Around the world, annuities are commonly used to fund retirement by providing a regular income, usually over a long period of time. Annuities are most often considered as financial solutions for older people who are close to retirement. They can come in a variety of shapes and sizes and are unfortunately often seen as complex products with heaps of rules and regulations.

But annuities are a great way to create an income stream in retirement.

In this article we aim to help you understand what an annuity is, the different types and the pros and cons. This should help you to make a more informed choice when faced with the decision to choose the right annuity for your retirement. And after reading this, if you’re asked: “What is an annuity?” you’ll have a better understanding to answer correctly.

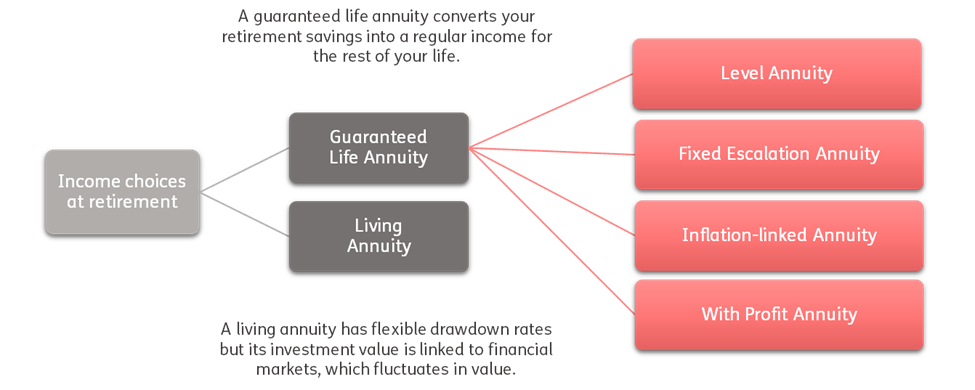

What are the different types of annuity products?

Comparing the different types of life annuities

|

The financial services industry is full of jargon. This can make it much more difficult to understand the differences in solutions available for your retirement. We asked a few people for their opinion on what they thought an annuity is. Have a look on our Facebook page to hear what they had to say. |

What is an Annuity?

An annuity is a financial term to describe a regular income stream that you get from an initial once-off payment, lump sum or investment. Purchasing an annuity is the recommended option for long-term retirement income planning (also commonly referred to as a pension).

The complexity creeps in when you need to decide which annuity product to choose to provide your income in retirement.

And you should be aware that once you have bought an annuity at retirement, your options to change that decision are limited and tied to the choice you make initially. So choosing an annuity is a decision that should not be taken lightly.

In South Africa, certain retirement income or annuity products are made available to you when you retire. If you are a member of a pension fund or have invested your own money over the years in a retirement annuity, you are legally required to use at least two thirds of your retirement savings to purchase one of these annuity products. This can be a living annuity, a life annuity (also known as a guaranteed annuity) or a combination of the two –a hybrid or a blended annuity.

Careful financial planning in the years leading up to your retirement is therefore very important to make sure you put yourself in the best possible position to choose an income structure that suits your needs. And seeking independent financial advice is strongly suggested if you want to gain a better understanding of which annuity product is best suited to your individual circumstances before you make your decision.

What are the different types of annuity products?

The different annuity products each have their own pros and cons.

Living Annuity

A living annuity is an investment product. Your savings are invested in a range of funds to continue growing and you choose to draw an income for as long as there is money in the living annuity. It is a popular choice for South African retirees.

PROS: Living annuities offer a more flexible option if you are looking for the flexibility to possibly adjust the amount of income you receive. This is because you can choose the amount you want to withdraw every year between 2.5% and a maximum of 17.5% from the total investment amount. You can also leave any remaining monies to your beneficiaries.

CONS: A living annuity carries some risks. There is no investment protection meaning that if investment markets are poor, your income will go down. There is also no guarantee that your money will last for as long as you live. You could run out of money if you don’t plan properly.

