A golden opportunity for your golden years

While South Africa’s rising short-term interest rates have inflicted some financial pain on consumers by increasing the cost of living, long-term bond yields have also risen, which means that life companies are able to offer higher annuity rates.

A guaranteed, or life, annuity is a pooled product that pays you a regular income for life. The annuity rate is the factor that determines how much annual income you get initially. South African life insurers are currently offering annuity rates at highs rarely seen over the past 20 years because the country’s long-term bond yields are at their highest since 2002.

This is good news for retirees looking to buy a guaranteed income for life with their retirement savings. Buying a guaranteed life annuity now will lock in the current high rates – for life!

“Depending on your age, you might consider delaying purchasing a life annuity in case the rates are higher next year, but there is a golden opportunity right now, and no one knows how long this will last,” says Just SA’s Bjorn Ladewig.

While it is true that annuity rates increase materially with age (due to a shorter expected lifespan) there is a misperception that you are getting a better deal. But when a male survives from 65 to 70, the average age at death increases from 82 to 84. This makes it more expensive to buy the annuity after 70 as the policy is expecting to provide for at least two more years of income.

To illustrate this, Ladewig looks at what the outcome would be for a male aged 65 if he took advantage of the great annuity rates at the moment, or if he waited and bought an annuity in five years’ time.

“To keep it simple, we used level annuities in our example, which don’t have built-in increases,” he says. A male aged 65 has a remaining life expectancy of 17 years as he’s likely to reach 82 years old. Let’s say he annuitises immediately, and gets an income of R1000 per month, guaranteed for life.

“If he waits for five years, when he turns 70, his remaining life expectancy doesn’t reduce by 5 years to 12 years, it only reduces to 14 years because he is likely to live two years longer, as explained above. These two extra years have to be financed and, considering that the pool had to be paid an income for the five years he missed out on, he will have to pay an extra 10% – 15% to buy an annuity at this point,” Ladewig says.

