Plan for the challenges of dementia before it's too late

While dementia is a broad term encompassing various cognitive impairments, Alzheimer's is a specific type of dementia that primarily affects memory, thinking, and behaviour.

According to Alzheimer’s Disease International, every three seconds someone is diagnosed with dementia and by 2030, up to 78 million people globally will be affected. The World Health Organisation supports these devastating facts estimating that at least 139 million people could have dementia by 2050. These figures are up from 55 million people impacted in 2019.

The disease typically affects people over age 65, though up to 6% of the global population may experience early onset symptoms at a younger age.

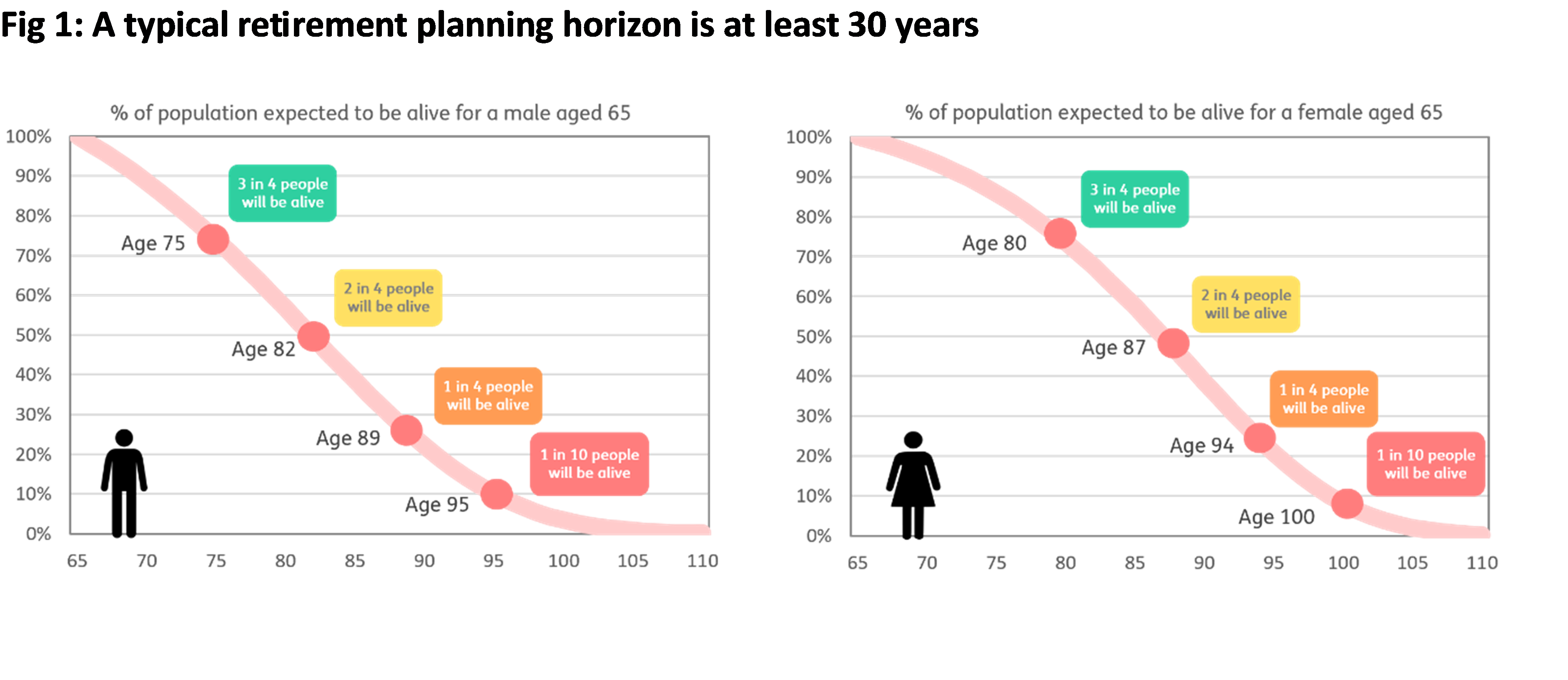

As people are living longer, life expectancy is a critical factor to consider when planning for retirement. Especially for women who according to statistics typically outlive men by an average of five years. The diagram below indicates the likelihood of males and females living to the ages of 75-100.

These figures show that a growing number of individuals could be grappling with this life-altering disease. As life expectancy rises, so do the odds of encountering this cognitive challenge, reinforcing the importance of planning ahead.

The selection of post-retirement products against the backdrop of Alzheimer’s becomes a pivotal decision in safeguarding one's financial security and quality of life.

A living annuity is a popular choice among retirees, with an estimate of 80% investing their savings in this option. Living annuities provide the flexibility to decide on underlying investments and annual drawdown rates. However, the gravitas of these choices cannot be understated, as one can easily run out of money by drawing too much income or making a bad investment choice. Alzheimer's introduces the potential for poor decisions that could negatively impact the longevity of a living annuity.

An alternative approach is a life annuity, also known as a guaranteed annuity. By opting for this, retirees purchase a consistent stream of income that is guaranteed for life. Another advantage is that there are no further choices required in terms of the income stream, which may only have complicated matters at a time when cognitive abilities have declined.

For those seeking a middle ground, a blended annuity presents a compelling option, allowing investors to have some funds in a living annuity structure and some allocated to a life annuity portfolio.

The plight of surviving spouses should also be addressed and further highlights the necessity of sound financial planning. This should ensure the wellbeing of both parties if cognitive decline becomes a family matter.

Retirees often underestimate the magnitude of living expenses during retirement. Apart from routine living costs, accounting for potential expenses related to Alzheimer's is recommended. This could include expensive medication or frail care, in the region of several thousands of rands a month.

It’s recommended to confront the realities of cognitive decline in retirement planning. Armed with knowledge, foresight, and a strategic selection of retirement products, it becomes easier to navigate any financial complexities associated with Alzheimer's, ensuring a dignified lifestyle even in the face of uncertainty.