Now is the time to lock in market gains

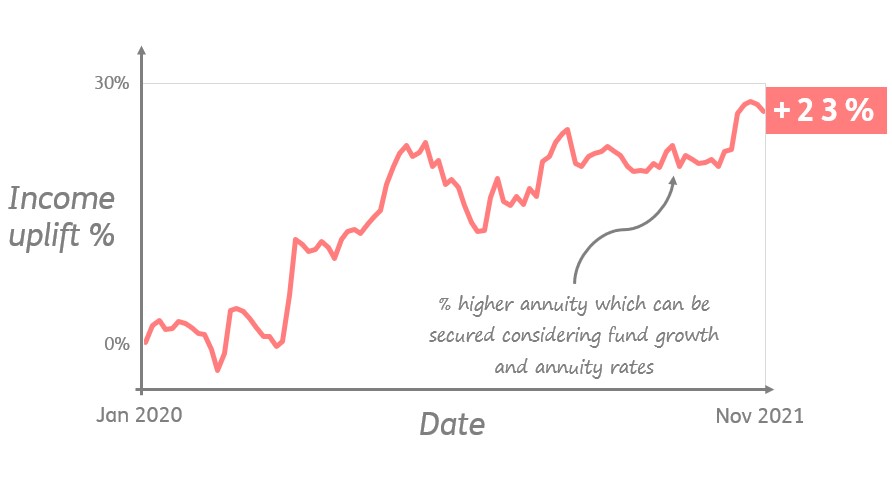

Fresh uncertainties created by the announcement of the Covid-19 Omicron variant could have people looking in earnest for certainty around their finances. And for those considering their retirement income options, there’s some good news. If your retirement savings were invested in a balanced fund through the market turmoil of 2020 until now, you could currently secure a lifetime income around 23% higher* than if you purchased a lifetime income on the 1st of January 2020, before the market crash.

In other words, you’re now able to get a higher income from each rand of your retirement capital if you invest it in a life annuity today.

“While it’s always a good time to purchase a life annuity, every now and again market conditions create an even better time to purchase a life annuity,” says CEO Deane Moore of retirement income specialist Just SA. “Now is one of those times.”

This is down to two reasons. Firstly, investment markets have recovered substantially since the 2020 market crash, which means investors’ capital value will have improved significantly. Secondly, life annuity rates have remained stable over the same period, as a result of two underlying factors which have cancelled each other out. These are high bond yields, resulting in higher annuity rates, and higher expected future increases off the back of higher portfolio returns, resulting in lower annuity rates.

“It’s a great combination of factors that make this the perfect time to lock in a secure, guaranteed income for life,” says Moore.

However, this window of opportunity may not last, so there is a strong case for those approaching retirement not to defer annuitisation any longer.

Besides the recent market gains, a life annuity will always be a good purchase in any economic climate, adds Moore. This is because the income of a life annuity is guaranteed and will never decrease, no matter what happens in the market or how long a retiree lives. What’s more, new generation with-profit annuities provide annual payment increases that target a percentage of inflation, which are linked to the performance of an independent underlying investment portfolio managed by specialist asset managers. “These elements provide a certainty of income and the prospect of upside gains if the market continues to outperform.”

With-profit annuities can also be purchased within a blended living annuity, a unique legal structure that combines life annuity and living annuity features in one product. A blended annuity affords pensioners the opportunity to lock in a guaranteed income for life while retaining the flexibility that a living annuity offers.

“It’s all good news, and there’s certainly not enough of that in the world right now,” says Moore.

*Based on:

- Allan Gray Balanced Fund returns over the period 1 January 2020 to 29 October 2021.

- Indicative level of Just Lifetime Income (HiGro) which could be purchased for R1m by a male aged 65 with a spouse’s benefit over the same period.

This article appeared in Money Marketing and EBNet.