in the event that they die. But this doesn’t need to be the case when investing part of their assets in a life annuity – they can add minimum guaranteed payment periods and income benefits which continue as long as their financial dependants remain alive.

Is there something about human nature which drives so many pensioners to run such an irrational risk in their retirement?

Reframing Loss in Retirement

As humans, we do not like to lose. In particular, people seem to be more averse to a perceived short-term loss of capital than a long-term loss of income.

Living annuities are better at preserving capital in the event of death early in retirement, but only preserve capital in the long term for the minority who draw less than the sustainable drawdown rate (those in the safe zone above). Life annuities are better at sustaining income for life. The reality is that pensioners need a mix of both.

And a blended annuity, which has both life and living annuity components in one product, allows clients to structure a suitable combination over time, balancing the various trade-offs by switching additional tranches into the life annuity portfolio when required.

An alternative approach to loss

While the attention has traditionally centered around not wanting to lose capital at death, along with an inherent desire to retain flexibility and defer big financial decisions, we believe that financial advisers have an important role to play in helping to reframe the narrative surrounding annuity options in retirement.

Life annuities are proving to be a suitable solution for clients seeking certainty and security, and for those seeking a diversifying asset class. As a client’s drawdown rate drifts above the recommended sustainable rate, it becomes more important to ensure that they have a guaranteed retirement income for life, so that they do not become a financial burden on their dependants, or on the state.

[1] FSCA: Notice regarding the publication of draft conduct standard [*] of 2020 (RF) Conditions for Living Annuities in an Annuity Strategy

This article first appeared in the October 2022 edition of FA News.