We have noticed several myths about blended annuities that we would like to dispel. In this article, we will unpack and debunk the five most common myths about blended annuities. But before we begin, here is a brief note for you, the reader.

This may be a longer read. However, sticking with this guide means you’ll gain several key insights into how retirement income works and what that might mean for your future. Whether you’re nearing retirement, already retired, or simply eager to stay informed, these insights can help you better understand your future choices and consider your retirement goals more clearly.

Retirement income jargon can be difficult to grasp – terms such as annuities, guaranteed income, investment returns, and drawdown rates can be overwhelming for people who aren’t familiar with financial products. (Note: we developed a retirement jargon buster to help you navigate this terminology more easily.) And then, on top of all that comes a relatively new concept called blended annuities! It’s a lot to get your head around, but we hope this guide will help it all make sense.

Myth #1: Blending is difficult to understand

The concept of blending is not particularly difficult to grasp as it simply involves blending two financial products – a living annuity and a life annuity. However, the intricacies of the combination can be tricky because each component has its own features, rules and complexities. But we believe that with careful explanation (and where possible, the help of a financial adviser), blending is not too difficult to understand.

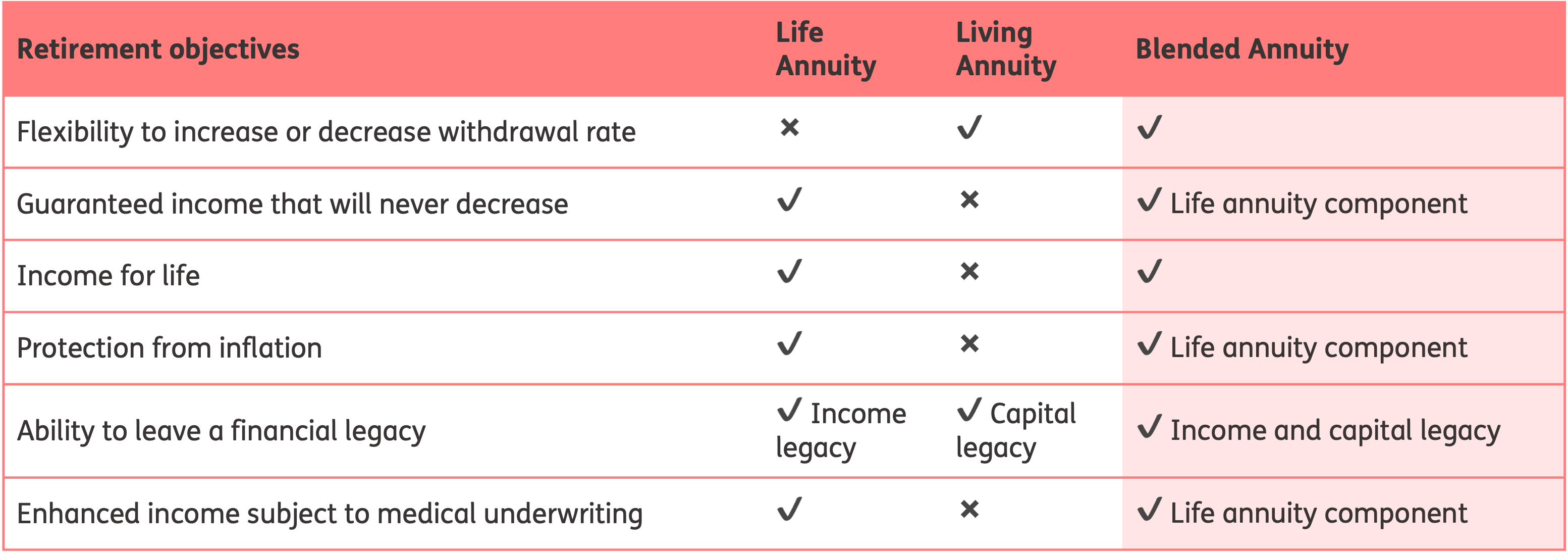

Let’s begin by laying the groundwork. If you understand the following concepts, you are already halfway there! Below are two distinct product types — the first is insurance-based, and the second is investment-based. For more information on this distinction, we recommend you read our article on why it’s essential to understand the difference between insurance and investments regarding retirement income planning.

|

Guaranteed income |

|

|

Living annuity |

Note: The rate of your withdrawals is commonly referred to by retirement income specialists as your drawdown rate. |

Blending is simply a combination of features of the above products — a mixture of insurance and investment wrapped in one product. Let’s look at how and why blending came about in the first place, as this will help you understand the blending mechanism itself and why blended annuities are regarded as a sustainable retirement income solution today.

