Will your money support your retirement dreams?

Travel, hobbies, and quality family time are all moments worth dreaming about for your retirement and, with proper financial planning, these dreams can become a reality. However, even with a solid retirement savings strategy, some risks, if not adequately planned for, can affect how far your money will go.

According to Just SA’s 2024 Retirement Insights study, seven in 10 retirees worry they’ll run out of money, and most say one of their biggest concerns is the rising cost of living.

What common risks face retirees today?

-

Life expectancy is increasing. This raises the risk of outliving your savings, requiring you to save more and/or plan for a longer retirement period than you may have initially anticipated.

-

Markets are more volatile than ever. Sharp swings on the Johannesburg Stock Exchange (JSE) and other global markets are more volatile than before, with frequent currency fluctuations, and changes in inflation and interest rates affect investment performance and your income stability over the long term. The real challenge? You still need income even when markets are down, and you can’t always wait for them to recover. This can force you to sell investments at a loss, shrinking your capital over time, leading to a sequence of negative returns.

-

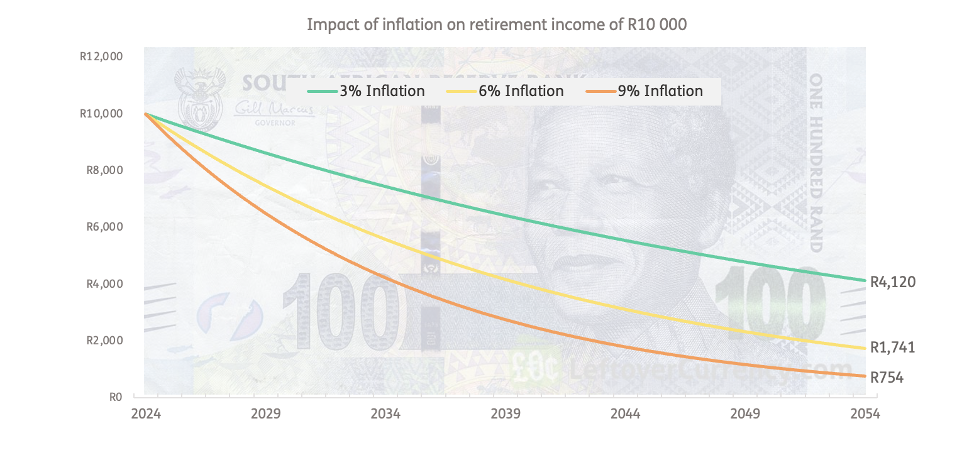

Inflation or CPI (Consumer Price Index, which tracks the cost of a standard basket of goods and services) in South Africa has been above 5% for more than half of the last 20 years. The purchasing power of your money has gradually weakened. This trend, in which the value of the rand declines, is likely to continue.

-

Retirement trends and behavioural studies indicate that many often underestimate the importance of retirement planning. Regularly spending more than we earn leaves wide gaps for financial shortfalls later on.

So, how do you ensure your retirement income can keep up with your retirement plans, not just now, but 10, 20 or even 30 years from now? At Just SA, we believe that understanding the four main retirement income risks — and how to manage them — is a good place to start.

1. Unpacking longevity risk

Longevity risk is the chance that you’ll live longer than your retirement savings can support you. It’s important to note that running out of money in later life is one of the most significant retirement risks you should manage.

Longevity risk is heightened today because people are living longer than ever before. While that’s something to celebrate, it also means your retirement savings need to last longer. A retirement spanning 25 to 35 years has become commonplace, which means if you haven’t considered a similar time horizon — assuming you’re in good health — your retirement savings may not go the distance.

Do people generally underestimate how long they’ll live?

The answer is yes. To understand how and why longevity risk can become a problem for so many, let’s take a look at Just SA’s 2024 Retirement Insights, which asked respondents to rate their confidence that their savings, despite inflation, would cover monthly retirement expenses if they lived until age 100.

Answers to this question showed confidence levels were much higher than in previous years: 23% of respondents were ‘Really Confident’; 40% were ‘Confident’. At the time, these numbers could have meant one of two things:

- Respondents recovered somewhat from the adverse economic effects of the COVID-19 pandemic, allowing them to invest more money in their retirement benefits each month.

- They have an unjustified level of self-confidence in their retirement planning.

