Adviser Newsletter, July 2025

We've summarised annuities so you don't have to

From our team to yours, we want to provide helpful resources about Just SA and our annuity options that you and your clients might find useful.

Annuities have a reputation for being complex, but this newsletter aims to provide valuable, informative resources to help you better understand them.

In this issue, we explore the ins and outs of different life annuities, shedding light on how they can help your clients achieve a better later life. No matter what happens in an increasingly uncertain world, a life annuity provides your clients with guaranteed retirement income that will never decrease.

We simplified life annuities so you don’t have to

We’ve been creating retiree-focused content that we hope will help your clients better understand their retirement income options.

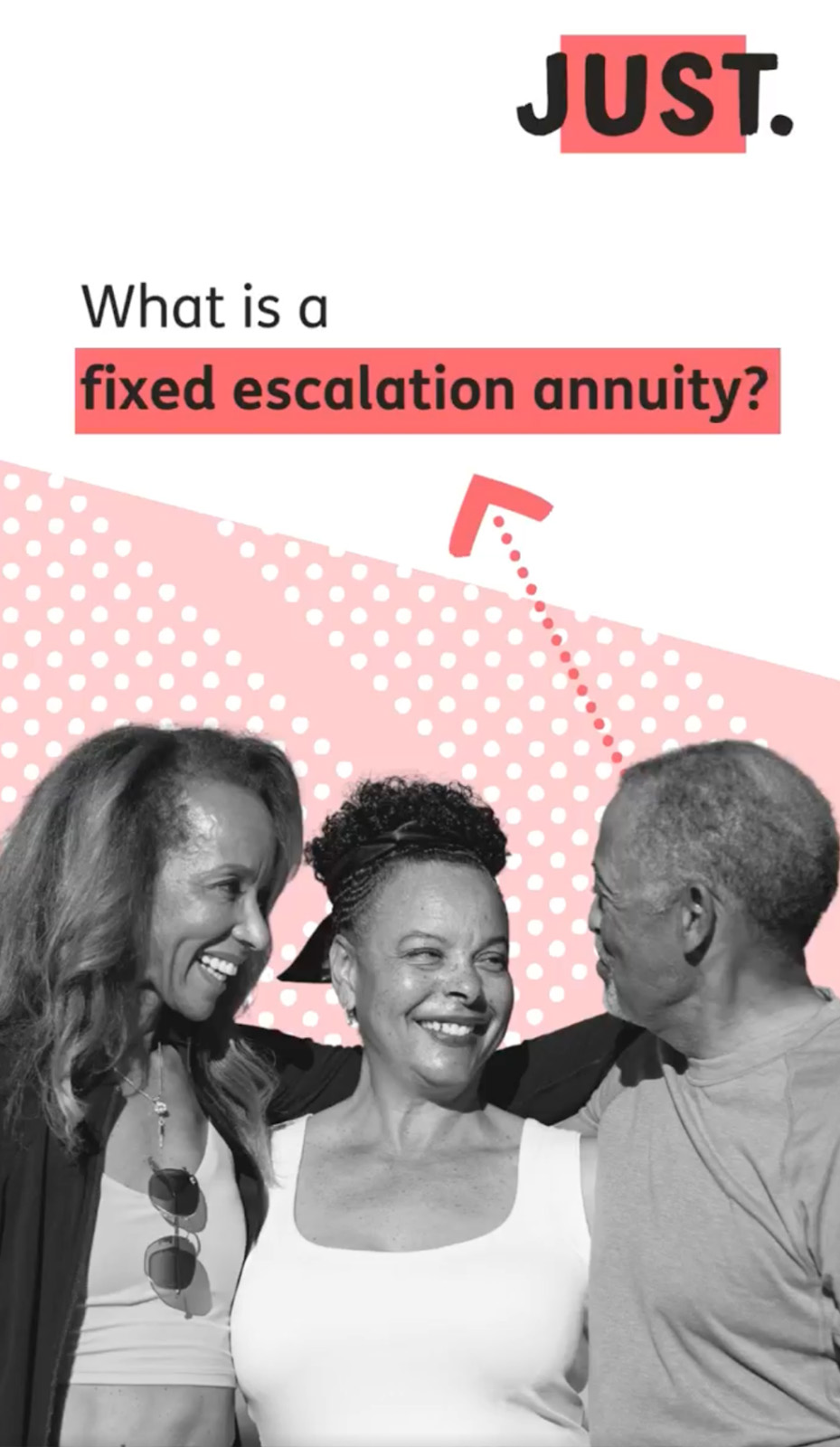

Our latest video shorts showcase the main differences between:

- Fixed-escalation annuities

- Inflation-linked annuities

- With-profit annuities

Rethinking retirement: A smarter drawdown mindset for longevity

South Africans are living longer—but their retirement strategies haven’t necessarily caught up. There is an urgency to shift from short-term drawdown thinking to a more sustainable, longevity-aware approach for retirement income planning.

Just SA’s Head of Distribution & Marketing, Bjorn Ladewig recently spoke to Citywire, emphasising that it isn’t just about retirement income products—it’s about mindset. We need to help clients understand the real risks of increasing longevity and guide them toward income strategies that last a lifetime.