The emergence of blended annuities

Blended annuities are a relatively recent innovation.

In 2016, Just SA developed a guaranteed annuity product called Just Lifetime Income (JuLI) for the South African market. And in 2017, with the help of several living annuity partners, this product was made available as a portfolio within a living annuity, creating a blended annuity product.

A blended annuity allows you to allocate some of your retirement assets to a guaranteed income product, while keeping the rest invested for growth and flexibility.

Ultimately, blended annuities are a response to retirees’ need for income security and investment growth in one single product — the best of both worlds.

|

Blended annuity |

|

As you can see, in principle, it’s not that complicated. Let’s look at a comparison between life, living, and blended annuities to get a bird’s-eye view:

Source: Just SA

This table drives home the simple truth about blended annuities. They:

- Offer certainty and flexibility—a broader range of benefits and a more sustainable income

- Combine the strengths of both life and living annuities

- Balance out each product’s limitations

So, why aren’t more people blending?

Given the range of overall benefits, we’ve often wondered why many more people aren’t blending (which involves annuitising a portion of their retirement benefit). In our research, we’ve seen that there are many reasons. For instance, many simply don’t know about this option yet, but, more often than not, the barriers to blending are often a result of behavioural biases and myths prevalent in the South African retirement context or the mindset of the average South African close to retirement.

The following section will explore one of the biggest myths.

Myth #2: A living annuity is sustainable on its own

To illustrate why this myth is problematic, let’s investigate what retirement income sustainability means and then look at the factors that impact living annuity sustainability.

Income sustainability: a non-negotiable

"Academic research has largely settled the life versus living annuity debate, proving that a combination provides a more optimal outcome when balancing the competing objectives of having a sustainable income for life and leaving a capital legacy on death. This was also recognised by the FSCA when it granted an exemption from its criteria for living annuities in a default annuity strategy, which paved the way for blended living annuities to be offered as a default option for retirees."

- Johann Swanepoel, Head of Product, Just SA

Income sustainability is the ability of a retirement income strategy to provide a stable and sufficient income throughout retirement, accounting for longevity, market volatility, inflation, and behavioural risks. In other words, you should be able to afford:

- Rising medical costs as you age

- The rising costs of living (inflation)

- Discretionary spending, such as travelling to visit loved ones

- Many other possible costs.

Conversely, unsustainable retirement income means not being able to cover basic retirement needs over the long term, or running out of money during retirement. It is important to acknowledge that running out of money in retirement is not as uncommon as you might think. Only about 6% of South Africans are on track to retire comfortably, leaving the majority at risk of outliving their savings and unable to sustain their desired lifestyle in retirement.

At Just SA, we believe a just and secure retirement is possible with the right planning. This is why we hold that income sustainability should be a top priority in your retirement plan. However, we believe that, for many, achieving income sustainability often involves very carefully considering whether a living annuity alone is the most suitable retirement income option.

Here’s why living annuity income can become unsustainable:

Pure living annuities: a risky business?

What you should know is that, over the last ten years, there has been much debate by retirement income experts surrounding the unsustainability of living annuity income. A living annuity can indeed be sustainable for a lifetime, but this possibility depends on several carefully managed factors, including:

|

Drawdown rate |

How much you draw from your living annuity annually. |

|

Investment performance and self-management |

If the value of your assets goes up or down over time, and how you manage them. |

|

Longevity |

How long you live and, by extension, how long you will need to rely on your living annuity income. |

Therefore, for your living annuity income to be sustainable, you would need to:

- Have stable investment performance (i.e. your investment returns aren’t negative)

- Keep your annual drawdown rate below a specific threshold

- Correctly estimate how long you’ll live, and plan your money accordingly. It should be noted that, on average, people are living longer than they used to.

However, as we’ll explain, effectively managing these factors, especially the drawdown rate, is far easier said than done.

Why do drawdown rates tend to go up?

It is vital to note that living annuity income is only considered sustainable if your annual drawdown rate is between 4 and 5% of your savings pot. This recommended rate is designed to provide a sustainable income (income that lasts as long as you do) while preserving your capital for as long as possible.

So, if you’ve invested R1 million at retirement, based on the recommended rate you’d be drawing R50,000 per year, which is roughly R4,166.67 per month. As you can see, this is not very much to work with. With less than 5% of South Africans able to afford a R1 million investment at retirement age, combined with rising living costs, it is easy to see why drawdown rates tend to creep up far higher than recommended. In other words, people are drawing more than is recommended to cover their basic needs, leading to an increased risk of running out of money in retirement.