As a general rule, if you plan on retiring at 65, you should aim to save at least 25 times your annual income for a sustainable retirement income. However, the survey revealed that on average, respondents fell about 40% short of this target. The study also showed that 80% of respondents planned to use a portion of their retirement benefit to pay off debt.

These findings are worrying, supporting the view that many people have an unjustified level of self-confidence in their retirement planning, given that most South Africans have not saved enough to generate a sustainable retirement income for the rest of their lives. The underlying cause of this has much to do with the fact that many underestimate their life expectancy, and, by extension, how much money they will need.

If your current plan can’t get you closer to this savings target, it may be time to consider adjusting it. That could mean saving more now, delaying your retirement slightly, or speaking to a financial adviser to help reevaluate your long-term income options.

So, how do you decrease the risk of outliving savings? Today, many are opting for guaranteed income in a blended annuity.

Considering a blended annuity option to manage longevity risk

According to ‘Optimal retirement income strategies: Insights into the key drivers’ — Just SA’s white paper exploring the relationship between heightened levels of longevity risk and living annuities — many living annuitants draw down too much of their income too quickly, without fully accounting for how long they might live. This exposes them to longevity risk in later years, especially when markets underperform or inflation eats into their income.

For those looking to fully guard against longevity risk using guaranteed lifetime income, a life annuity offers the most straightforward solution. It is an exchange of your retirement savings for a guaranteed income, paid out over time for the rest of your life. That’s income certainty! However, another crucial insight Just SA’s 2024 Retirement Insights study reveals is that people desire income certainty in retirement as much as income control or flexibility — unfortunately, flexibility is not a feature of pure life annuities.

Many want the best of both worlds. That’s why more people are exploring blended annuities.

A blended annuity combines guaranteed income from a life annuity within a living annuity structure, offering both peace of mind and flexibility. You can guarantee a monthly income portion which is paid into the living annuity (enough to perhaps cover your essential expenses) while still retaining investment control over the non-guaranteed portion of your annuity to withdraw from as you wish (within regulatory limits, of course) or to leave as an inheritance.

- The guaranteed portion is protected from investment volatility and will be paid for as long as you live.

- The flexible portion gives you control. You choose how it’s invested, how much to withdraw (within regulatory limits), and how to manage it as part of your estate or as an inheritance.

A blended annuity, therefore, is a smart hedge against longevity risk, giving you a built-in backstop which you can use to cover your essential expenses for life. The living annuity portion still carries some risk, but with the right balance, a blended annuity can give you the best of both worlds. Just SA offers a guaranteed lifetime inocme portfolio in several of our partners’ living annuities, including Alexforbes, Allan Gray and Sygnia.

Next, let’s explore another key retirement risk — and what you can do to stay ahead of it.

2. Understanding investment risk

Investment risk refers to the potential adverse effect of market volatility on your retirement income, which particularly affects pensioners who draw income through a pure living annuity. If the underlying living annuity investments lose value because of market volatility — something beyond your control — your income could decrease. Here’s why:

Investment risk and living annuities

Unlike life annuities, which are insurance products that provide a guaranteed income for life, a living annuity is an investment product and its value is determined by the performance of a range of underlying assets. When these investments perform poorly, the value of your living annuity declines, which can result in a reduced income. As a simplified example, drawing 5% from R1 million gives you R50,000, but if your capital drops to R990,000, that same 5% gives you just R49,500. Over time, this erosion can add up.

This can all contribute to the increased risk of running out of money if you withdraw at an unsustainable rate, especially if poor returns occur early in your retirement and/or coincide with high withdrawal periods, such as the active phase of retirement. In this situation, a sequence of negative returns becomes more likely.

The sequence of negative returns risk

During the initial accumulation phase of your retirement savings, the order of returns may not have a substantial impact. Regular contributions and compounding can work in your favour, smoothing out the effects of market fluctuations. However, as you transition into the withdrawal phase, the sequence of returns risk becomes more critical to understand.

To illustrate how this risk works, we’ve conducted a quick thought experiment:

-

You set up a living annuity to provide you with regular income during your retirement years.

-

During the early years of retirement, your living annuity investments experience a sequence of negative returns, which impacts the overall value your living annuity retains.

