A VPA is a financial product that allows individuals to purchase an annuity voluntarily at any time using discretionary savings. Unlike a compulsory annuity purchase, which is mandatory, VPAs offer the freedom to use discretionary funds, giving individuals greater control over their retirement income strategy. Any of the traditional life annuity types can fall into a compulsory or voluntary purchase annuity category.

Achieving financial stability for retirement starts with a comprehensive understanding of the options available to you. Many South African retirees opt for high-risk pensions. In some cases, these may not provide the income security needed to retire comfortably.

Having access to lifelong, guaranteed income may be an assurance you need. So, if you are approaching retirement, understand the options available before making any decisions.

In this article you'll find out how annuities work for retirement income planning in South Africa. We'll cover the value of guaranteed income, and why it may be crucial to consider for your retirement income plan.

Annuities work by converting a lump sum of money, often from retirement savings, into a series of regular payments. Retirement annuities are a type of pre-retirement savings vehicle. Our focus here is on annuities and their role in income planning for people approaching retirement.

The basics: An annuity in retirement vs retirement annuity?

Let's clarify a common misconception. In South Africa, annuities are often confused with retirement annuities. While the terms may sound similar, they serve different purposes:

Annuities work by converting a lump sum of money, often from retirement savings, into a series of regular payments. Retirement annuities are a type of pre-retirement savings vehicle. Our focus here is on annuities and their role in income planning for people approaching retirement.

The Income Tax Act

In South Africa, if you are a member of a pension fund or a retirement annuity, you are legally required to use at least two thirds of your retirement savings to purchase an annuity product.

