Careful tax planning can help you stretch retirement savings

If you have diligently saved for retirement, you don’t pay income tax on contributions paid into a retirement fund or retirement annuity, nor on the investment build up within these retirement vehicles. This means you avoid paying income tax on the money saved (between 18 and 45 percent, depending on how much you earn). But when you retire and start taking the money out, it will be taxed as income.

Soon-to-be-retirees have many options to consider to ensure their retirement and discretionary savings work best for them in retirement. This is especially relevant when considering the impact that the falling Rand and COVID-19 pandemic may have had on your retirement pot. Ultimately, the best-suited retirement income solutions are dependent on your specific retirement needs. And each of these solutions has a tax implication.

A compulsory purchase annuity is an annuity that must legally be bought with at least two-thirds of the benefits received from a retirement fund or retirement annuity. The entire annuity payment is subject to income tax, because no tax has been deducted on the retirement savings.

For discretionary savings, a voluntary purchase annuity can serve as a highly tax-efficient way to provide regular income in retirement that is guaranteed for life and never decreases. Unlike a compulsory purchase annuity, it can be purchased voluntarily from either the remaining one-third lump sum, or from discretionary savings.

“A voluntary purchase annuity may be a tax-efficient choice, as the income derived is only partially taxable,” says Just CEO Deane Moore.

In a voluntary purchase annuity, the annuity payment consists of a capital portion and an interest portion. The capital portion does not form part of the taxable portion of the annuity payment. Only the interest portion is taxable.

“Although voluntary purchase annuities have been around a long time, they generally tend to be overlooked as a tax-efficient income solution,” explains Moore. It can be particularly attractive for a retired person downsizing their property and releasing discretionary savings. These savings can be converted into guaranteed income for life with a higher, tax efficient income yield than traditional savings vehicles.

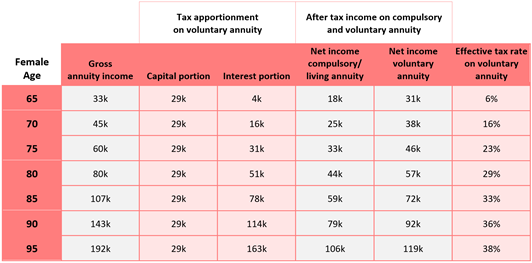

The table below shows the tax benefit of taking a tax-free lump sum of R500k at retirement and investing it in a voluntary purchase annuity, rather than allocating the full amount to a compulsory purchase annuity. This uses a realistic annuity rate for a single female aged 65 at retirement and assumes a tax rate of 45%. The after-tax income on the voluntary purchase annuity is approximately R10 000 per annum higher than the compulsory annuity.

Figure 1: Tax benefit of voluntary purchase annuities

Source: JuLI HiGro starting annuity rate of 6,6% for single female age 65, assumed to increase at 6% pa in line with inflation. Assumed no tax on lump sum of R500k used to purchase annuity. Assumed tax rate of 45% on income from compulsory annuity and interest income from voluntary annuity (ignored interest rebate)

Like compulsory annuities, a number of options are available for voluntary purchase annuities. For example, you can choose to receive the same income for a period of time or for the rest of your life (known as a level annuity) or link such income to increase with inflation or a set annual increase percentage of your choice. You can also provide for your spouse or purchase a minimum payment guarantee to provide for loved ones in the event of your early death.

It is also available as a with-profit annuity, where guaranteed income can never decrease, even in adverse conditions, and annual increases are linked to the smoothed investment return of a balanced fund managed by some of South Africa’s prestigious asset managers.

This article also appeared in BUSINESS TECH.