-

The situation worsens because your investments take a dip right when you start relying on them for income.

-

Now, when you start withdrawing money from your living annuity to cover living expenses, the value of your investments is down — this leads to you having to sell off more of these investments to get the same amount of money you need.

-

Then, when you sell off more investments during this time, your annuity's bucket of money becomes smaller. Even if the market eventually improves and your investments start to go up again, your annuity may not bounce back as strongly because you've sold off bigger portions during the low points.

This combination of selling investments when they're down and having a smaller base of investments to recover from can put a strain on your future income, even if the market improves later.

It might mean that the amount of money you receive from your living annuity each month is lower than you hoped for or planned. Moreover, seeing a decline in your living annuity's value can be emotionally challenging. It may cause you to become more cautious in your spending, or run out of money sooner than expected, or both!

2025 could be a challenging year to retire in South Africa

If you are planning to retire in 2025, it might be a more challenging year than most in terms of investment risk:

- Market volatility – The JSE and other global markets have seen increased swings because of global uncertainty, rising interest rates, and ongoing geopolitical tensions.

- Bear-market risk – Retiring during a market downturn may mean selling investments at a loss. This can shrink your portfolio faster than expected and leave less room for recovery, especially if your withdrawals begin while markets are low.

- Political uncertainty – South Africa’s evolving political landscape in 2025 could impact investor sentiment and market stability, adding another layer of unpredictability for retirees relying on investment-linked income.

In times like these, the ability to actively manage investment risk, protect capital, and adjust drawdown strategies — if you plan to purchase a living annuity — is invaluable. A financial adviser can help you with a well-structured plan that accounts for timing, volatility, and market cycles, which can make all the difference in safeguarding your retirement income.

But what if you want to minimise investment risk while still maintaining some exposure to growth? As with longevity risk, a blended approach is one option you can take.

Blending can help you manage investment risk

As we’ve discussed, a blended annuity allows you to safeguard a portion of your retirement benefit as guaranteed income — effectively shielding a portion of your money from market-related risks while still keeping the rest invested in a living annuity. This balance helps you maintain some investment exposure and the opportunity for capital gains, without putting your essential income at risk.

For those looking to retire with more certainty in uncertain times, blending your retirement savings could be a smart move.

Let’s dive into the next significant retirement risk.

3. Planning for inflation risk

Inflation risk is the potential loss of purchasing power over time due to rising costs — meaning your money may not stretch as far in the future as it does today. It’s typically measured by the Consumer Price Index (CPI). But in retirement, inflation can be more challenging, as pensioners often face additional pressures such as medical inflation or lifestyle inflation — the rising healthcare and age-related costs that usually outpace general inflation.

So, how can you manage inflation risk in retirement?

For those considering a life annuity, it's important to note that not all life annuities respond to inflation in the same way. The choice can increase the risk of your income not keeping pace with the actual cost of living throughout your retirement.

How different life annuities deal with inflation risk

|

Annuity type |

How it handles inflation | Risk to purchasing power |

| Fixed income that stays the same each year. | High — income loses value over time. | |

| Increases at a fixed rate (e.g. 5%) chosen upfront. | Moderate — can under- or overshoot inflation. | |

| Income increases annually in line with CPI. | Low — tracks official inflation, but may not match lifestyle inflation. | |

| Income increases are linked to investment returns, aiming to beat inflation over the long term. | Variable — depends on performance, but can offer inflation-beating returns. |

Let’s take a closer look at with-profit annuities. Alongside inflation-linked annuities, with-profit annuities can offer a practical approach to managing inflation in retirement.

Explaining with-profit annuities

With-profit annuities guarantee an income for life, and your annual increases are linked to investment returns. Unlike a living annuity, your income will never decrease, no matter what happens in the markets. Your annual increase could be 0% if investment markets perform really poorly over time, but on the other hand, your income could increase above inflation if the chosen investment portfolio performs well over time. The choice of underlying investment portfolio, which drives increases (and Just SA offers a range of funds for you to choose from), is managed by leading South African asset managers.

While a with-profit annuity might start with a slightly lower initial income compared to fixed increase annuity options, there are upsides:

-

Income that can never decrease

-

Investment-linked increases that could outperform inflation

-

Zero longevity risk

-

Guaranteed income for your life, or for the life of your spouse

Let's explore how Just SA's with-profit annuity option helps balance guaranteed income with the potential for income increases in retirement.