Life Annuity

A life annuity is an insurance product. You enter into an agreement with a life insurance company that trades your savings for regular income payments for the rest of your life, guaranteed. This retirement income (or a pension) will never reduce, regardless of what happens to investment markets or how long you live. Because of this guarantee for life, a life annuity is becoming a more popular solution among South African retirees, especially those who have just enough (or not enough) saved for retirement.

PROS: A life annuity gives you peace of mind and financial certainty by providing a guaranteed lifetime income – money every month. The amount will never reduce, even if investment markets crash, and it will continue to be paid to you by the issuing insurance company for the rest of your life.

CONS: Life annuities are not that flexible, meaning that once you’ve agreed to the terms of the life annuity with the insurance company, you cannot change anything. Once you’ve taken out a life annuity, you cannot change it to a living annuity or transfer it to another provider.

Types of life annuities

All life annuities are guaranteed for as long as you live, but there are also different types of life annuities to choose from – which determines how your annuity increases each year. This needs to be decided upfront. For example, you may prefer for your annuity to stay the same each year i.e. no increase or a fixed income stream, or to increase each year in line with inflation or by a certain percentage, or an increase that is linked to investment returns. You can also choose whether or not you want additional insurance (death benefits) so that your income will be paid to your beneficiaries if you die.

So where should you start in trying to understand the types and value-for-money of life annuities?

The ‘price’ of the annuity (how much income you will get) primarily depends on what income structure you choose, which is how the annuity increases. And if you want any assurances that your income will be paid to your beneficiaries if you die, this will also affect the ‘price’.

The typical types of life annuities are:

- Level life annuity

- Fixed-escalation life annuity

- Inflation-linked life annuity

- With-profit life annuity

Level Life Annuity

A level life annuity (such as Just Level Income) is a fixed guaranteed income every month for the rest of your life.

PROS: The monthly income amount is certain and secure and will be paid for the rest of your life. It will never decrease or run out for as long as you live.

CONS: Because your guaranteed income is level (doesn’t change), it doesn’t increase with inflation. This reduces your ability to be able to afford general products and services as you get older if/when prices go up.

Fixed-Escalation Life Annuity

A fixed-escalation life annuity (such as Just Fixed Escalation Income) means your guaranteed income will increase every year at a pre-determined rate (a chosen percentage), which you agree upfront when you buy this type of life annuity. For example, you can select a fixed-escalation percentage between 1 and10%.

This means your income will increase each year by your chosen percentage. It is important to understand that the fixed escalation annuity becomes more expensive the higher the percentage i.e. a 10% fixed escalation annuity is more expensive than a 5% fixed escalation annuity.

PROS: The monthly income amount is certain and secure and will be paid for the rest of your life. It will also increase by your chosen percentage each year, which can (but not always, see ‘cons’ below) help protect your income against inflation.

CONS: You cannot change the percentage your income will increase each year. So, if inflation is higher than your fixed escalation percentage, you run the risk of not being able to afford certain things.

Inflation-linked Life Annuity

An inflation-linked annuity (such as Just Inflation-linked Income) is designed to increase in line with inflation each year. In other words, it will match the percentage of each year’s Consumer Price Index.

PROS: The monthly income amount is certain and secure and will be paid for the rest of your life. You are protected against inflation each year, but remember that some things like medical costs often increase by more than annual inflation.

CONS: You will not know in advance what the increase will be, because you do not know what inflation will be. If the change in inflation has been negative, your income will not decrease and will remain the same as the previous year. But future increases may be reduced to bring total increases in line with inflation.

A With-profit Life Annuity

With-profit annuities (such as Just Lifetime Income) are linked to investment markets. With profit annuities typically use the investment performance of a balanced fund to help determine the annual increase amount. This means that you benefit from good market performance. And because it is a type of life annuity, it can never reduce, and your income will not go down when markets perform poorly. But it is important to understand that it could stay the same.

PROS: With-profit annuities score well in protecting you against certain retirement risks – living longer, inflation, and losing out when investment markets (stock markets) don’t do well. Over the long term, with-profit annuities generally provide higher overall increases in income compared to fixed escalation or inflation-linked annuities.

