Calming the waves of Trumpian storms in retirement

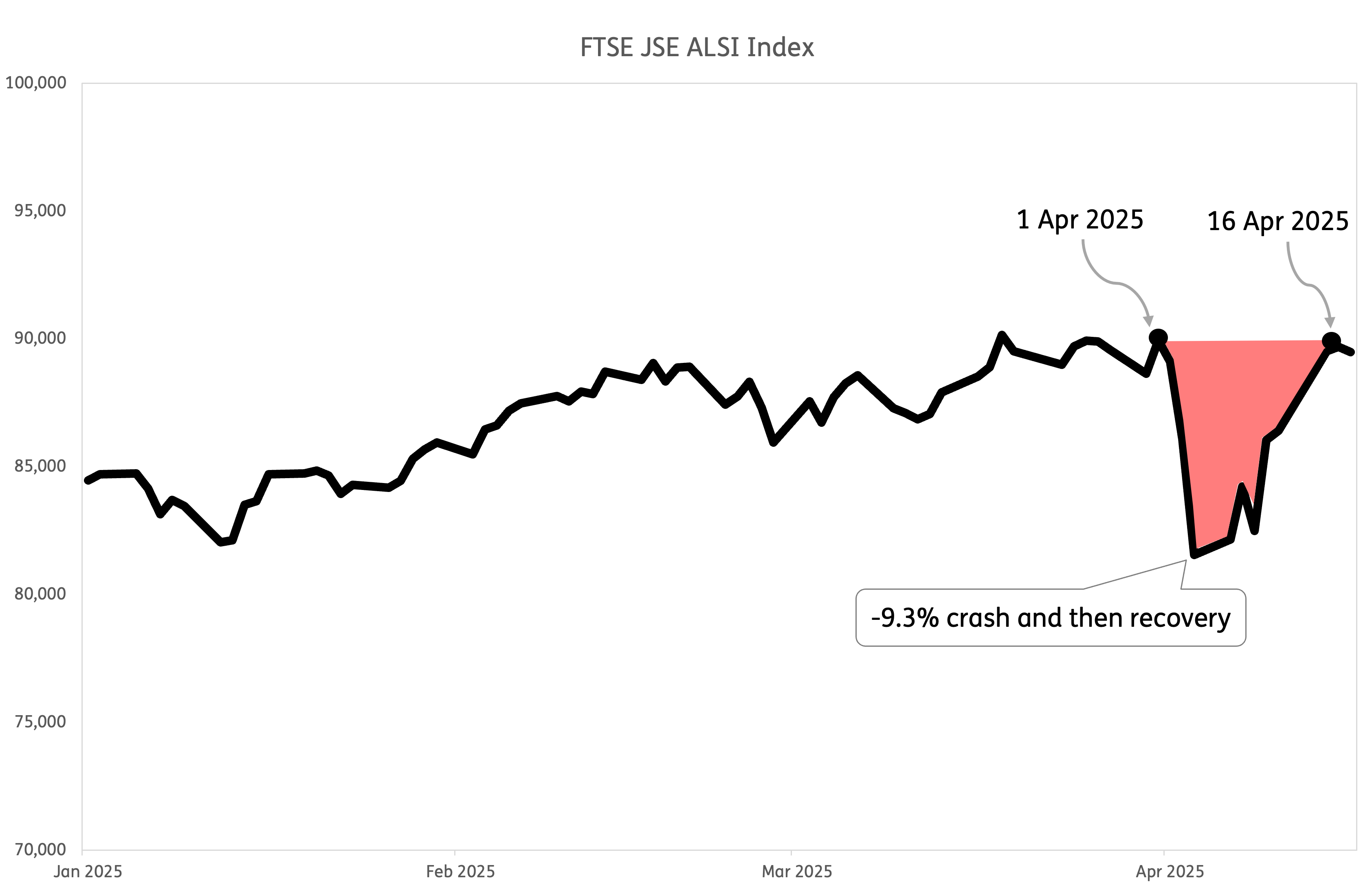

The first 16 days of April 2025 were a scary time for investors, as President Trump’s successive announcements of sweeping tariffs triggered the “Liberation Day” market meltdown that spread across global investment markets. In South Africa, the ALSI Index fell 9.3% over this period, as shown in the graph, a drop the likes of which was last seen in March 2020 during the height of market uncertainty as a result of Covid 19.

For investors in the accumulation (contribution) phase of their retirement planning, investment market declines and recoveries don’t significantly impact their overall savings as they remain in the market. In fact, you can get lucky and put money into the market during a decline and find that your money grows very quickly. However, for those in the decumulation (withdrawal) phase such as retirees, drawing an income means selling their units at a lower price and locking in a loss that may never be recovered. This magnifies the impact of market volatility on their overall savings.

This is especially true for retirees invested in pure living annuities, where they have a great deal of flexibility in terms of the drawdown rate they choose, and the funds their capital is invested in.

Graph: April 2025’s market crash and recovery

On the other hand, if you’re invested in a pure life annuity, investment market declines aren’t a concern as the monthly income cannot decrease, and it is guaranteed for life.

For those retirees that want the best of both - certainty and flexibility - the optimal solution is to blend a lifetime income (a life annuity) within a living annuity. In a blended annuity solution, a significant part or all of your drawdown would come from the lifetime income component of the investment, keeping the rest of the savings intact. This cushions the blow of market fluctuations (such as the period early in April 2025) as it allows for a better recovery of the savings component.

Here is a simple example. Let’s say a retiree has R1million invested in a pure living annuity from which she draws down 10% once per year i.e. R100 000. Let’s now consider two scenarios:

- Scenario A: 10% market decline, then recovery (for which 11.1% return is required)

- Scenario B: no market decline or recovery

If we present the results in a table:

|

Scenario |

A: Market decline then recovery |

B: No decline nor recovery |

|

Starting value |

R 1 000 000 |

R 1 000 000 |

|

Value after crash |

R 900 000 |

N/A |

|

Drawdown |

R 100 000 |

R 100 000 |

|

Value after withdrawal |

R 800 000 |

R 900 000 |

|

Value after recovery |

R 888 800 |

N/A |

|

End value |

R 888 800 |

R 900 000 |

|

Loss (A vs B) |

R11 200 |

|

The R11 200 loss (1.12%) which resulted from this illustrates the negative impact of drawdowns during market drops, albeit quite an extreme example given that a single annual drawdown was assumed.

The second term of President Trump is likely to continue to spark market volatility, just as it did in his first term. In fact, it could even produce more of a bumpy ride for investors as this time his actions are less constrained by the fact that he will want to seek re-election, as US presidents may only serve for two terms. Against this backdrop and given the fact that US politics have a great impact on global and local investment markets, reducing risk in a living annuity by blending - investing a part in a lifetime income - is a good decision. Blending allows retirees to better ride through such waves of volatility, as it reduces or can eliminate the need to sell valuable units at a time when prices are low.