When we think of insurance, we often picture paperwork, premiums, and something you’re not sure you really need right now. But what if we flipped the script? What if we saw insurance, and more specifically life annuities, as an act of self-care in retirement? Not just a financial product, but a promise to yourself: that your future will be secure, your lifestyle protected, and your dignity preserved. In this article, we invite you to reframe life annuities as a gift to your future self – an investment in comfort, peace of mind, and the freedom to enjoy retirement without constantly worrying about money.

The Power of Patience

Reframing delayed gratification as lifetime security

Insurance can involve a degree of delayed gratification, which means resisting the urge for immediate rewards in favour of longer-term benefits. In the case of life annuities, this can feel especially true: you invest a lump sum today, and in return, you receive a monthly income stream for as long as you live. Of course, receiving a regular monthly income doesn’t come with the same instant excitement as a lump sum payout. But over time, that steady stream can offer peace of mind and financial stability—something that becomes more valuable the older we get.

Delayed gratification isn’t just about waiting – it’s about planning with purpose. It’s about choosing long-term stability over short-term needs. And when it comes to retirement, that choice can mean the difference between financial stress and financial freedom. Life annuities offer the peace of mind that you’ll have a reliable income for the rest of your life, no matter how long you live. That’s not just a reward – it’s a reassurance.

How annuities work for your financial future

After 10 years of specialising in retirement income options in South Africa, we often see retirees misunderstanding annuities in general, which is why we strongly recommend consulting a financial adviser to help you understand the differences between types of annuities.

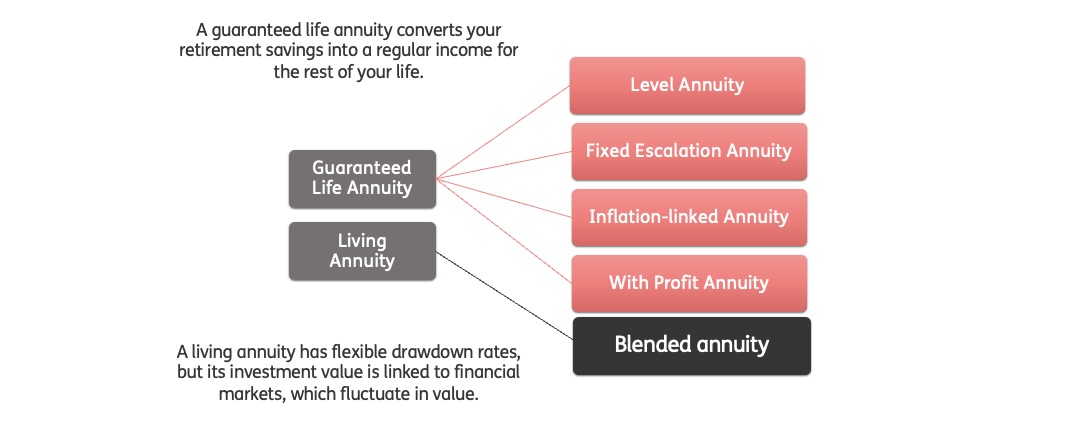

But to give you some context, when you approach retirement, you will need to decide whether to invest two-thirds (or all) of your pension fund or retirement annuity in a living annuity, a life annuity, or a combination of the two (called a hybrid or blended annuity). But with so many financial service providers offering a host of annuity products, it may be challenging to know which one gives you the best possible retirement income suited to your individual circumstances.

Retirement Annuities

Some might refer to living and life annuities as ‘retirement annuities’, but this is confusing and can be misleading. A retirement annuity or RA is the industry term for a long-term investment product designed to help you save for retirement during your working years (a pre-retirement savings vehicle). You use the funds in an RA to buy a life or living annuity when you retire.

Income choices at retirement

At Just SA, we specialise in life annuities to provide you with an income throughout your retirement – guaranteed. But people don’t see life annuities as insurance, but rather as ‘money locked away’ with no flexible access.

To a certain extent, we understand this view. Unlike a car, holiday, or home upgrade, there’s no instant enjoyment – but this is where the true power of a life annuity lies. Once a fleeting pleasure is over, it’s done. By contrast, a life annuity keeps on giving and can prove particularly useful later in life when you need that constant income stream the most. A life annuity is an investment in your future comfort, dignity, and financial security.