CONS: Annual increases are not known in advance (but can never be less than zero i.e. decrease). The annual increase can also be lower than inflation in some years when market performance is poor.

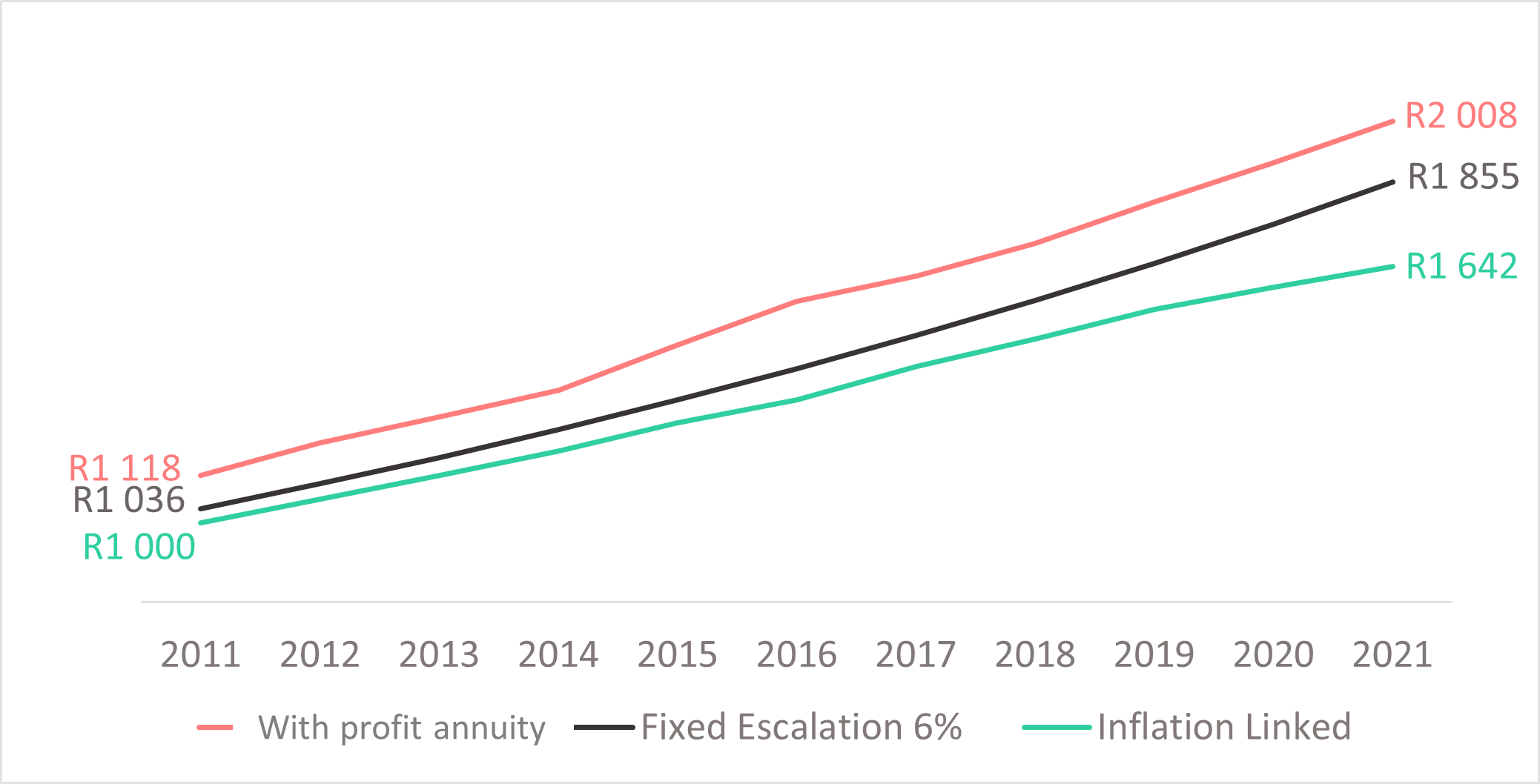

Comparing the different types of life annuities

When comparing life annuities, it’s important to look at more than just the starting incomes. For example, typically a level or fixed-escalation annuity may have a higher starting income compared to a with-profit annuity, which makes them look ‘cheaper’. But it is important to recognize that a with-profit annuity’s annual increases can quickly catch up to a fixed escalation increase.