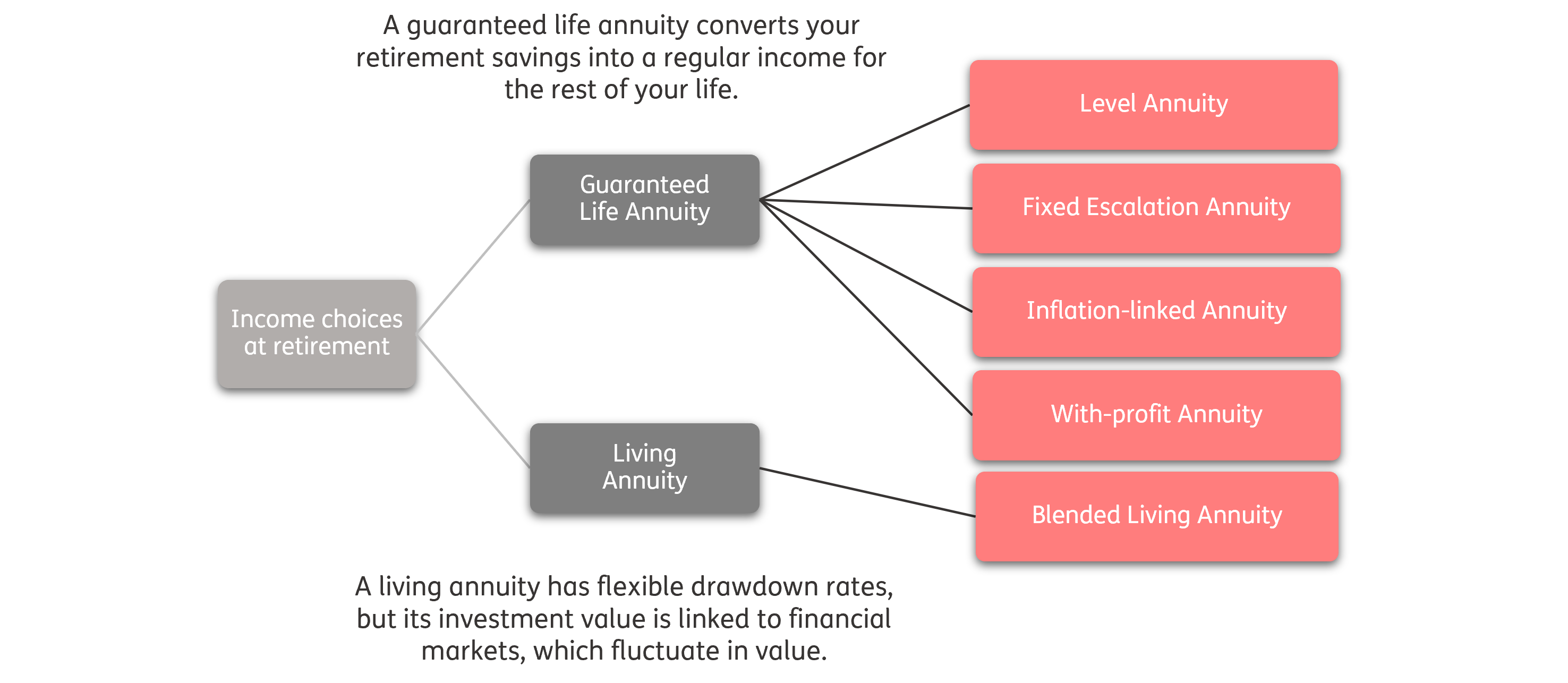

This is referred to as compulsory annuitisation. As mandated by The Income Tax Act, you have to purchase one of the following types of annuity at retirement age:

- Living

- Life (also known as a guaranteed annuity)

- Hybrid

- Blended

Understanding tax efficiency

Compulsory vs voluntary purchase annuities

By law, a compulsory purchase annuity must be purchased at retirement. The monthly annuity income is subject to income tax, because no tax has been deducted on the retirement savings.

On the other hand, a voluntary purchase annuity can be purchased from either the remaining one-third lump sum, or from discretionary savings. VPAs can be more tax efficient. See our note below to find out why.

A note on tax efficiency and voluntary purchase annuities

What is a voluntary purchase annuity?

Classification of discretionary savings

It's important to understand how discretionary savings are classified. These are funds that you've set aside willingly, often from sources like personal savings or non-compulsory retirement accounts, as opposed to funds from regulated retirement plans.

VPAs are especially popular among retirees looking to secure a dependable income from their discretionary savings. What sets VPAs apart, in terms of tax efficiency, is that only the interest portion of the income is typically taxable. This is because discretionary savings have already been subject to tax elsewhere.

Income generated from VPAs typically consists of two components:

- The capital portion, which is often tax-free.

- The interest portion, which may be subject to taxation.

This dual structure can have significant implications for the tax efficiency of your retirement income.

Do you need more information?

Consider seeking advice from a qualified financial adviser. Contact us to request the details of an adviser in your area, or to find out more about our offering.

How the different types of annuities work for income planning

Let's take a look at each annuity type. If you want in-depth information about the pros and cons of each type, read our article, What Is An Annuity?

Living annuity: an investment product

- An investment product where savings are invested in various funds for continuous growth.

- Regulated by the Long-Term Insurance Act and linked to unit trusts, mutual funds, or share portfolios.

- Offers flexibility in choosing income amount and frequency.

- Income from living annuities is taxable.

- Carries more risk; poor market performance can lead to reduced income, and there's no guarantee, which means you could run out of money if you don't plan properly.

Do you anticipate changing financial needs?

Do you expect your financial needs to fluctuate in retirement? If so, then having the ability to adapt your income may be a crucial aspect of your retirement income plan. Maybe you wish to fund travel or hobbies, or you need the ability to adapt to unexpected expenses as and when needed. In these cases, the flexibility that living annuities offer can be invaluable to the success of your income strategy.

In a living annuity, your annual withdrawal rate must fall between 2.5% and a maximum of 17.5% of the total investment amount. You choose whether your retirement income is paid annually, bi-annually, quarterly, or monthly.

Important Note

A recent study conducted by Just SA of approximately 20% of the living annuity market concluded that one in three living annuity clients risks running out of money. Learn more about the risks of unsustainable drawdown rates below.

Do you want to choose your investments?

If you're financially savvy, then having an active role in choosing investments (and providers) may be useful. With a living annuity, you choose from a range of investment options (unit trusts, cash investments, and share portfolios).

Depending on your chosen product, you may have provider options as well. These may include actively or passively managed portfolios, blends of these, or multi-manager funds as investment choices. A living annuity allows you to make your own choices based on individual risk tolerance, financial goals, and market outlook.

Do you want to be able to make additional contributions to your living annuity?

If you've purchased a living annuity as your compulsory purchase, you can increase the contributions into your initial investment from other savings vehicles like a pension fund, retirement annuity or preservation fund at any time after purchase. This contribution will be tax deferred.

A note on transferring living annuities

You also have the ability to transfer one living annuity to another provider at any time after retirement. However, you cannot split your retirement funds/savings between multiple providers after retirement — this can only happen at retirement.

Do you need a legacy plan?

Living annuities offer the ability to pass on any remaining monies to beneficiaries upon your death. Unlike a life annuity, nominated beneficiaries can either receive remaining monies as a lump sum payment or transfer the living annuity into their name.