To put this into perspective, we encourage you to ask yourself: Can I afford to invest R1 million at retirement? If your answer is no, and you buy a living annuity, your drawdown rate will likely be higher than recommended, which is a highly problematic scenario.

Here’s another factor that tends to cause higher-than-recommended drawdown rates:

Have you heard of present bias?

While the increased costs of living and/or insufficient retirement savings may lead to higher drawdown rates, present bias is also a significant factor.

Present bias is the tendency to prefer immediate rewards over larger delayed rewards. This plays out with living annuities: People tend to favour the immediate benefits of flexibility and capital access that pure living annuities provide. But present bias tends to lead to more present bias. One of the knock-on effects of flexible access to retirement capital is the tendency to overdraw, i.e. drawdown rates increase.

People tend to overdraw at the beginning of retirement for immediate rewards such as clearing debts, travel, new cars, gifts to family, and supporting adult children, and then realise that they have drawn too much, meaning they have to drastically cut expenses or risk running out of money in retirement.

In reality, an unsustainable drawdown rate is, at best, very alluring for some, and at worst, impossible to avoid for many. And, as we’ve explained, the risk you run when drawing more than recommended is depleted retirement savings.

Let’s examine the true cost of an unsustainable drawdown rate to put the gravity of income shortfall into perspective.

The true cost of an unsustainable drawdown rate

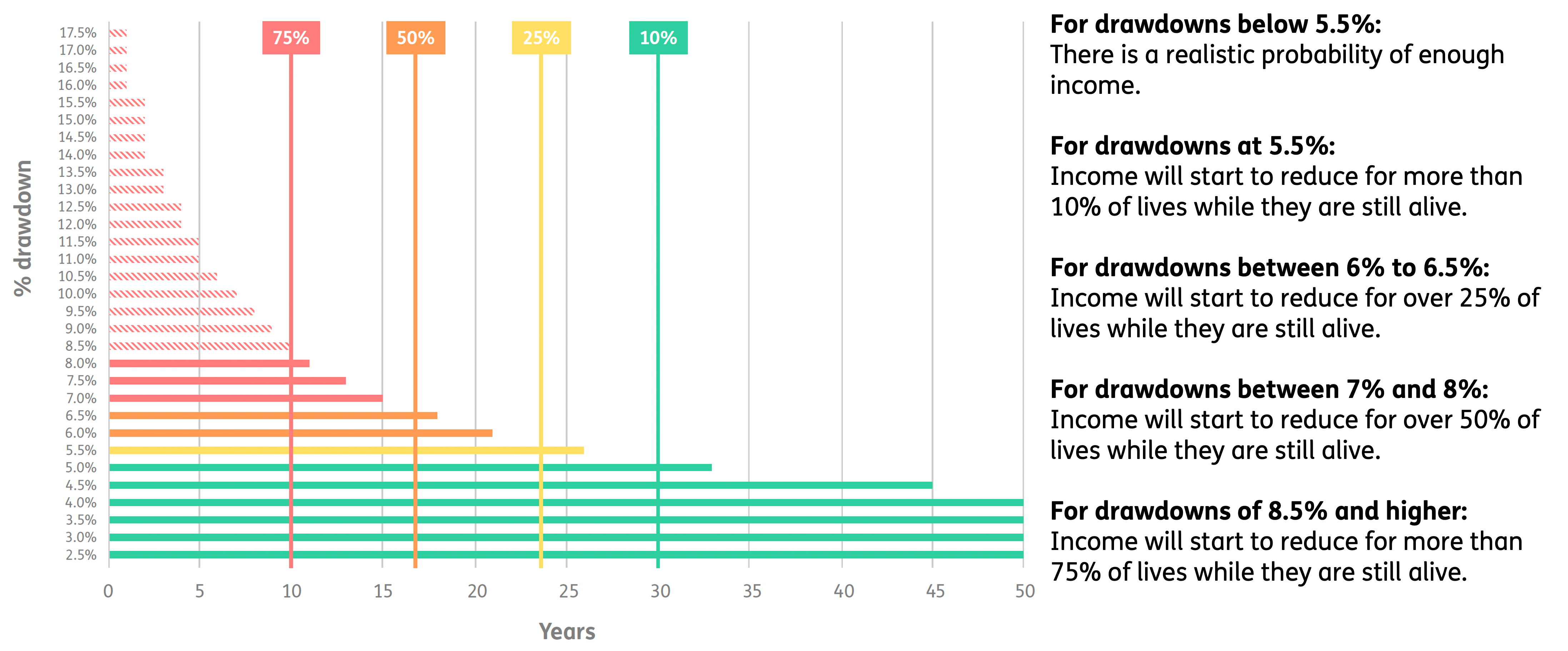

Just SA has been compiling and monitoring a composite income sustainability map of more than 20,000 lives. Our research reveals that the average drawdown rate is 8.5%, translating into an average income shortfall of 15 years. Scary.