Graph: Simplified comparison of growth in income for annuities with a similar starting income

Enhancing your income

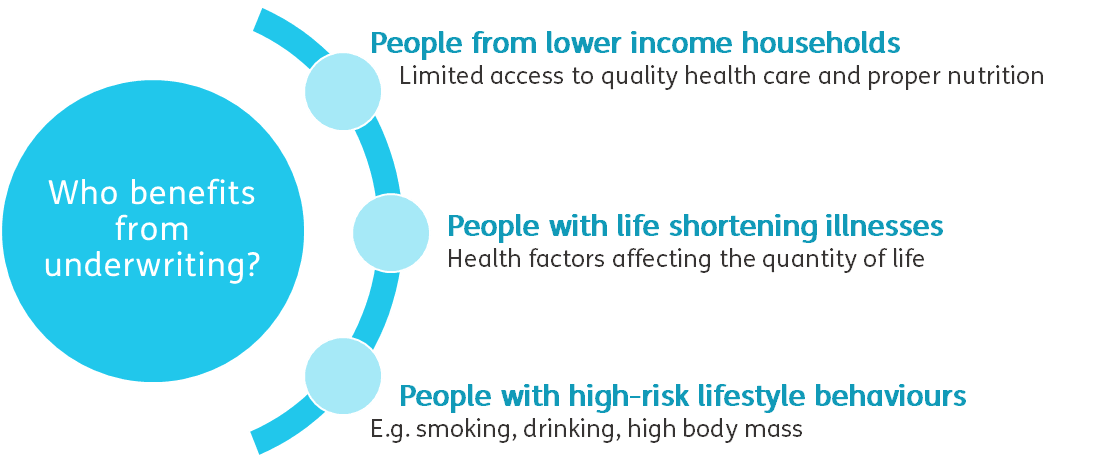

Do you want to ensure that you are getting the best possible income based on your own personal health and medical conditions?

You could qualify for a higher starting income for any of the annuities mentioned above – something called an ‘enhanced’ annuity – based on certain health, medical and lifestyle factors.

By completing a process referred to as underwriting (or reverse underwriting), and answering a few questions about your lifestyle and any particular medical conditions, you can give yourself the best chance of getting a higher starting income based on your personal information. The answers you provide allow the insurer to determine a starting income based on your own life expectancy (not the average life expectancy). This is likely to translate into more income, especially if you are of poor health or have a life-threatening condition or disease.

Note that not all insurers offer underwriting at retirement, so we suggest you shop around and do your homework to ensure you get the best possible outcome for your circumstances.

See how some of Just SA's clients have benefited from underwriting ---->

Death benefits

Both life and living annuities allow you to leave a money to your loved ones, but in different forms.

Any remaining balance from a living annuity is automatically passed on to beneficiaries. With a life annuity, you add further promises or guarantees to ensure your beneficiaries receive your income when you die.

These extra guarantees include:

- A minimum payment period (or guarantee period)

- A spouse’s annuity (also called a spouse’s benefit)

|

Meet Roger. Roger had a heart attack eight years ago and had a stent fitted. A week later he had a second heart attack and then had a heart bypass. He has to take daily medication to prevent further heart attacks. Meet Faizel. Faizel, aged 65, was diagnosed with chronic kidney failure ten years ago which has now progressed to end- stage kidney disease. He has to take daily medication and undergo Faizel also suffers from anaemia, was hospitalised earlier in the year because of the kidney failure and is now on the transplant waiting list. How they benefited Roger and Faizel’s medical conditions have impacted their quality of life. But because they completed the underwriting process with Just SA, they can look forward to a higher monthly income each month compared to standard guaranteed life annuities, giving them that little bit extra they deserve. |

Minimum payment period (also called a guarantee period)

If you opt for an annuity with a minimum payment period (e.g. ten years), the insurer is obliged to keep paying your annuity income for that specified period, no matter when you, or your spouse, pass away.