Normally, if a beneficiary elects to take a lump sum payment, this will be less tax efficient than electing to become the new policyholder, as a lump sum payout will be taxed in your name according to the retirement and death benefit tax table.

Life annuity: an insurance product

- An insurance product that exchanges savings for regular income payments for life.

- Provides guaranteed income for life.

- Guaranteed income won't decrease, regardless of market performance or lifespan.

- Lacks flexibility; terms cannot be changed or transferred.

Various types, including level, fixed escalation, inflation-linked, and with-profit options, determine income increases and inflation protection.

Do you need absolute income security for life?

By purchasing a life annuity, you enter into an agreement with a life insurance company who exchanges your savings for regular income payments for life. This is guaranteed income, making the key benefit of a life annuity income security. If having a reliable, steady income for the rest of your life is something you may need, then purchasing a life annuity should be a consideration.

Do you prefer to avoid the risks associated with investment market performance?

As an insurance product, life annuities aren't directly linked to investment market performance. This means that regardless of what happens to investment markets or how long you live, the income you receive from a life annuity will never reduce.

Do you prefer guaranteed protection against inflation?

Unlike a living annuity, which may outpace inflation only if investments outperform, some types of life annuity, such as Just SA's Inflation-Linked Income, offer the advantage of adjusting increases in income in line with the Consumer Price Index (CPI). This means that as the cost of living rises due to inflation, your income will also increase, helping maintain your purchasing power over time.

Important Note

An inflation-linked annuity will not necessarily provide enough purchasing power to protect you from medical or lifestyle inflation, which means you could suffer a real loss year on year.

Life annuities also allow you to select optional death benefits

Unlike a living annuity, a life annuity requires the selection of further guarantees to ensure your beneficiaries receive your income when you die. The more guarantees you select, the greater the impact on your starting income.

These extra guarantees include:

- A minimum payment period (or guarantee period)

- A spouse’s annuity (also called a spouse’s benefit)

Minimum payment period (or guarantee period)

If you have concerns about your life expectancy at the time of purchasing a life annuity, you can select a guarantee period, which safeguards your purchase amount for a set period. This means that if you, as the policyholder, pass away within the specified guarantee period (e.g. ten years), your insurer will continue making annuity payments to your nominated beneficiaries for the remainder of that period.

It is worth noting that if your chosen beneficiaries pass away during the chosen period, you cannot pass on any remaining monies to beneficiaries in the same way as a living annuity.

Spouse’s benefit

If you want to ensure your spouse or partner is taken care of financially in the event of your death, you can select a joint annuity option which will ensure your chosen second life continues to receive a monthly income when you pass away.

This feature is valuable for retirement income planning, as it offers you peace of mind during retirement and provides your partner with an income for life if you pass away. This can be the same amount, or it can reduce as expenses are likely to be less for one person.

What is the minimum amount you need to invest?

The amount of capital required to purchase an annuity can vary depending on the type and benefit choices. For Just SA, the minimum investment is R50,000.

Where does an annuity fit into your retirement income plan?

Annuities are an important component of a comprehensive retirement plan. To learn more about planning your retirement income in South Africa, check out our guide Your retirement plan: What you should know about planning retirement income in South Africa.

Do you need more information?

Consider seeking advice from a qualified financial adviser. Contact us to request the details of an adviser in your area, or to find out more about our offering.

Investing in a life annuity with Just SA

When it comes to securing a reliable and stable retirement income, investing in a life annuity is a smart choice. With numerous benefits and advantages, a life annuity can provide the financial security and peace of mind you deserve during retirement.

By investing in a life annuity, you can enjoy a monthly income for the rest of your life, eliminating the risk of outliving your money.

Learn about our life annuity products and get a no-obligation quote

If you're interested in exploring the annuity options that align with your retirement goals, explore our products to learn more and request a no-obligation quote. Alternatively, you can download a copy of our product guide below:

Product guide

Download a copy of our product guide

More annuity resources

For additional information and other access to resources on annuities, be sure to check out our annuity resources page. You'll find helpful infographics, articles, and more.

Want to know more?

Here's what to do

Still have questions about annuities and retirement income planning? Contact us with your queries by filling out the contact form. Our team will get back to you as soon as possible!

The information above is intended for information purposes only. It should not be regarded as advice as defined in the Financial Advisory and Intermediary Services Act 37 of 2002, or any form of advice in respect of the policy, retirement, tax, legal or other professional service whatsoever. You are encouraged to seek advice from an authorised financial adviser, or to independently decide that the financial product is appropriate for you based upon your own judgement and understanding of your financial needs.