Please take a close look at the figure below.

Figure: Combining drawdown levels and survival probability (male aged 65)

Source: Just SA's Optimal Retirement Income Strategies (2023)

Are living annuities sustainable on their own? It depends…

All living annuitants would draw at the recommended rate in a perfect world. However, significant data suggests that the tendency toward higher-than-recommended drawdown rates in the retirement market is the rule, not the exception. In this environment, the probability of depleting a living annuity is high.

So, are living annuities sustainable on their own? Yes, but only if you stick to the recommended drawdown rate, which, as we’ve seen, is very difficult for most people to do, especially when you combine present bias and rising living costs.

At Just SA, we believe that for most ordinary South Africans, living annuities are not sustainable on their own, and the retirement market may already be reflecting this truth. Just over ten years ago, it was widely recognised that 90% of pension money flowed to living annuities. Fast forward to today, and the flow of pension money has moved closer to 70% to living annuities and 30% to life annuities. Because the retirement market is gradually becoming more educated about the risks of only having a living annuity, a good portion of this shift may be the result of increased rates of blending.

Blending may be a better option

If you don’t manage your money carefully with a living annuity or, say, life throws something unexpected your way — higher expenses, rising inflation, or an emergency that forces you to withdraw more — you could find yourself at risk of running out of money. Moreover, behavioural factors such as present bias only add to the challenge.

That said, it’s easy to see why living annuities are so popular. People value the control they offer and the ability to fully access capital as and when needed. These are major strengths — and for many, non-negotiable.

But here’s the good news: you don’t have to choose between flexibility and security. Blending allows you to keep the benefits of a living annuity while offsetting its risks.

By building in a guaranteed income portion, you can create a layer of financial security or insurance, one that will support your essential needs no matter what happens.

The benefits of blending

Let’s recap the pros of blending now that we have a better idea of the risks of living annuities:

- Blending is an effective way of eliminating the risk of running out of money.

- A minimum level of income — guaranteed for life — is added, which can never be reduced.

- This guaranteed income can cover essential expenses and/or reduce the effective drawdown on the remainder.

- You can protect a spouse or partner by adding a spouse’s income benefit or a guarantee period (minimum payment period).

- A lump-sum legacy or inheritance is maintained through the living annuity portion.

- You can preserve flexibility in terms of the overall level of income you need to draw from the living annuity.

Let’s take a look at the next blended annuity myth.

Myth #3: Blending into a life annuity should be done when you’re older

Before we unpack this myth, it's important to understand loss aversion, a kind of behavioural bias in which people tend to feel more emotional pain when losing something rather than the satisfaction of gaining something of equal value. Loss aversion is one of the primary reasons why many purchase pure living annuities, even when they understand the long-term value of guaranteed income.

People might feel they will ‘lose out’ in a life annuity if they pass away earlier than expected. So, even if it means missing out on the security that life annuities offer, they opt instead to defer or delay annuitisation. Annuitisation refers to buying a life annuity, or switching from a living annuity to a life annuity, or blending, i.e. including a life annuity component in a living annuity.

Even though, statistically speaking, people live at least five years longer than they expect to, this irrational emotional fear — loss aversion — often makes it easier for people to fall victim to several misperceptions and mistruths, for example:

|

Procrastination |

Fear often leads people to delay big financial decisions — not because they don’t know what to do, but because taking action feels risky or irreversible. |

|

Confirmation bias |

When people are already nervous about loss, they’re more likely to believe misleading ideas that support their hesitation, such as the myth that annuity rates always get better with age. This reinforces the idea that it’s ‘safer’ to wait, even when the data says otherwise. |

|

Commitment aversion |

Fear also makes people more sensitive to losing control. Since annuitising is a one-way decision — you can’t undo it — it can feel like giving up flexibility, which loss-averse people find especially uncomfortable. |

|

Present bias |

Loss aversion — the intense fear of immediate loss even when better gains lie ahead — reinforces other irrational behaviours such as present bias. When focused on avoiding any loss at all costs, you’re also more likely to favour immediate rewards, no matter the long-term cost. This mindset helps explain why many defer buying a life annuity: they avoid the immediate ‘loss’ of capital, even though delaying usually reduces future income and increases overall costs. |

The myth that it’s better to annuitise when you are older is a clear example of how loss aversion lays the emotional groundwork for some of the behavioural pitfalls and misperceptions above.