PROS: The capital does not ‘die’ with the policyholder if you pass away within the minimum payment period.

CONS: If included it is priced into the annuity, which means you would have a slightly lower starting income.

Spouse’s Annuity (also called a joint annuity)

You can opt to provide an income for your spouse to be able to cover their essential expenses if you die. This is called a joint life annuity (as opposed to a single life annuity).

Taking into consideration that everyday expenses (like food and medical expenses) should reduce in the event of the death of one spouse, you can opt for a reduced percentage of income to continue to be paid to your spouse when you die.

PROS: The income will be paid to your spouse in the event of your death. This income will continue to be paid to them until they pass away.

CONS: It is priced into the annuity, which means you would have a slightly lower starting income compared to a single life annuity.

A New Generation Annuity – a BLENDED ANNUITYOne way to overcome any conflicting ideas or features between a living annuity and a life annuity is to combine them. This ensures you get the flexibility of a living annuity, and the certainty of a life annuity. A blended annuity is a unique annuity structure and is gaining in popularity. A blended annuity enables you to have a guaranteed life annuity inside a living annuity. You get one income, but your living annuity has some insurance that money will not run out because of the safety net provided by the life annuity. In a blended annuity, you can choose how much to allocate to the guaranteed portion and how much remains flexible. In this way you can balance your needs (essential spending) and your wants (flexible spending). By blending a life and a living annuity, you can better manage the risk of outliving your savings by adding more to the guaranteed component over time, when required. |

Life annuities in a nutshell

Life annuities – no matter what shape or size – provide an income for life.

Income for life means a regular, monthly income paid to you until your death. Or until your spouse’s death if you have a joint annuity and you pass away first. It is the ultimate peace of mind!

Annuity products have advanced, and with the many options available, it’s critical to do your home work and seek the advice of a qualified financial adviser to find an annuity solution that is best suited to your individual needs. Consider your retirement journey or contact us and we can put you in touch with an independent financial adviser.

Summary: Your retirement income options

|

Your retirement objectives |

Life Annuity |

Living Annuity |

Blended Annuity |

|

Flexibility to increase or decrease withdrawal rate |

✖️ |

✔️ |

✔️

|

|

Guaranteed income that will never decrease |

✔️ |

✖️ |

✔️ Life annuity component |

|

Income for life |

✔️ |

✖️ |

✔️

|

|

Protection from inflation |

✔️ |

✖️ |

✔️ Life annuity component |

|

Ability to leave a financial legacy |

✔️ Income legacy |

✔️ Capital legacy |

✔️ Income and capital legacy |

|

Enhanced income subject to medical underwriting |

✔️ |

✖️ |

✔️ life annuity component |

A note on tax

If you have diligently saved for retirement, you don’t pay income tax on contributions paid into a retirement fund or retirement annuity, nor on the investment build up within these retirement savings vehicles.

This means you can avoid paying income tax on the money saved (between 18% and 45%,depending on how much you earn). However, when you retire and start taking the money out in the form of annuity payments, it will be taxed as income. It is important to be aware of the tax amount liable across all your annuity payments when planning for a tax efficient retirement.

