Blended living annuities – a just choice for retirees

Article by Bjorn Ladewig

The most common requirement for South Africans approaching retirement is to secure a stable income that at least covers essential monthly spending and will last as long as they do. A surefire way to achieve this is through a life annuity which offers a guaranteed monthly income for life that never decreases. But the biggest detractors from a life annuity are often the perceived lack of flexibility, as well as the belief that leaving a capital legacy for beneficiaries is not possible.

Retirement income specialist Just SA cautions that, as in life, there are many trade-offs in retirement. Having an income that lasts and leaving a legacy are often perceived as opposing ideas. Instead of being conservative with a view to leave money to heirs, retirees should rather be looking to reduce the risk of depending on the next generation later in life.

Historically, the inability to adjust income from a life annuity has led to many retirees self-insuring against running out of money and is the reason why many South African retirees opt for a living annuity. However, where annuitants can’t afford to draw an income at a sustainable level, they face increased longevity and investment risk. And many South African retirees invested in living annuities will likely outlive their savings.

Blending a life annuity within a living annuity

Just SA believes the answer lies in a blended living annuity – a unique combination of a living annuity and a guaranteed life annuity. Offering the ability to partially annuitise inside a living annuity, blended annuities allow you to balance a sustainable income for life and provide a capital legacy – all in a single product. And it is not an all or nothing decision. Blending allows annuitants to structure an optimal portfolio over time, balancing the various trade-offs by switching additional tranches into the life annuity component when required.

Identifying who will benefit most from blending

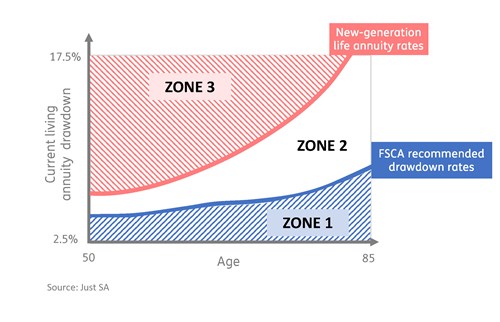

By analysing the distribution of living annuity clients by age and current living annuity drawdown in relation to the FSCA draft recommended drawdown rates and the rates of a new-generation life annuity, you can identify annuitants who are most at risk of outliving their savings. The following illustrative example shows who could benefit most from a blended living annuity.

Retirees with high, unsustainable drawdown rates (Zone 3) can both mitigate the risk of running out of money by incorporating a switch to a lifetime income portfolio and prolong their living annuity to at least cover essential expenses. Even in a blended annuity, those drawing the maximum (or close to it) will still need to consider lowering their drawdown rates to avoid depleting their flexible assets and having to rely solely on guaranteed income from a life annuity. Annuitants in Zone 3 who are closer to the pink line are likely to secure a life annuity rate close or equal to their current drawdown and protect against longevity and market risk.

Those in Zone 2 benefit most from a switch to a blended annuity, which will allow them to rest easy and consume more with less risk of running out of money.

Even those with very low drawdown rates (Zone 1) can seek to improve their retirement outcome with a blended annuity as a diversifying asset class.