Read the full article here or download Optimal Retirement Income Strategies— a white paper designed to help you navigate those difficult discussions around living annuity drawdown rates and retirement income sustainability.

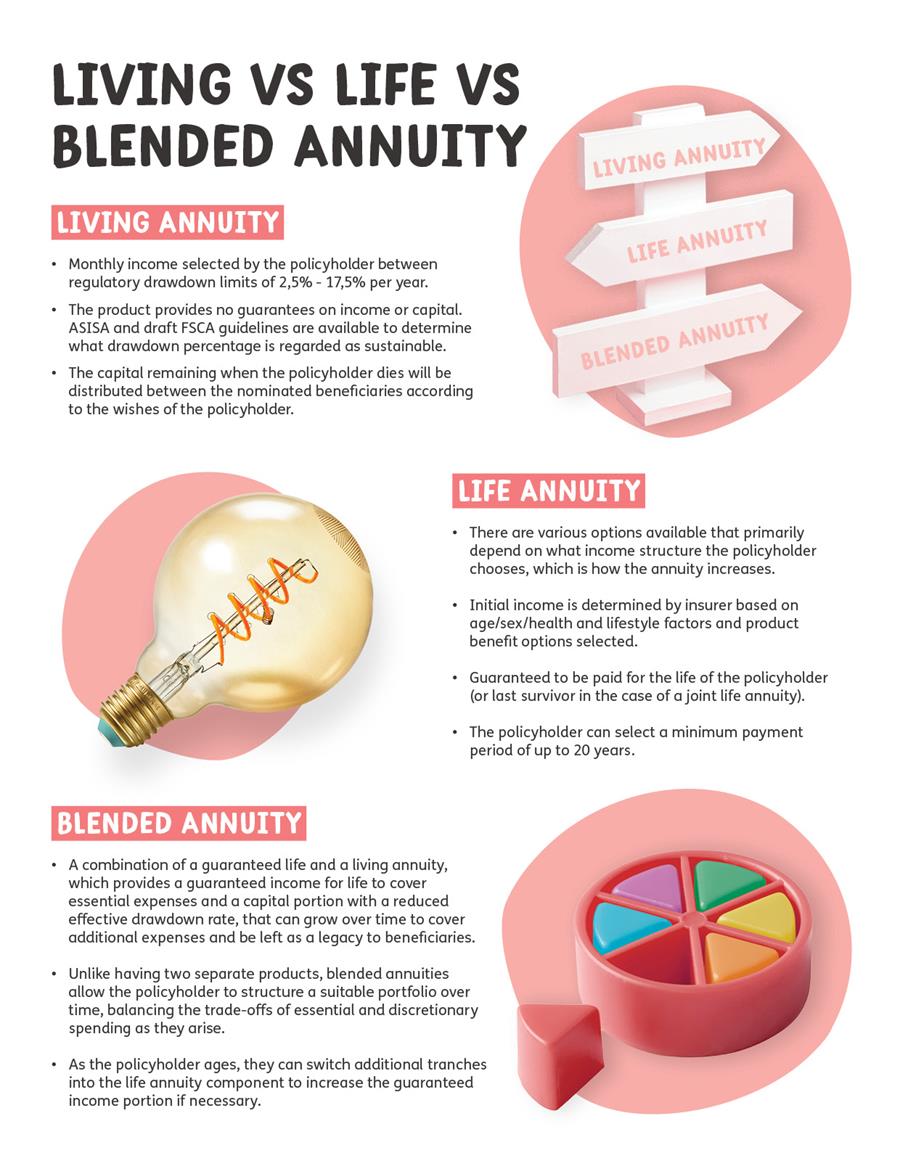

Infographic: Know your annuities

Our comparison of annuities infographic, to help you and your clients understand the key differences. Click below to view larger image or download.

Four retirement risks and how to manage them

What common risks do retirees face today?

- Life expectancy is increasing.

- Markets are more volatile than ever.

- Inflation is taking its toll.

- Retirement trends and behavioural studies.

So, how do you ensure your retirement income can keep up with your retirement plans, not just now, but 10, 20 or even 30 years from now? At Just SA, we believe that understanding the four main retirement income risks — and how to manage them — is a good place to start.

2025 marks Just SA’s 10th anniversary!

Over the past decade, thanks to your support and trust, we have grown and evolved. We have expanded our services, embraced innovation, and continuously strived to exceed your expectations.

We are proud of the milestones we've achieved together. Your partnership has been instrumental in our success, and we look forward to many more years of collaboration and growth.

Thank you for being a part of our story. Here's to the next decade of excellence!

Meet Leigh-Ann Padayachee

Business Development Manager

Leigh-Ann joined Just SA in 2024 from Sanlam, where she was a Broker Consultant, gaining experience building relationships with advisers and clients, analysing data and market trends, and processing financial transactions. She holds a post-graduate financial planning diploma from Stellenbosch Business School and an LLB from the University of the Western Cape.

Leigh-Ann has a solid understanding of the financial services sector, which complements her passion for business development and client service. She has already made a positive impact in her short time at Just SA and continues to excel and provide service excellence to our clients.

Found this helpful?

Contact us to join our mailing list!

Or follow us on LinkedIn, Facebook and YouTube for regular updates and retirement-related content.

All the best,

The Just SA team