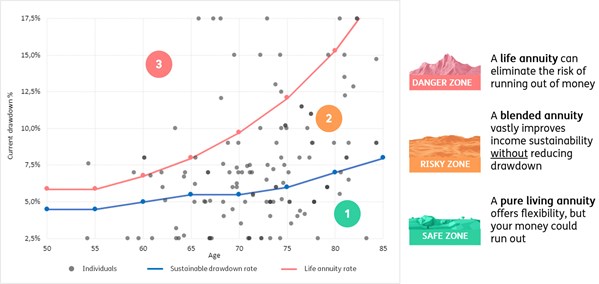

There are three possible scenarios or 'zones' for living annuitants in South Africa.

They are either:

- Drawing an income at a sustainable rate (safe zone)

- Drawing an income that is above the recommended sustainable rate, but below life annuity rates (risky zone)

- Drawing an income at an unsustainable rate, above life annuity rates (danger zone)

Income Sustainability Map Example

According to Deane Moore, this is ironic because half of these living annuity policyholders could guarantee a regular income for life, with annual increases that target inflation, by investing part of their living annuity assets in a life annuity (i.e. those in the ‘Risky Zone’ in the diagram above).

The simple reason that life annuities sustain a higher income for life is that policyholders pool their risk, and those who die earlier cross-subsidise those that live longer.