Life annuities = long-term financial empowerment

It’s helpful to see a life annuity not as a delayed payoff, but as a guaranteed income that protects you from some of life’s unknowns. One of these unknowns is how long you will live, which means not being sure how much money you may need each month in retirement to cover your expenses and desired lifestyle for the rest of your life.

In retirement, certainty and security are priceless. Rising costs, market uncertainty, and longer life expectancies can put unexpected pressure on retirees at a time in life that is meant for calm and relaxation.

Life insurance vs life annuities: securing your freedom in retirement

Life insurance vs life annuities: the difference matters when planning for your retirement. While life insurance protects your family after you pass away, a life annuity protects you while you live.

Life insurance pays your loved ones a lump sum when you die. A life annuity, on the other hand, pays you a monthly income for the duration of your life. Both products address a specific need: providing for your dependants on your death, or securing your own financial freedom in retirement and reducing the risk of becoming a financial burden on family if you run out of money.

Key differences at a glance

- Purpose: Life insurance offers protection for your family after death; a life annuity offers financial stability and peace of mind for you in retirement.

- Payment structure: Life insurance requires monthly premiums and pays out once; a life annuity uses a single lump sum to provide regular, guaranteed income for the rest of your life.

- Timing of benefit: Life insurance benefits your heirs later; a life annuity benefits you now, and in the future, for as long as you live.

- Outcome: Life insurance can safeguard dependants; life annuities can protect your personal independence, lifestyle, and dignity in later life.

Retirement protection = self-care

Think of a life annuity as the reverse of life insurance. It puts you first, providing a baseline income or safety net that could cover essential expenses, regardless of your lifespan or market performance. This shift from protecting others to protecting your own income represents a new kind of self-care: one that leads to consistent, self-reliant, worry-free living in retirement.

Living annuity vs life annuity

Choosing between flexibility and certainty in retirement

When comparing a living annuity to a life annuity, the main difference lies between flexibility and certainty. Both annuity options provide ways to draw an income in retirement, but they operate very differently: one as an investment, the other as insurance. Understanding these distinctions will help you make an informed decision about your long-term financial security in your retirement.

Living annuity (investment based)

A living annuity gives you control over how much income you withdraw each year, which, by law, must be between 2.5% and 17.5% of your total investment. The rest remains invested, allowing for potential growth, but also exposing you to market fluctuations.

While it may be a flexible option, a living annuity requires discipline. Safe drawdown rates are typically around 4% to 5%, but research by Just SA shows that many retirees withdraw closer to 8%, risking premature fund depletion. For example, a retiree adjusts withdrawals based on lifestyle needs, but when markets underperform, their monthly income may drop, forcing lifestyle compromises or the likelihood that they will run out of money sooner than expected.

With a living annuity, the capital you haven’t used by the time you die can be passed on to beneficiaries, making it appealing for those wishing to leave a legacy.

Life annuity (insurance based)

A life annuity, on the other hand, guarantees you a secure monthly income for life, regardless of market movements or how long you live. It acts as insurance for your later life, ensuring stability and peace of mind.

Your income never decreases, even during market downturns – protecting your financial longevity and minimising the market risk. While it does not leave behind capital for heirs, it offers something unique and significant: certainty and independence throughout retirement.

For example, a retiree opts for a life annuity to ensure a reliable baseline income (or safety net), leading to less financial stress about covering monthly essential expenses.

Flexibility or peace of mind? Understanding your annuity options

The choice between a living annuity and a life annuity is about your comfort with risk and your need for stability.

- Living annuities = flexibility and control.

- Life annuities = certainty and peace of mind.

Both can support a secure, dignified retirement when chosen wisely. Increasingly, retirees are opting for blended annuities that combine the growth potential of a living annuity with the guaranteed income of a life annuity. A blended annuity offers the best of both worlds, and allows you to shift towards more certainty as you age, with the option to transfer tranches into your life annuity component over time.