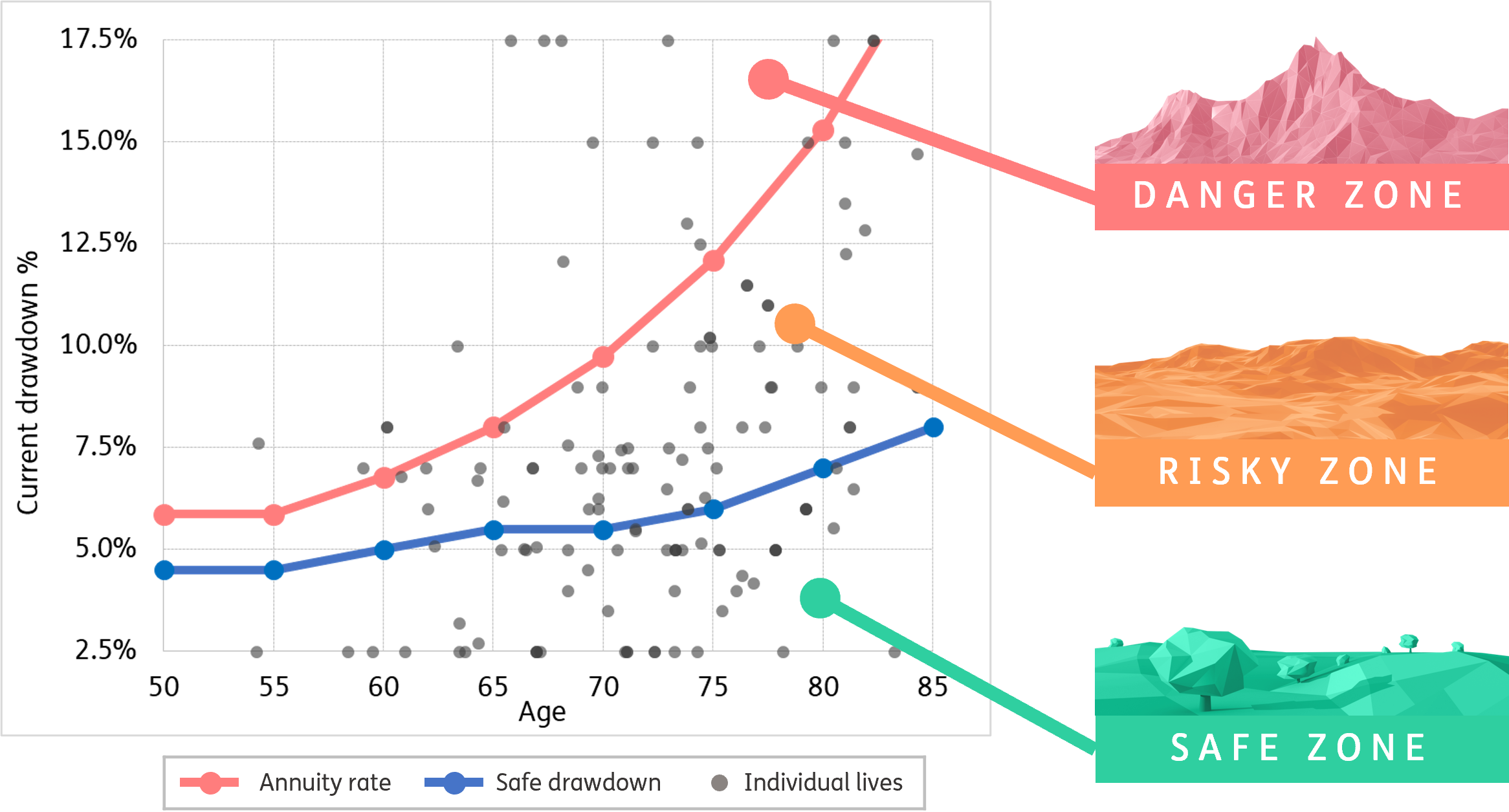

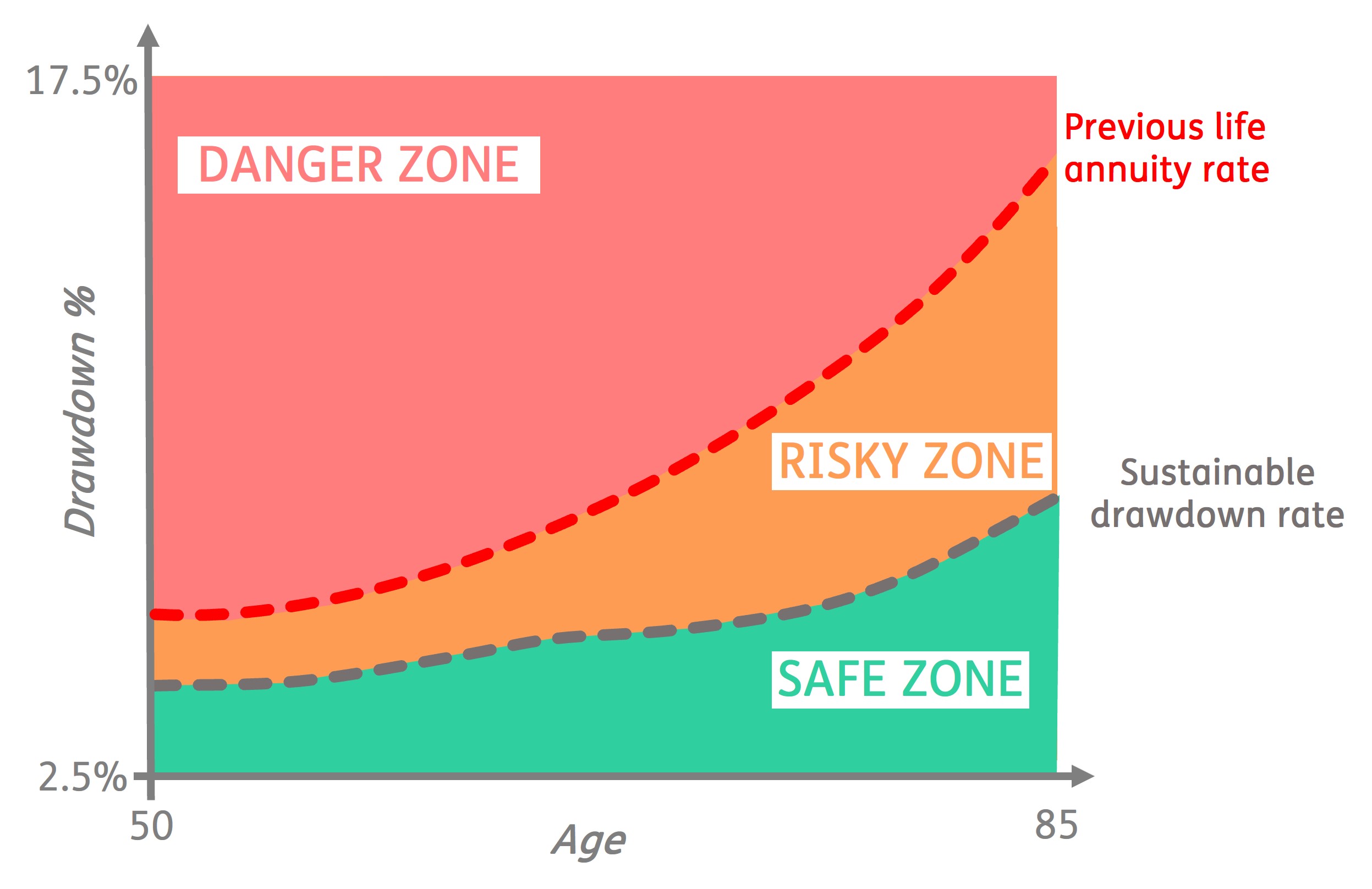

To help gauge the reality of running out of money in retirement, Just SA has developed an Income Sustainability Map that assesses living annuitants in terms of three zones – the Safe Zone, the Risky Zone and the Danger Zone – based on age and current drawdown percentage. It considers the likelihood of sustaining an income until death, as well as a suggested post-retirement income option for individuals in each zone.

| Zone | Solution |

| Danger zone: Annuitants are drawing above the guaranteed sustainable annuity rate, which is an unsustainable drawdown strategy. |

Life annuity |

| Risky zone: Drawdown % between the sustainable drawdown rate and the life annuity rate, which is potentially unsustainable depending on circumstances. |

Blended annuity |

| Safe zone: Drawdown % is less than the sustainable drawdown rate, which is sustainable. |

Living annuity |

Each dot in the figure represents an individual who invested in a living annuity in retirement. In the Safe Zone, the individual is drawing less than the sustainable drawdown rate* and is therefore unlikely to run out of money before they pass away. “For this zone, a pure living annuity offers great flexibility, but there is still a level of risk that their money could run out due to market risk,” Ladewig says.