Introducing JuLI

Just SA’s JuLI (Just Lifetime Income) is a with-profit annuity that offers all the above features as a standalone life annuity or lifetime income portfolio in a blended living annuity. JuLI aims to provide annual increases that keep up with the cost of living over time.

You can choose from one of the following three increase options:

-

JuLI HiGro has the lowest starting income and the highest future increases

-

JuLI HiYield has the highest starting income and the lowest future increases

-

JuLI StableGro has a moderate starting income and moderate annual increases

Find out more here or download our JuLI brochure.

Remember, managing inflation during retirement is not just about securing an income today, but is also about ensuring that your income can still meet your essential needs in 10, 20, or even 30 years’ time. Without proper planning, inflation risk can leave you underfunded when you need stability the most.

Let’s take a look at the last of the four retirement risks and how to manage it.

4. Behavioural risk

When planning for retirement, several behavioural risks can significantly impact your financial security and overall wellbeing. These risks often arise from common misconceptions, emotional decisions, and the tendency to overlook long-term consequences.

Here are the top behavioural risks to keep in mind:

| Underestimating retirement needs | As we’ve discussed, many individuals fail to accurately assess how much they will need in retirement, often underestimating how long they will live. These underestimations can lead to inadequate savings. |

| Confidence bias | As outlined in Just SA 2024 Just Retirement Insights, a high level of self-confidence about retirement savings doesn't always align with reality. Some overestimate their preparedness, which can result in insufficient funds. |

| Ignoring cognitive decline | Cognitive decline, particularly in the later stages of retirement, can affect your ability to manage finances soundly. However, very few people plan for this risk, leaving them unprepared for potential difficulties such as dementia. |

| Not seeking professional advice | Many retirees make critical financial decisions without consulting a financial adviser. This often leads to poor planning and missed opportunities. |

| Relying on others for support | As retirement savings may fall short, an increasing number of individuals may turn to family or the government for financial help. This shift places an additional burden on loved ones and public resources, often highlighting a lack of preparation and planning. |

| Not prioritising retirement planning | Many individuals don’t view retirement planning as a high priority, especially in today’s challenging economic climate marked by rapidly rising living costs, high stress, and financial uncertainty. Some may not be able to plan for retirement at all as they are simply struggling to survive. |

Ensuring you are on track

To mitigate the adverse effects of behavioural risks, we want you to consider the following when preparing for retirement:

-

Seek professional financial advice: Consulting an expert will usually help you navigate retirement planning and make informed decisions more effectively.

-

Consider an appropriate time horizon: It's essential to plan for a realistic retirement age and duration, taking into account your life expectancy.

-

Consider your options if you run out of money: Plan for potential income gaps and explore annuity options, such as life or blended annuities.

-

Evaluate whether you can afford to leave an inheritance: As part of your planning, consider how your retirement savings align with your goals for legacy and inheritance.

Remember, a common rule of thumb is to save around 25 times your annual salary to retire at 65. Have you made plans to achieve this savings goal?

Don't wait, seek expert advice from a qualified financial adviser

Just SA recommends seeking advice from a qualified financial adviser if you:

- Need help understanding the retirement income options available at retirement — life, living, and blended annuities

- Want to explore tax-efficient income options (tax benefits)

- Want to consider your financial circumstances

- Are exploring other savings and investment vehicles

Remember: there are only benefits to seeking the services of an adviser!

Making your retirement dreams a reality

Securing a retirement income that supports your dreams requires careful planning and consideration of the risks you may face over time.

As you approach retirement, ask yourself:

- How can I ensure my savings will last through a potentially longer retirement?

- Am I prepared for market volatility and how it may affect my income?

- Will my income keep up with inflation, especially as healthcare costs continue to rise?

- How can I manage behavioural risks and avoid underestimating my future needs?

The four key retirement risks — longevity, investment, inflation, and behavioural — can all significantly impact your ability to sustain your desired lifestyle. To manage these risks, it's essential to be proactive and seek help from a qualified financial adviser if you need it.

Do you need more information?

Consider seeking advice from a qualified financial adviser. Contact us to request the details of an adviser in your area, or to find out more about our offering.