But as we’ll explore next, deferring annuitisation, perhaps as a result of present bias, can come at a real cost:

Why deferring annuitisation can cost you

Many people don’t realise how costly it can be to delay switching into a life annuity. The risks of living a long life are just as real as the risk of dying early — and yet, most of us worry more about the latter.

It’s easy to think that waiting means a better deal because the income you’re offered does go up with age. But in reality, the total income you’ll receive is usually lower if you wait too long.

For example:

If the annuity rate is 10% for a 70-year-old male, and 8.5% for a 65-year-old male, one assumes 10% is better than 8,5%. However, this does not compare like-for-like as the annuity rate for the 65-year-old is expected to pay five years more income.

Differently put, if you invest in a life annuity with a reasonable increase at age 65, you would expect the effective annuity rate at age 70 to be higher than 10%, which is what you will get if you annuitise at that point.

Flexibility isn’t always a benefit

Living annuities feel more flexible because you keep control of your money. But with that control comes risk: you’re now responsible for making your money last, for possibly 30+ years. This is called self-insurance, and it’s not free.

You carry all the risk if markets perform badly, or if you live much longer than expected, making it the most expensive way to secure an income over time.

Why blending makes sense for many

When you combine (or blend) a life annuity with a living annuity, you strike a balance:

- You still keep some flexibility

- You get a guaranteed income you can’t outlive

- You’re protected from market shocks

- You can spend more confidently, knowing the basics are covered

In short, blending gives you more income security with less risk.

Let’s take a look at the next myth about blending.

Myth #4: Blending is expensive, so it is cheaper and more effective to create my own blend using two separate products

It is important to note that a blended annuity is, in fact, a living annuity that incorporates a guaranteed life annuity as an investment portfolio within its structure. As such, it is one product and it follows the typical legal guidelines of a living annuity.

One of the main benefits of a blended annuity is that annuitisation doesn’t have to be an all-or-nothing decision. The blended annuity structure allows for the purchase of numerous tranches of guaranteed income as and when it is appropriate for the client (as opposed to splitting retirement capital between living and life annuities on a once-off basis at retirement), making the product dynamic and more flexible.

You pay the normal linked-investment product administration fee, as a blended annuity is treated as one product. So, it is cheaper than creating your own blend of living and life annuities, which would consist of two separate products and their associated fees.

Another drawcard of blending as opposed to holding two separate products is that you have one income stream to manage (which must be between 2.5% and 17.5%). In a hybrid, you have two income streams, and you have to take at least 2.5% on the living annuity and also receive an income from a life annuity. This also means two separate tax applications.

Let’s bust the last blended annuity myth.

Myth #5: A blended annuity is the same as a hybrid annuity

As we’ve explained, a blended annuity combines two annuities inside one living annuity product. The life annuity portion is embedded in the living annuity contract. You don’t need to exit or switch from one product to another — it's all done under one roof.

A hybrid annuity is a strategy, not a single product — you have two separate annuity contracts working together, where you use part of your retirement funds to buy a life annuity (guaranteed income) and the rest goes into a separate living annuity (flexible income + investment growth). These two annuities are managed separately, and you’re ‘hybridising’ your income strategy, not blending the income.

Imagine your retirement income is like a meal:

- A blended annuity is a smoothie: ingredients (life + living) are blended together in one glass.

- A hybrid annuity is a combo meal: separate burger and drink (life and living), on one tray, but served separately.

A hybrid may also be less tax efficient. With a blended annuity, if you want to delay paying tax (by reducing income) you can do this by allowing the life annuity income to build up inside the living annuity, rather than drawing it as an income.

Conclusion: Should you blend?

Blending gives you the best of both worlds by combining the security of insurance with the growth potential of investments. It offers peace of mind knowing you have a guaranteed income that protects you from running out of money, while also letting part of your savings stay invested to grow and keep pace with your needs. This balance means you can enjoy the stability of a lifetime income alongside the flexibility and potential gains from participating in the market.

By finding the right mix based on your comfort with risk and personal goals, blending helps you feel confident that you won’t miss out on growth or security. It’s a simple, practical way to manage your retirement money that considers both your immediate needs and your future well-being!

As always, we strongly recommend speaking with a qualified financial adviser. They can help you assess your needs, align your risk appetite with the right product, and give you peace of mind that your retirement plan is built for the long term.

Do you need more information?

Consider seeking advice from a qualified financial adviser. Contact us to request the details of an adviser in your area, or to find out more about our offering.