The Risky Zone is where people are drawing down between the safe drawdown rate of a living annuity and the life annuity rate. This is potentially unsustainable depending on their circumstances. “In the Risky Zone, blending a living annuity with a life annuity can provide a drawdown strategy that is acceptable overall, as the life annuity component provides an income safety net and reduces the net drawdown rate from the flexible assets in the living annuity component.”

The Danger Zone is where annuitants have a high probability of running out of money. “However, those who fall into this zone can fully annuitise with a life annuity, which will give them a guaranteed income for the rest of their lives,” Ladewig adds.

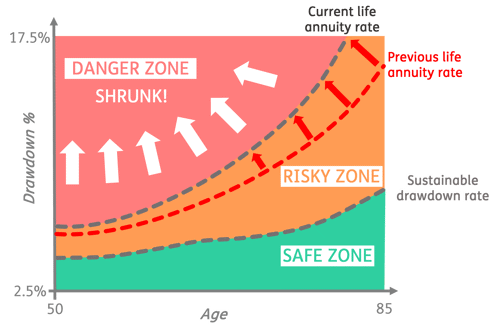

Below is what Just SA’s income sustainability map looked like in 2018, when life annuity rates were much lower. There is a smaller risky zone and a bigger danger zone.

What has happened since then, due to increasing annuity rates, is that the risky zone has increased, which is good news because the danger zone has shrunk. This indicates that more living annuitants are now in the risky zone, as opposed to the danger zone, compared to five years ago.

“Now is certainly a good time for living annuitants who are at risk to blend by adding a lifetime income portfolio to their living annuity. This provides a more sustainable income solution, without having to reduce withdrawal amounts,” Ladewig says.

The risk of outliving your savings is real, but it’s not too late to make the most of current, strong guaranteed life annuity rates, which will help to mitigate the risk of running out of money in your golden years.

*The sustainable drawdown rate is the rate at which you can safely ‘draw down’ capital from a living annuity product for as long as you live.