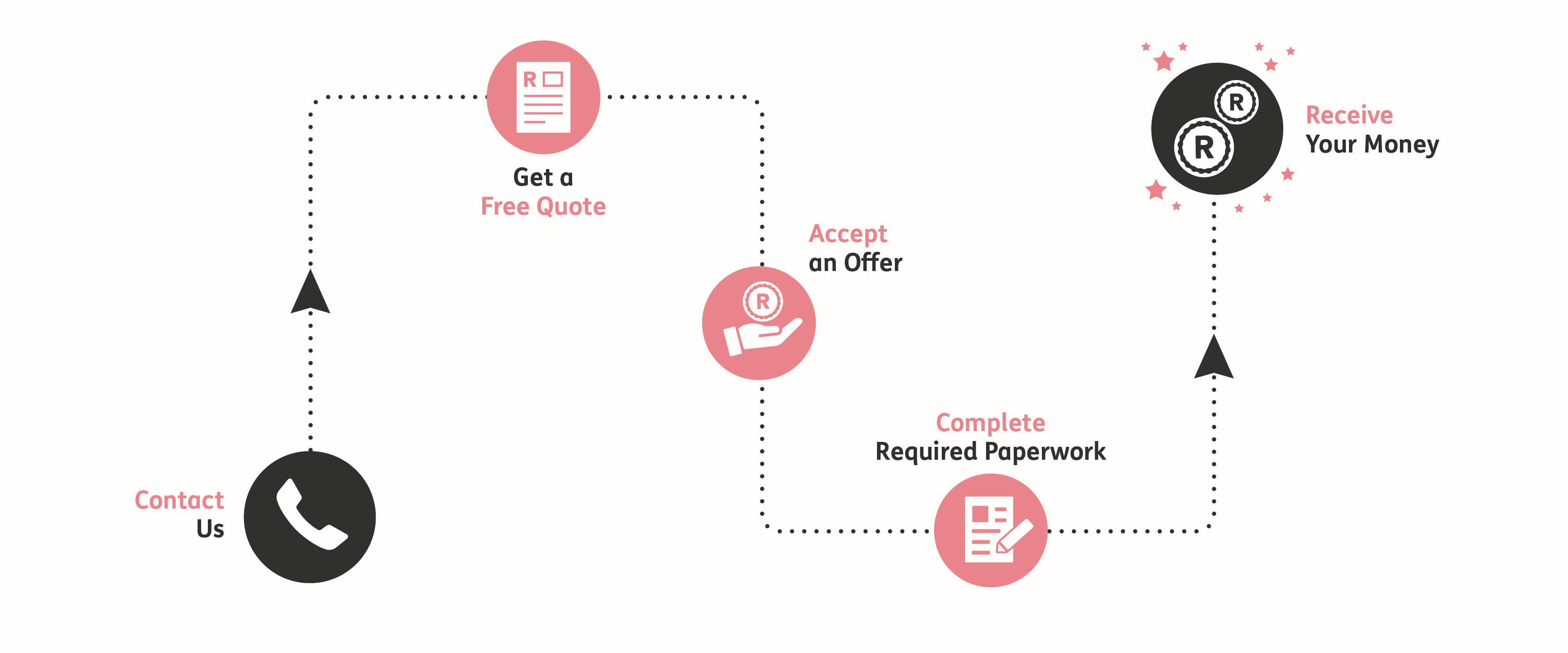

I’m interested in a life annuity – what do I do?

Like with regular insurance, a life annuity starts out with a quote. Minimum information is required to get an initial quote:

If you want a joint annuity, then your spouse’s birth date and sex is also required.

|

Why? Age and sex help the actuaries estimate your life expectancy, which is important in calculating your guaranteed future payments over time. |

How to secure an income for life

American TerminologyThere is a lot of American literature available on the internet that covers variable annuities, indexed annuities and deferred annuities (also sometimes called longevity annuities). These products have different regulations to traditional South African living and life annuities.

We once again stress the importance of financial advice to make sure you get the right information on how an annuity works in South Africa, which includes up-to-date information on tax as required by the South African Revenue Service (our equivalent of the Internal Revenue Service, the USA’s federal government agency). |

Disclaimer: This information is for information purposes only and it should not be regarded as advice as defined in the Financial Advisory and Intermediary Services Act 37 of 2002, or any form of advice in respect of the policy, retirement, tax, legal or other professional service whatsoever. You are encouraged to seek advice from an authorised financial adviser, or to independently decide that the policy or financial product is appropriate for you based upon your own judgment and understanding of your financial needs. Just Retirement Life (South Africa) Limited is a registered life insurance company, regulated by the Prudential Authority of the South African Reserve Bank and the Financial Sector Conduct Authority as an authorised financial services provider (FSP no. 46423).