Comparing the four types of life annuities for guaranteed retirement income

|

Type of life annuity |

Level Life Annuity |

Fixed Escalation Life Annuity |

Inflation-linked Life Annuity |

With-profit Life Annuity |

|

Annuity overview |

Fixed monthly income for life. |

Income rises by a pre-determined percentage each year. |

Income increases in line with CPI. |

Annual increases are linked to smoothed investment performance. |

|

Pros |

Certainty and security. |

Predictable growth helps to partially offset inflation. |

Protects against rising costs of living. |

Potential for higher increases over the long-term. |

|

Cons |

Does not increase with inflation; buying power may decrease over time. |

If inflation exceeds the fixed rate, purchasing power may be affected. |

Exact increase unknown; may not match all lifestyle cost increases (such as healthcare). |

Annual increases depend on market performance and may not always fully match inflation. |

The retirement landscape in South Africa offers a silver lining, as it allows retirees to choose an annuity type that best fits their goals and level of comfort with risk. Each option offers varying levels of predictability, stability and security which can be tailored to your needs.

You can also provide for your loved ones through a joint life annuity that continues to pay your spouse after your death, or a minimum payment period that will continue to pay out a monthly amount to beneficiaries for a fixed number of years if you die in that specified period. While these options can give you peace of mind that your loved ones won’t be left without an income when you die, they come at an ‘extra’ insurance cost.

And then, for a more individualised retirement income from a life annuity, underwriting is available for individuals with specific health risks.

How underwriting at retirement can boost your monthly income

Underwriting at retirement is the process of assessing an individual’s health, lifestyle, and medical history to determine a personalised starting income. Unlike standard annuities, which rely on generalised averages, underwritten life annuities fairly and accurately ensure your income reflects your own life expectancy.

Just SA is currently the only provider in South Africa offering underwriting at retirement, giving retirees the unique opportunity to receive higher starting incomes based on personal lifestyle factors.

Success stories show the tangible benefits. For example, Roger, a retiree who utilised Just SA’s underwriting, qualified for a higher monthly income than a standard annuity because his underwriting assessment recognised his ill health and economic circumstances. Underwriting ensures retirees receive the income they deserve, empowering them to live well without compromise.

Our underwriting service includes:

- A personal lifestyle assessment

- Analysis of health and medical history to potentially increase starting income

Underwriting at retirement ensures a fair, transparent, and personalised outcome, giving retirees confidence that their retirement income accurately reflects their personal circumstances.

Income insurance delivers freedom, peace of mind and certainty

Many people look forward to retirement – when their time belongs to them, bond repayments are likely squared up, and children are fully grown and independent, with their own families. Early retirement planning, preferably with the help of a financial adviser, can ensure that you live out your retirement dreams without financial stress or the risk of becoming a financial burden on your family.

While life annuities may not produce instant pleasure, the level of insurance provided can improve your financial independence in later life. Your lump-sum investment today buys you peace of mind and secures a monthly ‘salary’ for the rest of your life, which is essential when your working life comes to an end.

Just SA: Ensuring a secure and dignified retirement for South Africans

Insurance isn’t just a policy – it’s a promise to your future self, a safeguard that ensures the effort, discipline, and savings of your working life translate into lasting financial security.

As specialists in retirement income and life annuity solutions, Just SA helps South Africans retire with confidence. We are regulated by the Prudential Authority and Financial Sector Conduct Authority (FSCA), and we partner with leading financial institutions to deliver retirement income solutions built on trust and performance.

Just SA leads the way in South Africa, pioneering underwriting at retirement. This approach ensures that every retiree starts with the best possible guaranteed income, tailored to their unique health profile and risk factors. It’s a personalised way to make your savings work for you.

With Just SA, you have the freedom to tailor your retirement income options to your needs. Whether you prioritise flexibility, security, or a balance of both, our partnerships offer solutions that give you confidence your income will last for life, no matter the market conditions.

Secure your retirement with guaranteed income and peace of mind

Everyone deserves a fair, secure retirement: one that supports independence, dignity, and peace of mind. Retirement insurance is not just about money; it’s about freedom. A life annuity guarantees a monthly income for life, protecting you from the very real risk of outliving your savings.

Now is the time to assess your retirement goals and understand your risk appetite. Explore the different annuity options available and consider how underwriting could maximise your guaranteed income.

Your future self will thank you.

Contact Just SA to explore which life annuity best aligns with your retirement goals and take the next step towards lasting financial security.

Do you need more information?

Consider seeking advice from a qualified financial adviser. Contact us to request the details of an adviser in your area, or to find out more about our offering.